Abstract

The role of venture capital in promoting entrepreneurship and funding innovation cannot be underestimated. However, it is important to acknowledge noteworthy concerns associated with collusive behavior in the venture capital process. “Guanxi” is a relatively intimate and closed social relationship, which can impact venture capital through trust and social obligations. Drawing on the theories of unethical pro-relational behavior and social networks, using data from GEM-listed companies supported by venture capital from 2009 to 2021, this research investigates the phenomenon of collusion behavior between venture capitalists and entrepreneurs, with a particular focus on the influence of “guanxi”. The research finds that the presence of “guanxi” between venture capitalists and entrepreneurs tends to facilitate collusive behavior. Specifically, “guanxi” tends to increase entrepreneurial self-interest behavior, and venture capitalists’ returns, infringe upon minority shareholders’ interests, and increase corporate operational risk. Moreover, the study further explores the moderator effect of equity incentives on such collusion behavior. This research not only enriches the theoretical framework of the relationship between “guanxi” and venture capital activities but also provides insight into the ethical implications associated with “guanxi”, contributing to the broader literature on social relationships and unethical behavior.

Similar content being viewed by others

Introduction

Venture capital plays a crucial role in fostering entrepreneurship and financing innovation, facilitating economic structural adjustments, and industrial transformation (Jeon and Maula 2022). However, several significant issues relevant to venture capital cannot be ignored, including the “collusive behavior” between venture capitalists and entrepreneurs. Collusive behavior in venture capital activities refers to the unethical actions of venture capitalists and entrepreneurs in pursuing their interests, which harm the interests of minority shareholders and increase corporate operational risks (Stigler 1982). Venture capitalists can increase investment returns through collusion, while “quid pro quo” relaxes their monitoring constraints on entrepreneurs. Collusive behavior not only misleads investors into making erroneous decisions but also diminishes the positive role of venture capital in innovation and entrepreneurship. Therefore, it is of great importance for both academia and practitioners to recognize and explore deeply how to mitigate the adverse effects of collusive behavior.

Based on similarities in human capital characteristics, “guanxi” such as alumni, hometown connections, and colleagues among venture capitalists and entrepreneurs can cultivate interpersonal connections that facilitate a mutual exchange of favor (Hou and Zhu 2020). “Guanxi” is a relatively intimate and closed social relationship that helps improve the efficiency and effectiveness of resource acquisition for both parties, while reducing information asymmetry and transaction costs (Butt 2019). However, transactions formed based on trust and personal exchange are prone to weakening supervision, increasing business risk, and speculative behavior (Khedmati et al. 2020; Muldoon et al. 2018). Based on “guanxi”, venture capitalists rely on relationship contracts, not meticulously designed incentive mechanisms, resulting in looser investment contracts and adverse effects on investment performance (Bengtsson and Hsu 2015; Deakins and North 2016). In venture capital transactions, collusive behavior between venture capitalists and entrepreneurs is covert and not explicitly stated in formal contracts, which depends more on trust, tacit understanding, and incentives provided by implicit contracts. “Guanxi” helps create these conditions and promotes the occurrence of collusive behavior between venture capitalists and entrepreneurs.

Although scholars have increasingly focused on collusive behavior in corporate operations and the influence of “guanxi” in venture capital transactions, there are still certain research gaps. Firstly, based on social identity and principal-agent theory, previous research has focused on the “investment” stage of venture capital processes, highlighting the positive effects of “guanxi” in inhibiting moral hazards, facilitating investment and financing activities (Ed-Dafali and Bouzahir 2022). However, there is a lack of attention to the negative effects caused by collusion behavior between venture capitalists and entrepreneurs based on “guanxi” during the “exit” stage. Secondly, in the context of collusive behavior, existing research has primarily focused on shareholders, management, auditing, and external supervision (Wang et al. 2023; Wang et al. 2022), with limited attention given to collusive behavior between venture capitalists and entrepreneurs. Thirdly, the formation and corporate governance of collusive behavior between venture capitalists and entrepreneurs based on “guanxi” still requires further exploration and refinement (Ren and Chadee 2017).

Given the importance of “guanxi” and collusive behavior as well as the research gaps, this study incorporates the principal-agent relationship in venture capital and the hierarchical “guanxi” network to focus on collusive behavior between venture capitalists and entrepreneurs, taking a theoretical approach based on social identity theory, social exchange theory, and the theory of unethical pro-relational behavior. The study addresses the main research questions: (1) Is “guanxi” conducive to inducing collusive behavior between venture capitalists and entrepreneurs during the “exit” stage of venture capital? (2) What can restrain this kind of collusive behavior? To address these research questions, this study employs empirical methods using Chinese Growth Enterprise Market (GEM) listed companies from 2009 to 2021 as the research sample.

