Abstract

ESG (Environmental, Social and Governance) management practice is an important part of promoting sustainable operation and development of manufacturing enterprises. Currently, traditional evaluation methods have limitations such as low efficiency and lack of objectivity. To improve the efficiency and accuracy of ESG evaluation and promote the optimization of ESG performance in manufacturing enterprises, this article combined data mining and analytic hierarchy process (AHP) to conduct effective research on ESG management practice evaluation in manufacturing enterprises. This article adopted the best priority search strategy to collect and process enterprise ESG data. By using AHP to construct hierarchical and segmented objectives for target problems, a performance evaluation index system for management practices was built based on the evaluation objectives and hierarchical priority order. Finally, based on the performance evaluation of ESG management practices, the K-nearest Neighbor algorithm was applied to analyze historical data of key indicators. According to the weights, various key indicators were re-integrated, achieving practical evaluation and decision support for enterprise ESG management. To verify the effectiveness of data mining and AHP, this article took Z enterprise as the research object and conducted empirical analysis on it. The results showed that in terms of evaluation accuracy, the method proposed in this article achieved the highest evaluation accuracy of 92.51%, 91.16%, and 91.75% in environmental, social, and governance dimension data use case evaluation, respectively. The conclusion indicated that data mining and AHP could improve the accuracy of ESG management practice evaluation in enterprises, provide reliable decision support for enterprise development, and help promote sustainable development of enterprises.

Similar content being viewed by others

Introduction

With the deepening of the concept of social responsibility investment, the role and influence of enterprise ESG management practices in the process of enterprise operation and development are becoming increasingly prominent. In an increasingly competitive market environment, the manufacturing not only needs to focus on economic performance, but also needs to pay attention to environmental protection, social responsibility, and good governance. ESG management practices have become the key to the sustainable development of manufacturing enterprises, involving energy conservation and emission reduction, resource recycling, employee welfare, community relations, corporate governance structure, and other aspects. As the core of high-end equipment manufacturing and production, manufacturing plays a crucial role in the entire manufacturing. Evaluating the ESG management practices of enterprises has become an important direction for the sustainable development of the manufacturing. At present, most ESG management evaluations in enterprises rely on manual labor, resulting in low evaluation efficiency and a lack of accuracy and objectivity in evaluation results, which has had a certain impact on enterprise management decisions.

ESG management practice evaluation helps to enhance the value of manufacturing enterprises. An increasing number of investors are paying attention to the ESG performance of enterprises, believing that ESG management practices are closely related to the long-term value of the enterprise. Through evaluation and research, enterprises can discover their strengths and weaknesses in ESG, improve management practices in a targeted manner, and enhance enterprise value.

With the mature development of artificial intelligence theory, data mining has made great progress and has been widely applied in various professional fields. It can process large amounts of data in real time and achieve automated analysis. In manufacturing, applying data mining to evaluate enterprise ESG management practices can effectively improve evaluation efficiency, improve the accuracy of evaluation results, and provide a reliable basis for enterprise business decision-making. This article aims to evaluate employee management and corporate governance to enhance corporate social responsibility and transparency. The application of data mining algorithms in ESG management can help enterprises collect, analyze, and utilize ESG-related data more efficiently, and help them identify potential ESG risks and opportunities.

To improve the accuracy and objectivity of ESG management practice evaluation in enterprises and promote sustainable development of the manufacturing, this article combines data mining to conduct effective research on ESG management practice evaluation in the manufacturing, and verifies it from four levels: relevance of evaluation indicators, accuracy of evaluation, efficiency of evaluation, and decision support. From the perspective of the correlation of evaluation indicators, the ESG management practice evaluation indicators in this article are all concentrated on the right side of the causal diagram, with a high degree of correlation between the indicators. From the perspective of evaluation accuracy, the evaluation accuracy in all three dimensions reaches over 80%. From the perspective of evaluation efficiency, the average completion rates of the three dimensions are approximately 93.61%, 87.81%, and 88.23%, respectively. From the perspective of decision support, the average expected rate of return for decision support based on the evaluation results of the three dimensions is approximately 11.73%, 12.46%, and 12.76%, respectively. In practical applications, the ESG management evaluation results based on data mining in this article can provide more reliable decision support for enterprise development and achieve ESG performance optimization.

The main contributions of this work include:

-

(1)

Improving ESG management efficiency and accuracy:

This article proposes an efficient and accurate ESG data analysis and management method by applying intelligent data mining algorithms. By automatically processing and analyzing a large amount of complex ESG data, the efficiency of data processing is improved, and human intervention errors are reduced, thereby enhancing the objectivity and reliability of ESG evaluation.

-

(2)

Building a systematic ESG management framework:

This article constructs a systematic ESG management framework based on data mining intelligent algorithms, which helps enterprises quantitatively evaluate their ESG performance, provides comprehensive technical support for ESG management of manufacturing enterprises, and promotes the standardization and systematization of ESG management.

-

(3)

Efficient data processing and analysis:

This article adopts the best priority search strategy to collect and process ESG data of enterprises, improving the efficiency and accuracy of data processing. By combining the K-nearest neighbor algorithm to analyze historical data of key indicators, the accuracy of performance evaluation in ESG management practices is effectively improved, providing reliable data support for enterprises.

-

(4)

Practical guidance for promoting sustainable development of enterprises:

This article emphasizes that while pursuing economic benefits, companies should incorporate ESG factors into their decision-making frameworks to achieve sustainable development goals. Through empirical cases, this article provides examples and lessons learned from the successful implementation of ESG management, encouraging manufacturing companies to actively engage in ESG-related innovative practices and promote the long-term development of the enterprise.

The main research structure of this article is as follows: in the first section, the background and significance of this study are introduced. In the second section, the current research is described. In the third section, the application of data mining in the evaluation of ESG management practices in the manufacturing is analyzed. In the fourth section, the empirical analysis is conducted. In the fifth section, the research results and contributions of this article are summarized.

Related works

ESG management practice assessment is particularly important in manufacturing enterprises, as the industry has a significant impact on resource consumption and the environment, and the labor-intensive nature makes social responsibility and governance structure particularly critical.

Current status of ESG assessment research

ESG evaluation can help businesses identify and manage risks and opportunities related to environmental, social, and governance. To evaluate the risk profile of the enterprise, Giese evaluated the connection between enterprise ESG management practices and company valuation and performance by examining three transmission channels in the standard discounted cash flow model, and tested the transmission channels using ESG rating data and financial variables1. Research showed that changes in company ESG characteristics could serve as effective financial indicators, and their evaluation methods were suitable for inclusion in enterprise decision-making benchmarks and financial analysis. In order to identify the financial risks of listed companies in Turkey, Saygili used the principles of governance of the Capital Market Committee and the environmental indicators of the Global Reporting Initiative to evaluate the ESG management practices of listed companies from 2007 to 2017 and revealed the impact of environmental disclosure on financial risks2. Finally, through case analysis, it was demonstrated that the proposed indicators helped evaluate the overall performance of enterprises in ESG aspects. To balance the potential benefits and related risks of enterprise operation and achieve expected business outcomes, Grim proposed an objective and practical evaluation framework that helped investors establish specific goals, evaluate the effectiveness and potential choices of enterprise ESG management practices, and determine ESG investment methods based on personalized standards and trade-offs3. The practical application showed that the proposed ESG framework could reliably assess the risks and potential returns of investment portfolios, helping investors develop more responsible investment strategies3. To reveal the risks in enterprise ESG management practices, Garst proposed a substantive evaluation method that evaluated enterprise ESG management practices from the perspectives of social impact and stakeholders4. The results indicated that the substantive perspective chosen could provide corresponding support for enterprise risk decision-makin. Existing research has adopted a substantive perspective to evaluate corporate ESG management practices, and its proposed ESG evaluation framework provides investors with effective risk assessment tools and responsible investment strategy guidance to a certain extent, which helps companies improve ESG management and also provides investors with a certain basis for evaluating investment risks and returns. However, most of these studies focus on listed companies as a whole, lacking industry-specific attention and failing to fully consider the impact of ESG management practices on the long-term sustainability of enterprises, which make it difficult to comprehensively understand the impact of ESG management practices on financial risk and performance5. Some commonly used ESG evaluation frameworks in current research lack standardized evaluation indicators specific to the manufacturing6. The lack of systematic quantitative research limits a comprehensive understanding of the effectiveness of ESG practices, making it difficult to compare evaluation results between enterprises.

Current status of ESG evaluation research based on data mining

The development of data mining provides more possibilities for improving the objectivity of ESG management practice evaluation results in manufacturing enterprises. To scientifically evaluate the practical level of ESG management in enterprises and support decision-making and improvement of ESG management, Zhou analyzed the relationship between ESG management practices and company market value by constructing a linear regression algorithm model and a mediation effect model with financial performance as the intermediary variable7. The results indicated that the proposed model could effectively avoid the influence of subjective factors and had a strong guiding role in improving ESG performance. To objectively evaluate the achievements of ESG management practices in enterprises, Afanas’ev developed an evaluation algorithm for changes in the governance system during ESG transformation and proposed the optimal reporting structure for disclosing accounting information on ESG factors in company activities8. He elaborated on the research results of the main methodological methods used to construct the evaluation of ESG management practices, objectively revealing the main problems faced by enterprises in the process of ESG management practices, which helped identify potential risk points and helped enterprises better understand and improve their own ESG management practices8. Jiang proposed a hybrid method based on existing ESG standards and report extraction simplification, post-event, and dynamic classification to improve the comparability of ESG reports9. This hybrid method combined text mining techniques with manual processing, balancing the efficiency of automatic processing with the effectiveness of human judgment. Ziolo conducted a multi-criteria decision analysis using the PROMETHEE method (preference ranking organization enrichment assessment method) to evaluate ESG factors and rank financial systems based on sustainability standards10. The experimental results showed that the proposed method could comprehensively evaluate the ESG performance of enterprises by integrating information from multiple data sources, avoiding the bias that might arise from a single source. From current research, data mining techniques can provide quantitative, standardized, and automated data analysis capabilities in ESG management practice evaluation. They provide strong support for the scientific evaluation of corporate ESG management practices and are of great significance in promoting the sustainable development of enterprises. However, most studies still have certain limitations in evaluating efficiency and the accuracy and reliability of evaluation results11,12.

This article implements efficient data collection based on the breadth-first intelligent search algorithm and combines AHP multi-standard decision analysis method to provide a more comprehensive ESG evaluation. It also takes into account the three dimensions of environment, society, and governance, providing a more accurate assessment.