The reason why we chose China as the empirical research sample is that “guanxi” and collusive behavior are hot topics in venture capital transactions with typical Chinese characteristics. The Chinese government placed great importance on the crucial role of venture capital in transforming technological innovation and industrial patterns and has implemented various policies to encourage the development of venture capital, providing a strong impetus for the high-quality development of China’s real economy. However, China’s secondary securities trading market has a speculative atmosphere (Hu and Wang 2022). Venture capitalists have an incentive-compatible mechanism with entrepreneurs to manipulate stock prices by using “market value management” to boost stock prices and generate high returns for venture capital. Moreover, Chinese society is a relational society, and social networks exhibit the characteristic of a “diversity-orderly structure”, with typical “relationship-based” social features in China (Barbalet 2021). Therefore, “guanxi” is a hot topic in Chinese venture capital transactions with typical characteristics.

This study contributes to the existing theoretical research in three aspects. Firstly, based on social exchange theory and social identification theory, this study examines the impact of “guanxi” on collusion behavior between venture capitalists and entrepreneurs from the interactive perspective, enriching the theoretical framework on the influence of “guanxi” on venture capital activities. Existing studies on the impact of venture capital on innovation and entrepreneurship are based on the agency theory, and lack of consideration of the interactivity between venture capitalists and entrepreneurs (Lahr and Mina 2016). However, venture capital involves a mutual selection and evaluation process, and the relationship between the parties directly influences the effectiveness of venture capital. This study explores collusion behavior between venture capitalists and entrepreneurs by utilizing the characteristics of “guanxi” that facilitate communication and trust-building from the interactivity perspective, offering a more comprehensive understanding of collusion behavior in venture capital transactions.

Secondly, this study focuses on the negative impact of “guanxi” in the exit stage of venture capital transactions, which provides new insights for the study of the relationship between venture capitalists and entrepreneurs, and enriches the research field of “cooperation or collusion”. Existing literature reveals the positive influences of “guanxi” on investment decisions at the investment stage of venture capital transactions (Xue et al. 2018). This study not only investigates the negative impact of venture capital but also explores the method of constraining the adverse implications of “guanxi” on the interests of minority shareholders and firm performance.

Thirdly, building upon the theories of unethical pro-organizational behavior, this study introduces the concept of unethical pro-relational behavior, which explores the logic of the ethical and moral issues triggered from the perspective of moral psychological mechanisms, thereby expanding the relevant theoretical frameworks of social relationships and unethical behavior research. Existing literature on the influence of “guanxi” on firm decision-making is mostly based on social identity and social exchange theories (Ma et al. 2022). However, these theories fail to effectively explain the mechanisms of the impact of “guanxi” on the stakeholders. The concept of unethical pro-relational behavior proposed in this study emphasizes that collusion behavior between venture capital and entrepreneurs based on “guanxi” can harm the interests of minority shareholders and increase corporate operational risks.

The paper is organized as follows. In the next section, the literature review and the development of the hypotheses are reported. Then, we report the methodology followed by the results obtained. Next, the results are discussed and the main contributions of the work are presented. Last but not least, the limitations of the research are discussed, and future research directions are suggested.

Literature review

Collaboration between venture capitalists and entrepreneurs

Drawing on the principal-agent theory, existing literature explores the collaboration between venture capitalists and entrepreneurs from the perspectives of regulatory mechanisms and incentive contracts (Gu et al. 2018). This collaboration is based on formal contractual constraints on entrepreneurial behavior by venture capital’s use, characterized by compulsion or inequality (Sun et al. 2019). Due to differences in sources of returns, expertise, and information advantages, venture capitalists also have motives and capabilities to engage in opportunistic behaviors (Christensen et al. 2009; Wen and Feng 2018). Therefore, relying solely on the principal-agent theory and contractual cooperation is insufficient to effectively address the contradictions and conflicts in the venture capital process.