Application of data mining in ESG management practice evaluation of manufacturing enterprises

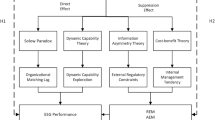

The ESG management practice evaluation process based on data mining is shown in Fig. 1. From Fig. 1, it can be seen that in the ESG management practice evaluation process based on data mining, this article first collects enterprise management data from three dimensions: environment, society, and governance of the enterprise, and adopts the optimal priority search strategy, where A-G represents nodes in the search space. Then, based on the Analytic Hierarchy Process, relative scaling is applied to construct a hierarchical structure for evaluating the target problem. Based on the evaluation objectives and construction hierarchy, a performance evaluation index system oriented towards management practice is constructed. Finally, based on ESG management practices, the performance evaluation is conducted using the K-nearest neighbor algorithm to analyze the historical data of selected key indicators, achieving management time decision support.

Data collection and processing

The concept of enterprise ESG management practice originates from the idea of social responsibility investment, which is an extension of social responsibility investment from investment philosophy to company value orientation after several years of development13. According to dimensional differences, data related to ESG management in manufacturing enterprises is classified into three categories: environmental, social, and governance. The data classification is shown in Table 1. In Table 1, ESG data is classified into three categories based on data attributes: environmental, social, and governance.

Environmental: it refers to the data of manufacturing enterprises fulfilling their responsibilities related to the natural environment. Social: it refers to the data on how enterprises fulfill their responsibilities related to the welfare and interests of society. Governance: it refers to the data on how a company fulfills its responsibilities related to its own governance.

To improve the utilization of enterprise management information resources, the best priority search strategy is adopted in ESG management data collection to collect ESG data based on the data classification in Table 1. Among them, the best priority search strategy is a breadth-first intelligent search algorithm in data mining14. The collection of ESG management data is shown in Fig. 2. Generally speaking, during the search process, breadth-first intelligent search algorithms prioritize the collection and selection of data with the best applicability15. From Fig. 2, it can be seen that in data collection, this article first selects data blocks related to ESG management data through the best priority search strategy and assigns them a priority. Then, the data blocks with higher priority are selected and analyzed to obtain the required ESG data content.

\({F}_{t}\) is set as the frequency of ESG data \({t}_{i}\) appearing in data block \({d}_{j}\) to increase the weight of keywords, which is expressed as16:

Among them, \({x}_{i,j}\) is the number of occurrences of ESG data \({t}_{i}\) in data block \({d}_{j}\). \(\sum_{n}{x}_{n,j}\) is the sum of all occurrences of data block \({d}_{j}\).

IDF (inverse document frequency) is used to reduce the topic weight of public data, represented as:

\(\left|T\right|\) is the total number of data blocks in the database, and \(\left|\left\{j:{t}_{i}\in {d}_{j}\right\}\right|\) is the number of data blocks containing data \({t}_{i}\).

\({w}_{i,j}\) is set as the weight of ESG data \({t}_{i}\) for weight sorting, and the ESG data classification obtained from different dimensions is used as a keyword. \({w}_{i,j}\) is represented by the formula:

By using vector space models, the calculation of topic relevance is achieved. In vector space, the number of keywords is referred to as the dimension. The weight \({w}_{i}\) of each keyword \(k\) is the value of each dimension. \({F}_{k,s}\) represents the weight of keyword \(k\) in topic \(s\). \(s\) is represented as:

Then, data block \({d}_{j}\) is parsed. The frequency of keyword occurrences is counted, and the ratio between frequencies, that is, frequency, is calculated. The keyword with the highest frequency is used as a reference, and the frequency of this keyword is set to \({q}_{i}=1\). Based on the ratio between frequencies, the frequency of other keywords is identified. The values of each dimension of the vector corresponding to this data block are represented by \({q}_{i}{w}_{i}\). Then, the data block theme can be represented as:

The Resource Ratio (the ratio of the number of blocks related to the topic to the number of blocks extracted) is used to calculate the topic correlation of the data block:

According to the specific situation, threshold \(m\) is set. If \(cos\alpha ,\beta \ge m\), then the correlation between the data block and the topic is considered.

The collected ESG management data comes from various modules. To eliminate incomplete, duplicate, and abnormal data and reduce data bias, this article processes the collected ESG management data. Firstly, data cleaning is carried out to remove redundant data attributes generated during data analysis to reduce data noise and eliminate unit gaps between data, and then the data is integrated. The correlation criteria for determining the redundancy of data attributes is17,18:

Among them, \(N\) represents the number of tuples in the data structure, and \(A,B\) are data attributes. \(a\) and \(b\) represent the average value of attributes, and \({\sigma }_{a}\) and \({\sigma }_{b}\) represent the standard deviation of data attributes \(A,B\) respectively. The specific calculation methods are as follows:

If \({\delta }_{A,B}>0\), there is a positive correlation between data attributes and, that is, the value of \(A\) increases in the same direction as \(B\) increases. When the values of \(A,B\) are large, the likelihood of one attribute containing another is greater. When the value is large enough, one attribute can be determined as a redundant item of the other data attribute, and then it can be deleted.

By reducing data attributes in a certain proportion, they are concentrated within a specific range, thereby transforming enterprise ESG management data into a storage method that is convenient for data mining. Taking numerical attribute \(A\) as an example, according to Formula (10), the attribute value \(g\) of \(A\) is normalized to \({g}{\prime}\).

By preprocessing the collected ESG management-related data, on the one hand, the quality of ESG data can be improved, and on the other hand, the impact of ESG data bias on subsequent evaluation and analysis can be effectively reduced.

Performance evaluation of ESG management practices

From the perspective of the development of manufacturing enterprises, performance evaluation of ESG management practices can be seen as an auxiliary means for enterprise asset assessment and risk assessment. Similar to traditional financial analysis, the performance evaluation of ESG management practices evaluates the advantages and disadvantages of sustainable development in enterprises19. When constructing the evaluation matrix, this article applies relative scales based on the Analytic Hierarchy Process (AHP) to minimize the difficulty of comparing evaluation indicators and improve the accuracy of the evaluation. AHP is a multi-criteria decision analysis method that quantifies the relative importance of different factors by constructing a hierarchical structure, determining weights, and conducting pairwise comparisons, thereby helping decision-makers make more scientific and objective decisions. In ESG management practice performance evaluation, by constructing a hierarchical structure, environmental, social, and governance indicators are divided into different levels, and their relationships are determined. Then, through pairwise comparison, the relative importance of each indicator can be quantified, and the weights of each indicator can be obtained, thereby achieving an accurate evaluation of ESG performance.

Firstly, the evaluation objective problem is constructed at a hierarchical level to achieve the decomposition of the evaluation objectives. According to the evaluation objectives and construction level, a performance evaluation index system for management practices is constructed by sorting and classifying according to the ESG data in Table 1, as shown in Table 2. The importance of all indicators in Table 2 is compared to each other in pairs. A matrix is constructed based on a score of 1–5 levels of importance. The higher the score, the higher the relative importance of the corresponding indicator.

The importance assignment is performed according to the scaling method in Table 3.

The constructed judgment matrix is represented as \(P\)20:

On this basis, a hierarchical single sorting method is adopted to sort the indicators and test the consistency of the matrix. \(\upomega \) represents the ranking weight of the relative importance of each indicator in the same hierarchy relative to a certain indicator in the previous hierarchy, which belongs to a single hierarchical ranking. After column normalization of the judgment matrix, the arithmetic mean method is used to obtain the weights of various indicators \({\upomega }_{i}\):

The importance ranking of each indicator is then tested to determine whether they have contradictory relationships. Consistency indicator \(CI\) is calculated. A value of \(CI\) close to 0 indicates high indicator consistency; on the contrary, it indicates the lower the consistency:

After completing the construction of the ESG evaluation hierarchy matrix, the weights of each level are calculated based on the interval range, and the corresponding intervals of each indicator are determined and scored. The weight allocation of the three-level indicator comparison matrix is shown in Table 4. From Table 4, it can be seen that the allocation results of the three-level indicators in the environmental aspect are carbon reduction, comprehensive energy consumption per unit output value, and water consumption per unit output value, in order of size and weight. At the social level, the distribution results of the three-level indicators based on the weight of their size are the social insurance payment ratio, donation income ratio, proportion of welfare expenses, and labor contract signing rate. At the level of governance, the distribution results of the three-level indicators based on their respective weights are accounts payable turnover rate, employee salary payment rate, shareholders’ equity ratio, and proportion of independent directors.

In Table 5, combined with relevant research results21,22 and consultation feedback from relevant experts based on the principles of representativeness, scientificity, comprehensiveness, and comparability in indicator selection, this article sets the evaluation scope of each indicator into four levels: 10 points, 7 points, 4 points, and 1 point.

Decision support

The K-nearest neighbor algorithm has a simple idea and does not make any assumptions about data distribution23,24. It does not require training and has a wide range of applications. Therefore, this article selects the K-nearest neighbor algorithm to analyze key indicators. Based on the performance evaluation of ESG management practices, historical data of selected key indicators is analyzed. According to the weight, each key indicator is re-integrated and used to measure the operational risk of manufacturing enterprises. K-nearest neighbor clustering analysis is performed on key indicators to provide decision support for enterprise management and development.

All evaluated ESG management-related data is used as the initial set for decision support analysis. Assuming that \(X\) evaluated ESG management practice data samples \({x}_{j}\in {R}^{n}(j=\text{1,2},\cdots ,n)\) are divided into \(k\) categories \(\left\{{c}_{1},{c}_{2},\cdots ,{c}_{k}\right\}\), \(i=\text{1,2},\cdots ,c\) and \(j=\text{1,2},\cdots ,n\) , which are defined as:

Assuming \({l}_{j}\in {R}^{n}\) represents the center of class \(j\) and \({u}_{i}\) represents the number of samples included in class \(i\), then there is:

The intra-class difference of class \(i\) is:

The overall intra-class difference is:

For the case where the number of clusters is unknown, the ESG management practice decision support optimization problem is solved by minimizing intra-class differences and maximizing inter-class differences:

By adjusting the formula and replacing it with the minimum connection distance between classes, the ESG management practice decision support optimization problem is transformed into25,26:

The ESG management practice decision support optimization problem belongs to a multi-objective optimization problem. In multi-objective optimization, there may be trade-offs between different objectives27. Taking governance in ESG management practices as an example, enterprises need to strike a balance between different stakeholders and meet the needs and expectations of different parties. Employees may focus on welfare and the work environment, while investors may focus on returns and risk management. These two goals are conflicting in the short term. To simplify the decision-making process, this article uses the multiplication and division method in the non-uniform model to turn it into a single objective optimization problem28,29:

Transforming multi-objective optimization problems into single-objective optimization can help decision-makers identify outliers in ESG data, analyze the underlying laws and correlations of ESG data, and deepen their understanding of the practical level of enterprise ESG management. They can also develop different decision-making strategies for specific ESG management practical problems.