Based on organizational relationship theory, governance of the relationship between transaction partners contributes to fulfilling cooperative obligations and restraining opportunistic behaviors, supplementing the limitations of formal contracts (Feng and Li 2019). Venture capitalists, when seeking investment opportunities, are essentially looking for partners, emphasizing cooperation, social exchange, and trust dependency (Kwok et al. 2019). The accumulation of proprietary knowledge and resources based on their own technical and industry experience by venture capitalists and entrepreneurs has a significant impact on firm performance and innovation (Yi et al. 2023). The resources provided by venture capitalists, as well as the acceptance of these resources by entrepreneurs, depend on the level of closeness in their relationship. Xu et al. (2021) suggest that factors such as fairness, goal consistency, and uniform behavioral norms in the relationship can impact the compatibility of venture capitalists and entrepreneurs, subsequently affecting the efficiency and effectiveness of post-investment management activities.

Trust is particularly important in the process of establishing long-term, stable, and close cooperative relationships (Muldoon et al. 2018). Trust can promote knowledge sharing and complementary resource integration between venture capitalists and entrepreneurs, reduce opportunistic risks, and establish efficient governance mechanisms (Christensen et al. 2009; Grilli et al. 2019). Reciprocal trust enhances the willingness of both parties to share risks, alleviates agency problems and conflicts of interest in investments, achieves overall efficiency optimization, and avoids efficiency losses resulting from the prisoner’s dilemma caused by mutual suspicion between venture capitalists and entrepreneurs (Kaiser and Berger 2021). Furthermore, scholars have found that factors such as information exchange (Kwok et al. 2019), fairness in the transaction process (Fu et al. 2019), relationship characteristics (Vedula and Fitza 2019), and geographical proximity (Colombo et al. 2019) all have significant influences on trust and cooperative relationship between venture capitalists and entrepreneurs.

“Guanxi” in organizational behavior

According to social network theory, “guanxi” is a strong tie developed through long-term interactions and exchanges between individuals with similar socioeconomic characteristics, which facilitate the acquisition of resources, information, and tacit knowledge for collaboration (Tan et al. 2022). Cohen and Keren (2008) found that when fund managers and company executives graduated from the same university, fund managers were able to obtain more valuable information on companies, leading to higher excess investment returns. Tao and Chuang (2018) found that in scenarios with a high level of distributors’ speculation, “guanxi” is more effective in promoting cooperation between transaction parties compared to IT resources. “Guanxi” within corporate boards can reduce opportunistic behaviors, increase team cohesion, and positively impact corporate governance and performance.

However, some scholars have declared that “guanxi” between CEOs and directors weakens the supervisory role of directors. Khedmati et al. (2020) found that an intimate relationship between directors and CEOs leads to lower labor investment efficiency and damages shareholder value. Lu and Hu (2016) found that a hometown relationship between CEOs and directors increases firm risk, raises the likelihood of corporate misconduct, and reduces the possibility of being investigated for misconduct. If “guanxi” is used to share insider information for illegal trading, it undermines market fairness and justice.

“Guanxi” also plays an important role in venture capital transactions. During the investment screening stage, “guanxi” facilitates information communication and exchange between venture capitalists and entrepreneurs, enabling venture capitalists to uncover soft information on the true state of business development (Lee 2017). However, in relationship-based investments, venture capitalists often rely on relational contractual constraints rather than carefully designed incentive mechanisms, resulting in relatively loose investment contracts that adversely affect investment performance (Ding et al. 2018). Additionally, as trust between venture capitalists has become particularly crucial in joint investments (Plagmann and Lutz 2019), venture capitalists with “guanxi” are more likely to form syndication partnerships. However, due to the ease of making irrational decisions in a friendly relationship, the success rate of investments is lower (Gompers et al. 2016).

Collusion behavior in transactions

The collusion behavior between venture capitalists and entrepreneurs in this study is discussed within the context of social relationships. According to the definition of collusion behavior by Stigler (1982) “an illegitimate behavior where two or more economic entities collude with each other, guided by the maximization of individual interests, causing harm to the interests of third parties”, the collusion behavior between venture capitalists and entrepreneurs in this study specifically refers to the alliance formed by venture capitalists and entrepreneurs using various means to maximize their interests at the expense of sacrificing the interests of minority shareholders and increasing corporate operational risks.

Existing research has shown that incentives for self-interests for both parties (Azar et al. 2018), low collusion costs (Laffont and Martimort 1997), and a poor corporate governance environment (Guoyu 2019) contribute to collusion behavior. Cai et al. (2015) concluded that firms collude with the media to obtain additional profits, mainly by releasing more positive news to attract investors to buy stocks and increase stock prices. Laffont and Martimort (1997) proposed that the probability of collusive behavior increases significantly when the information is verifiable and non-counterfeitable. When corporate governance is poor, the major shareholders may collude to hollow out the company’s interests and infringe on the interests of minority shareholders, and the controlling shareholders may also engage in collusion by buying off executives (Guoyu and Wei 2018).

Efforts to prevent collusive behavior mainly focus on regulatory agencies and corporate governance. Governance and prevention measures primarily focus on external governance, emphasizing the strengthening of legal supervision and the improvement of the business environment (Bian et al. 2023). They also focus on strengthening incentives for regulators, reducing the benefits of collusive behavior, and increasing the transaction costs of collusive behavior (Ouyang et al. 2020). It is important to note that prevention and governance of collusive behavior require a multi-faceted approach that combines regulatory measures, corporate governance practices, and the active participation of various stakeholders, including regulators, companies, and investors.

Theoretical analysis and research hypothesis

The impact of “guanxi” on collusion behavior between venture capitalists and entrepreneurs. “Guanxi” and entrepreneurial self-interest behavior

Due to the information asymmetry in venture capital transactions, venture capitalists often face serious agency problems (Burchardt et al. 2016). To protect their investment profit, venture capitalists supervise the decisions of entrepreneurs through investment contract terms and post-investment management activities (Gompers et al. 2020). When venture capitalists and entrepreneurs have “guanxi”, collusion between them is more likely to occur. According to social identity theory, “guanxi” formed based on similarities in human capital characteristics can establish emotional trust mechanisms, facilitating mutual understanding, and the formation of a community of interests (Hogg et al. 2012). Based on “guanxi”, venture capitalists may develop overly optimistic attitudes and engage in irrational behaviors, leading to more lenient investment contracts (Bengtsson and Hsu 2015). In the process of post-investment management, they may not design incentive mechanisms carefully, reducing the supervision and constraint on entrepreneurial self-interest behavior. When entrepreneurs slack off, venture capitalists, driven by the friendly trust established through the “guanxi”, will not impose severe punishment, which in turn provides a reverse incentive for entrepreneurs to pursue their self-interest.

Moreover, within social networks formed by “guanxi”, the negative information on behaviors that harm the interests of “insiders” quickly spreads, making it difficult for individuals to continue accessing resources within that social network (Froehlich et al. 2020). Under the constraints of this relationship contract, the opportunistic behavior between venture capitalists and entrepreneurs is reduced, making it easier to achieve collusion (Mishra et al. 2021). Without harming the interests of venture capital, venture capitalists will support entrepreneurs. To manipulate stock prices to maximize returns on venture capital, venture capitalists may even intentionally consolidate and strengthen the power of entrepreneurs, thereby causing entrepreneurs to engage in more self-interest behaviors. Based on the above analysis, the hypothesis 1 is proposed.

Hypothesis 1: The “guanxi” between venture capitalists and entrepreneurs is conductive to induce entrepreneurial self-interest behavior.

“Guanxi” and venture capitalists’ returns

From the perspective of social exchange, when venture capitalists relax their supervision of entrepreneurial self-interest behavior, they show more trust and understanding towards entrepreneurs (Grilli et al. 2018). This helps foster a positive exchange awareness between venture capitalists and entrepreneurs, thereby inducing collusion to assist venture capitalists in increasing their returns. Furthermore, social networks formed through “guanxi” are characterized by strong ties, which contribute to more efficient resource and information exchange and facilitate the achievement of economic goals for venture capitalists and entrepreneurs. Strong ties represent intimate and closed social relationships, making it easier for tightly bonded groups to establish cooperative relationships based on trust and maintain stable expectations for the future (Muldoon et al. 2018; Shuwei and Chunling 2018).

To consistently access resources within the network, entrepreneurs must adhere to the principle of reciprocity and maintain a good relationship with “insiders”. This involves exchanging resources or benefits with venture capitalists and providing them with maximum assistance to enhance their performance in terms of investment exit (Neumeyer and Santos 2018). Otherwise, entrepreneurs may face exclusion or even punishment within the network. Venture capitalists primarily seek to realize profits through the exit of invested firms via public listing, with the key determinant of profitability being the performance of stock transactions at the time of exit. Based on social exchange theory, entrepreneurs are more likely to manipulate stock prices with venture capitalists on the same values and beliefs, helping venture capitalists maximize their investment returns. Based on the above analysis, the hypothesis 2 is proposed.

Hypothesis 2: The “guanxi” between venture capitalists and entrepreneurs is conductive to induce venture capitalists’ returns.