Empirical evaluation of ESG management practices in manufacturing enterprises

To verify the effectiveness of data mining in the ESG management practice evaluation of manufacturing enterprises, this article took Z enterprise as the object and conducted an empirical analysis of ESG management practice evaluation.

Enterprise overview

Z enterprise was founded in 1992 with a registered capital of 8.677 billion yuan. Its main business is the research and development and manufacturing of mining machinery, cement machinery, and other engineering machinery, as well as other high-tech equipment. It is a continuously innovative international machinery manufacturing enterprise with global business coverage, and its products have been exported to multiple countries and regions. In the context of sustainable development, Z enterprise’s future development direction inevitably focuses on green, low-carbon, and high-quality development as its development theme. Considering that the content of performance evaluation for ESG management implementation in this enterprise is relatively single and lacks an objective and unified evaluation system, this article selected Z enterprise. Taking the representative enterprise in the manufacturing industry as the research object, this article uses data mining to empirically analyze the evaluation of its ESG management practices.

Evaluation data source

Considering that the ESG information disclosed in the Z enterprise social responsibility report from January to December 2022 was relatively small, this article set the evaluation period for Z enterprise environmental, social, and governance management practices from January 1, 2021, to December 31, 2021. The ESG-related data and information in this article were all sourced from the official website of Z enterprise, the 2021 annual report, the 2021 social responsibility report, government and non-governmental organization websites, news media, and other public channels. In ESG management data collection, the best priority search strategy was adopted to collect ESG data. The data blocks related to Z enterprise ESG management data were selected and priority was specified. The data blocks with high priority were selected for parsing, and finally, the required ESG data content was obtained.

Among them, a total of 303 pieces of environmental management data were collected, covering indicators such as carbon emissions, energy consumption, and water resource use. A total of 296 pieces of social management data were collected, mainly covering indicators such as donation income and employee benefits. A total of 471 pieces of corporate governance data were collected, mainly covering indicators such as corporate governance structure and board composition.

To ensure the objectivity and accuracy of the experimental results, data cleaning was first carried out to remove redundant data attributes generated during the data analysis process to reduce data noise and eliminate unit gaps between data, and then the data was integrated. The redundancy of data attributes could be determined according to Formula (7), and the data attributes could be reduced and normalized in a certain proportion. The data blocks could be analyzed to extract the required ESG indicator data, forming a structured dataset.

Evaluation results

Guided by the ESG evaluation index system under the hierarchical structure model in this article, the management practice level of the enterprise in environmental, social, and governance was evaluated. According to the interval range, the ESG management practice data of Z enterprise was judged and scored in the corresponding interval of each indicator. The scoring results are shown in Table 6. The ESG performance evaluation score of Z enterprise in 2021 was 68 points, which reflected the overall management practice level of Z enterprise in terms of environmental, social, and governance in 2022. From the results of management practice performance at three levels, Z enterprise’s management practice scores at the environmental, social, and governance levels were 15 points, 28 points, and 25 points, respectively. Among them, the environmental evaluation results accounted for 50% of the full score structure at this level, while the management practice evaluation results at the social and governance levels accounted for 70% and 62.5% of the full score structure at their respective levels. From the overall evaluation results, Z enterprise’s social responsibility performance in 2022 was superior to its governance performance, and its governance performance was superior to its environmental protection performance.

To gain a deeper understanding of the effectiveness of data mining and AHP in the ESG management practice of Z enterprise, this article used the scoring results in Table 6 as a benchmark to validate them from the aspects of the correlation of evaluation indicators, evaluation accuracy, evaluation efficiency, and decision support in ESG management practice.

-

(1)

Correlation of evaluation indicators.

The correlation of evaluation indicators has a crucial impact on the reliability of evaluation results. The higher the correlation of evaluation indicators, the more comprehensive and objective the ESG management practice information reflected in the evaluation results. This helps to improve the accuracy and reliability of the evaluation and provides a better decision-making basis for decision-makers.

In the correlation analysis of evaluation indicators, this article distinguished and separated the performance evaluation indicator system of ESG management practice into three-level evaluation indicators with a hierarchical structure, and formed a subset. The evaluation indicators in each subset were grouped into an element group. The influence relationship between the element groups in the evaluation indicator subset was compared in pairs, and the sum and difference were calculated based on the importance assignment to generate the indicator coordinate values, as shown in Table 7. This article calculated the coordinate values of each three-level indicator in the ESG management practice performance evaluation indicator system and used causal diagrams to evaluate the correlation of indicators.

The correlation of each evaluation indicator is shown in Fig. 3. The ESG management practice evaluation indicators in this article had a strong correlation, with environmental, social, and governance indicators concentrated on the right side of the causality diagram, and the correlation between the indicators was relatively high. Among them, the environmental indicators such as carbon reduction and water consumption per unit output value, and the social indicators such as labor contract signing rate and donation income ratio, as well as the governance indicators such as accounts payable turnover rate, proportion of independent directors, and shareholders’ equity ratio, were all located at the upper end of the causality diagram, indicating that these indicators had important evaluation value in Z enterprise’s ESG management practice. From the correlation analysis results, it can be seen that the selection of ESG management practice evaluation indicators under the intelligent algorithm in this article had a certain degree of objectivity, and the correlation between each indicator was strong, which could effectively reflect the ESG management practice level of manufacturing enterprises.