“Guanxi” and the minority shareholders’ interests

Although some studies argued that venture capitalists can supervise entrepreneurial behavior to protect the interests of minority shareholders, the interests of venture capitalists and minority shareholders were not completely aligned (Bonini and Capizzi 2019). When the gains obtained through collusive embezzlement with entrepreneurs exceed the gains obtained through regulatory actions, venture capitalists are likely to engage in collusion to empty the company. Minority shareholders suffer from significant information asymmetry regarding entrepreneurial behavior and are unaware of the informal contracts between venture capitalists and entrepreneurs (Kong 2019). Due to the “guanxi” between venture capitalists and entrepreneurs, the cultivation of mutual trust and effective communication can facilitate reciprocal behaviors and give rise to implicit relational contracts. Both entrepreneurial self-interest behavior and measures to enhance venture capitalists’ returns can harm the interests of minority shareholders.

From the perspective of unethical pro-relational behavior, collusion that harms the interests of minority shareholders can be explained. Venture capitalists and entrepreneurs may feel less ethical pressure and fewer ethical constraints in “guanxi”. “Guanxi” is more likely to make “insiders” identify with group ethical norms, form moral intuitions that protect the interests of the group, and attach more importance to communal interests maintained by these relationships (Baker et al. 2019). When “guanxi” exists, venture capitalists and entrepreneurs are more likely to protect each other’s interests. In carrying out unethical behavior, individuals may engage in moral disengagement to escape moral constraints, reinforcing the rationality of unethical behavior and disregarding the fact that it violates financial ethics.

The pattern of relationships in a network exhibits a “hierarchical structure”, and different moral rules may apply to relationships of varying levels of closeness (Flicker et al. 2021). In “guanxi” with narrower contact surfaces and stronger relationship intensities, individuals’ moral restraints weaken as the distance from the “central core” of the relationship increases. Unethical behavior that sacrifices the interests of “outsiders” to satisfy the needs of “insiders” is more likely to occur (Hongdan and Jun 2017). Additionally, minority shareholders in China generally face challenges in supervising entrepreneurial behavior and protecting their interests due to deficiencies in corporate governance and equity structures (Mo 2021). Therefore, venture capitalists and entrepreneurs based on “guanxi” have stronger motives and abilities to exploit the interests of minority shareholders. Based on the above analysis, the hypothesis 3 is proposed.

Hypothesis 3: The “guanxi” between venture capitalists and entrepreneurs is conductive to induce the minority shareholders’ interests.

“Guanxi” and corporate operational risks

“Guanxi” between venture capitalists and entrepreneurs can weaken the supervisory role of venture capital, which is detrimental to the long-term development of firms and the stability of secondary market stocks. Previous studies on the influence of “guanxi” between boards of directors and CEOs found that “guanxi” weakened the supervisory governance of the board, increasing business risks (Lu and Hu 2016). Based on social identity theory, “guanxi” undermines the inhibitory effect of venture capital on entrepreneurial self-interest behavior, increasing moral risks and agency costs within firms. To satisfy personal interests, entrepreneurs engage in opportunistic behavior, leading to inefficiency in decision-making, ineffective resource allocation, and increased business risks (Christensen et al. 2009). Furthermore, under the influence of social exchange, entrepreneurs may manipulate stock prices through changes in secondary market prices to increase the volatility of the firm’s capital market, thereby increasing venture capitalists’ returns (Cao et al. 2021).

Unethical behavior resulting from collusion behavior between venture capitalists and entrepreneurs also damages the capital market environment and harms firm development (Baker et al. 2019). Although unethical behavior may benefit the maintenance of social networks and the interests of “insiders”, these benefits are only short-term. Unethical behavior in violation of mainstream social norms has negative consequences for other stakeholders, undermining the establishment of corporate social reputation and healthy sustainable development (Guoyu and Wei 2018). The collusive process between venture capitalists and entrepreneurs distorts stock prices and firm value, increasing market volatility and business risks. Simultaneously, it harms the interests of minority shareholders, undermines investor confidence, reduces trust in the market, and may even lead to a crisis of public trust, thereby increasing corporate operational risk. Based on the above analysis, the hypothesis 4 is proposed.

Hypothesis 4: The “guanxi” between venture capitalists and entrepreneurs is conductive to induce corporate operational risks.

Moderator effect of equity incentives

Corporate governance plays a crucial role in maintaining robust operational health and protecting shareholder interests (Guoyu 2019). Equity incentives, as a cornerstone of governance practices, align the interests of management with the strategic objectives of the company. This alignment not only promotes long-term stability but also strengthens market competitiveness and enhances investor trust (Baker et al. 2019). The implementation of equity incentives significantly constrains collusion between venture capitalists and entrepreneurs by reducing both the motivation and capacity for such behavior.