-

(2)

Evaluation accuracy.

The accuracy of ESG management practice evaluation is of great significance for correctly identifying the risks faced by enterprises in sustainable operation. Accurate evaluation of an enterprise’s environmental, social, and governance levels can help identify potential environmental, social, and governance risks, as well as related business opportunities, enabling the enterprise to maintain an advantage in competition and avoid potential negative impacts. This article used the ESG performance of Z enterprise in 2021 in Table 6 as the dataset, and randomly selected data use cases from the ESG data classification of environmental, social, and governance. The evaluation results under the intelligent algorithm in this article were compared with the real data values in the ESG management practice of the enterprise to calculate the accuracy of the evaluation method in this article.

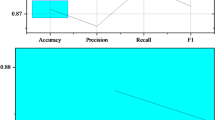

To ensure consistency between the real labels and the evaluation data use case index, before the accuracy testing begins, this article first divided the data use cases and generated corresponding indexes. In the evaluation stage, by sorting or re-indexing the data use cases, the index of the real labels and predicted results was consistent. For missing values in real labels or predicted results, interpolation methods were chosen to fill in the missing values by inserting the mean. The final selected data is shown in Table 8, and the evaluation accuracy results are shown in Fig. 4.

In Fig. 4, the horizontal axis represents the data use cases, and the vertical axis represents the evaluation accuracy of the method in this article. Overall, the evaluation accuracy of this method in environmental, social, and governance dimensions reached over 80%. In the evaluation of environmental dimension data use cases, the highest evaluation accuracy of the method in this article was 92.51%, with an average accuracy of about 88.49%. In the evaluation of social dimension data use cases, the highest accuracy of the method in this article was 91.16%, with an average accuracy of about 87.06%. In the evaluation of governance dimension data use cases, the accuracy of this method reached the highest of 91.75%, with an average accuracy of approximately 85.33%. With the support of data mining, manual intervention and errors in ESG management practice evaluation can be effectively avoided. By automatically identifying and clearing outliers in data, the accuracy of enterprise ESG management practice evaluation can be effectively improved.

-

(3)

Evaluation efficiency.

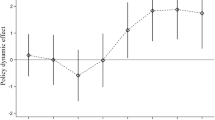

Efficient evaluation of ESG management practices in enterprises can save time, manpower, and financial resources. By quickly responding to ESG issues and trends, enterprises can better meet the expectations of investors, customers, and other stakeholders, and improve their competitiveness in the market. This article divided the evaluation cycle into 6 periods based on the ESG data dimension. Considering the scale of Z enterprise’s production and business plan, the time interval for each cycle was set at 2 days. The evaluation efficiency of ESG management practice under data mining was verified. To highlight the results, this article compared it with the on-site inspection manual evaluation method adopted by Z Company in 2020 and compared the completion rates of the two methods on various dimensions of data in different cycles. The results are shown in Fig. 5.

In Fig. 5, the horizontal axis represents the evaluation period, and the vertical axis represents the completion rate of evaluation for each dimension of data within the period. The evaluation efficiency of the method proposed in this article was significantly better than that of manual evaluation methods. From Fig. 5A, it can be seen that the average completion rate of the environmental dimension data evaluation under this method was about 93.61%, while the average completion rate of the social dimension and governance dimension data evaluation was about 87.81% and 88.23%, respectively. From Fig. 5B, it can be seen that the average completion rate of environmental dimension data evaluation under manual methods was about 75.18%, while the average completion rate of social dimension and governance dimension data evaluation was about 73.67% and 75.29%, respectively. Data mining can achieve rapid collection and processing of ESG data. With the assistance of data mining, enterprise ESG management practice evaluation can achieve automated processing, reducing the workload and time of manual report preparation. However, the manual evaluation method is relatively single and lacks unified qualitative and quantitative standards, which consumes a lot of time and cost in the evaluation process. Therefore, compared to the method in this article, its evaluation completion rate within the cycle is not ideal.

Figure 5A shows the evaluation efficiency of the method proposed in this article.

Figure 5B shows the evaluation efficiency of on-site inspection methods.

-

(4)

Decision support effectiveness.

One of the main purposes of ESG management practice evaluation is to provide support for enterprise management decisions. This article was based on the evaluation results of ESG management practices in Z enterprise and evaluated the effectiveness of decision support by conducting trend analysis on historical data of environmental, social, and governance indicators, using monthly expected returns as a testing indicator. Its calculation is shown in Formula (22):

The expected rate of return is based on the original financial data provided in the annual financial statements of Z enterprise. In the formula, \({R}_{f}\) is the risk-free return rate, and \({\beta }_{i}\) is the \(\beta \) value of decision \(i\). \(E\left({R}_{m}\right)\) is the expected return rate of the market decision portfolio, and \(E\left({R}_{m}\right)-{R}_{f}\) is the risk premium of the decision portfolio. According to the formula, the decision support effect of Z enterprise ESG management practice evaluation under data mining is shown in Fig. 6.

In Fig. 6, the horizontal axis represents the month and the vertical axis represents the expected return rate. In the practical evaluation of enterprise ESG management using the opportunity intelligence algorithm, the average expected return rate based on the evaluation results of the environmental dimension as decision support was about 11.73%; the average expected return rate based on social dimension evaluation results as decision support was approximately 12.46%; the average expected return rate based on the evaluation results of governance dimensions as decision support was approximately 12.76%. From the decision support results, it can be seen that the evaluation of enterprise ESG management practices under data mining can effectively provide reliable decision support for enterprise management and operation. Data mining can predict potential risks and problems through the analysis of historical and real-time data, and provide corresponding response strategies and suggestions, thereby reducing business risks and improving decision returns.

Conclusions

With the continuous deepening of the concept of sustainable development, the role and status of ESG management practices in manufacturing enterprises in the process of sustainable operation and development are becoming increasingly important. The current evaluation of ESG management practices lacks subjectivity and accuracy. To improve evaluation efficiency and reduce manual intervention and evaluation errors, this article combined data mining to conduct in-depth research on ESG management practice evaluation in manufacturing enterprises. This has not only significantly improved the correlation between evaluation indicators, but also to some extent improved evaluation efficiency and accuracy, providing reliable and objective decision support for enterprise management and operation. Although the research on the application of data mining in the evaluation of ESG management practices in manufacturing enterprises has a certain guiding role in promoting the sustainable development of enterprises, there are still areas for improvement in the research process. The explanation of the mechanism of enterprise ESG management practice in this article is still insufficient. In the evaluation data collection, only enterprise data from a single market was selected as samples. In empirical analysis, this article focuses on Z enterprise, and there are certain limitations in the universal applicability of decision support results. In the case of data scarcity, the generalization ability of the model may be limited, making it difficult to adapt to different scenarios. In practical applications, transfer learning techniques can be used to transfer knowledge learned from other fields or areas with rich data to the ESG management practice evaluation in manufacturing. In the case of data scarcity, transfer learning can improve the generalization ability of the model, and incremental learning techniques can be adopted. As the model gradually receives new data, it continuously adjusts and updates its parameters to adapt to the changes and scarcity of data. Subsequent research can focus on addressing difficulties in data collection and annotation, improving model generalization ability, and reducing knowledge graph construction and maintenance costs to enhance the practical relevance and applicability of ESG management practice evaluation frameworks in data-scarce environments. In future research, it is necessary to consider improving the shortcomings of evaluation data and evaluation objects to enhance the practicality of data mining in ESG management practice evaluation, thereby promoting the healthy development of enterprises.

Data availability

The datasets used in the current study are available from the corresponding author on reasonable request.

References

Giese, G., Lee, L.-E., Melas, D., Nagy, Z. & Nishikawa, L. Foundations of ESG investing: How ESG affects equity valuation, risk, and performance. J. Portf. Manag. 45(5), 69–83. https://doi.org/10.3905/jpm.2019.45.5.069 (2019).

Saygili, E., Arslan, S. & Birkan, A. O. ESG practices and corporate financial performance: Evidence from Borsa Istanbul. Borsa Istanb. Rev. 22(3), 525–533. https://doi.org/10.1016/j.bir.2021.07.001 (2022).

Grim, D. M. & Berkowitz, D. B. ESG, SRI, and impact investing: A primer for decision-making. J. Impact ESG Invest. 1(1), 47–65. https://doi.org/10.3905/jesg.2020.1.1.047 (2020).

Garst, J., Maas, K. & Suijs, J. Materiality assessment is an art, not a science: Selecting ESG topics for sustainability reports. Calif. Manage. Rev. 65(1), 64–90. https://doi.org/10.1177/00081256221120692 (2022).

Madison, N. & Schiehll, E. The effect of financial materiality on ESG performance assessment. Sustainability 13(7), 3652–3672. https://doi.org/10.3390/su13073652 (2021).

Escrig-Olmedo, E., Fernandez-Izquierdo, M. A., Ferrero-Ferrero, I., Rivera-Lirio, J. M. & Munoz-Torres, M. J. Rating the raters: Evaluating how ESG rating agencies integrate sustainability principles. Sustainability 11(3), 915–930. https://doi.org/10.3390/su11030915 (2019).

Zhou, G., Liu, L. & Luo, S. Sustainable development, ESG performance and company market value: Mediating effect of financial performance. Bus. Strategy Environ. 31(7), 3371–3387. https://doi.org/10.1002/bse.3089 (2022).

Afanas’ev, M. P. & Shash, N. N. ESG transformation in the corporate sector: Systematizing the global approach. Stud. Rus. Econ. Dev. 33(6), 707–715. https://doi.org/10.1134/S1075700722060028 (2022).

Jiang, L., Yu, Gu. & Dai, J. Environmental, social, and governance taxonomy simplification: A hybrid text mining approach. J. Emerg. Technol. Account. 20(1), 305–325. https://doi.org/10.2308/JETA-2022-041 (2023).

Ziolo, M., Filipiak, B. Z., Bąk, I. & Cheba, K. How to design more sustainable financial systems: The roles of environmental, social, and governance factors in the decision-making process. Sustainability 11(20), 5604–5637. https://doi.org/10.3390/su11205604 (2019).

Ahn, T. W., Lee, H. S. & Yi, J. S. A study on the keyword extraction for ESG controversies through association rule mining. J. Inf. Syst. 30(1), 123–149. https://doi.org/10.5859/KAIS.2021.30.1.123 (2021).

D’Amato, V., D’Ecclesia, R. & Levantesi, S. ESG score prediction through random forest algorithm. Comput. Manag. Sci. 19(2), 347–373. https://doi.org/10.1007/s10287-021-00419-3 (2022).

Leins, S. ’Responsible investment’: ESG and the post-crisis ethical order. Econ. Soc. 49(1), 71–91. https://doi.org/10.1080/03085147.2020.1702414 (2020).

Sihotang, J. Analysis of shortest path determination by utilizing breadth first search algorithm. J. Info Sains: Informatika dan Sains 10(2), 1–5. https://doi.org/10.54209/infosains.v10i2.30 (2020).

Lina, T. N. & Rumetna, M. S. Comparison analysis of breadth first search and depth limited search algorithms in sudoku game. Bull. Comput. Sci. Electr. Eng. 2(2), 74–83. https://doi.org/10.25008/bcsee.v2i2.1146 (2021).

Sujaini, H., Perwitasari, A. & Januardi, T. Sistem pembelajaran algoritma best first search, breadth first search & depth first search. J. Teknik Indones. 2(2), 65–78. https://doi.org/10.58860/jti.v2i2.15 (2023).

Wang, T. et al. Big data cleaning based on mobile edge computing in industrial sensor-cloud. IEEE Trans. Ind. Inform. 16(2), 1321–1329. https://doi.org/10.1109/TII.2019.2938861 (2019).

Kumar, S. & Chaurasiya, V. K. A strategy for elimination of data redundancy in internet of things (IoT) based wireless sensor network (wsn). IEEE Syst. J. 13(2), 1650–1657. https://doi.org/10.1109/JSYST.2018.2873591 (2018).

Yi, L., Yichi, J. & Shujie, Y. Research on the value creation effect of enterprise ESG practice - a test based on external pressure perspective. South. Econ. 41(10), 93–110. https://doi.org/10.19592/j.cnki.scje.391581 (2022).

Ho, W. & Ma, X. The state-of-the-art integrations and applications of the analytic hierarchy process. Eur. J. Oper. Res. 267(2), 399–414. https://doi.org/10.1016/j.ejor.2017.09.007 (2018).

Aureli, S., Gigli, S., Medei, R. & Supino, E. The value relevance of environmental, social, and governance disclosure: Evidence from Dow Jones sustainability world index listed companies. Corp. Soc. Responsib. Environ. Manag. 27(1), 43–52. https://doi.org/10.1002/csr.1772 (2020).

Amosh, HAl. & Khatib, S. F. A. Ownership structure and environmental, social and governance performance disclosure: The moderating role of the board independence. J. Bus. Socio-econ. Dev. 2(1), 49–66. https://doi.org/10.1108/JBSED-07-2021-0094 (2022).

Cunningham, P. & Delany, S. J. k-Nearest neighbour classifiers-A Tutorial. ACM Comput. Surv. (CSUR) 54(6), 1–25. https://doi.org/10.1145/3459665 (2021).

Hassanat, A. B. A. Furthest-pair-based binary search tree for speeding big data classification using k-nearest neighbors. Big Data 6(3), 225–235. https://doi.org/10.1089/big.2018.0064 (2018).

Lubis, A. R. & Lubis, M. Optimization of distance formula in K-Nearest Neighbor method. Bull. Electr. Eng. Inform. 9(1), 326–338. https://doi.org/10.11591/eei.v9i1.1464 (2020).

Abu, A. et al. Effects of distance measure choice on k-nearest neighbor classifier performance: A review. Big Data 7(4), 221–248. https://doi.org/10.1089/big.2018.0175 (2019).

Liu, Z.-Z. & Wang, Y. Handling constrained multiobjective optimization problems with constraints in both the decision and objective spaces. IEEE Trans. Evolut. Comput. 23(5), 870–884. https://doi.org/10.1109/TEVC.2019.2894743 (2019).

Wang, Y., Hongda, Ye., Zijie, Q. & Zhiyong, W. A crowdsourcing task pricing model based on single objective optimization. Exp. Sci. Technol. 16(5), 1–5. https://doi.org/10.3969/j.issn.1672-4550.2018.05.001 (2018).

Li, Z., Wenyi, Z., Hengtian, Z., Ran, G. & Xingdong, F. Global digital compact: A mechanism for the governance of online discriminatory and misleading content generation. Int. J. Hum. Comput. Interact. 2(18), 2–25. https://doi.org/10.1080/10447318.2024.2314350 (2024).

Acknowledgements

This study was supported by the Guangdong Science and Technology Innovation Strategy Special Fund Project (Grant Number pdjh2023a0735); Zhuhai college of Science and Technology 'three levels' talent construction project; Young Innovative Talent Project of Universities in Guangdong Province (2021WQNCX118); Innovation and Entrepreneurship Training Program for College Students (202413684001X); Innovation and Entrepreneurship Training Program for College Students (S202413684004S).

Author information

Authors and Affiliations

Contributions

Zhenzu Li is responsible for the design of research project framework and research methods, data analysis and interpretation, paper writing. Yuli Yu is responsible for the data validation, formal analysis and project contact. Shiyu Wang is responsible for the data validation, formal analysis as well as writing review and editing.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Li, Z., Yu, Y. & Wang, S. Practical evaluation of intelligent algorithms in ESG management of manufacturing enterprises. Sci Rep 14, 19394 (2024). https://doi.org/10.1038/s41598-024-70376-9

Received:

Accepted:

Published:

DOI: https://doi.org/10.1038/s41598-024-70376-9