Firstly, implementing equity incentives diminishes the motivation for collusion between entrepreneurs and venture capitalists. When entrepreneurs hold company shares, their anticipated returns encompass not only salaries and bonuses but also dividends and capital appreciation. This integration aligns entrepreneurial interests with long-term corporate goals, augmenting wealth motivations and redirecting focus toward sustained company development (Ouyang et al. 2020). As equity holdings form part of economic incentives, they effectively boost executives’ legitimate earnings, thus mitigating incentives for misconduct (Martin et al. 2020). While collusion may yield short-term gains, it escalates operational risks and stock price volatility, undermining investor trust and eroding long-term company value. These adverse outcomes amplify the covert costs of collusion, prompting entrepreneurs to steer clear after weighing the pros and cons. Under such incentive mechanisms, entrepreneurs prioritize promoting sound operations and long-term value through legitimate means, pursuing enduring returns from equity rather than short-term gains from collusion.

Moreover, equity incentives reduce the capacity for collusion between entrepreneurs and venture capitalists. When companies adopt equity incentives, other executives also hold stakes, aligning their interests with the company’s long-term objectives and collectively constraining collusion. Given that collusion heightens operational risks, this conflicts with the desires of other equity-holding executives. To safeguard their interests and prevent collusive-induced losses, executives enforce oversight measures to constrain collusion between venture capitalists and entrepreneurs. Furthermore, equity incentives prompt management to scrutinize corporate governance and internal controls, facilitating robust governance frameworks and transparent operations (Martin et al. 2020). Wruck and Wu (2021) demonstrate that equity incentives enhance information disclosure quality, thereby reducing information asymmetry within firms. Well-designed equity incentive schemes preempt and constrain collusion between entrepreneurs and venture capitalists by enhancing transparency and governance efficacy through optimized information flow and supervisory roles. Based on the above analysis, the hypothesis 5 is proposed.

Hypothesis 5: The equity incentives can weaken the influence of “guanxi” on collusion behavior.

H5-1: The equity incentives can weaken the positive influence of “guanxi” on entrepreneurs’ self-interested behavior.

H5-2: The equity incentives can weaken the positive influence of “guanxi” on venture capitalists’ returns.

H5-3: The equity incentives can weaken the negative influence of “guanxi” on the minority shareholders’ interests.

H5-4: The equity incentives can weaken the positive influence of “guanxi” on corporate operational risks.

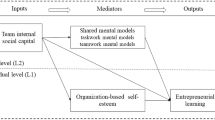

With the above five hypotheses, the conceptual model is illustrated in Fig. 1.

Empirical design

Data sources and sample selection

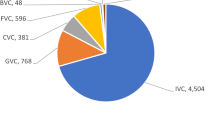

This study seeks to analyze the impact of venture capital on entrepreneurial firms within the context of the Growth Enterprise Market (GEM). Recognized as a primary capital-raising platform for entrepreneurial enterprises, the GEM also represents an essential channel for venture capital firms to exit their investments. After a successful listing, venture capital firms embark on exit strategies, which can potentially exert enduring effects on the invested firms. This study leverages information spanning the year of listing and the subsequent two years, culminating with a data cutoff of December 31, 2021. Rigorous sample selection procedures involved the exclusion of non-financial firms, ST and *ST firms, as well as samples with incomplete data, yielding a final sample size of 462 firms and 1600 observations for meaningful analysis.

Entrepreneurs refer to the founders of the invested firms. It is determined whether they are explicitly identified as founders or co-founders in their executive resumes. If the executive’s resume does not explicitly disclose the founder’s name, this article will designate the “Chairman” as the entrepreneur. This is because most of the companies listed on the SME board and the Growth Enterprise Market are private enterprises, and their founders usually serve as the Chairman and hold company shares. Venture capitalists refer to the leaders of venture capital institutions involved in investment events, and data related to venture capital institutions’ investment activities can be obtained from the CVSource database.

The data on collusion behavior include the entrepreneur’s executive overcompensation and executive perk consumption, venture capitalists’ returns, minority shareholders’ interests, and corporate operational risks. These financial data and corporate governance data are obtained from the CSMAR and CNRDS databases, while venture capital event data are obtained from the CVSourse and CNRDS databases. For data that cannot be directly acquired from the databases, such as the personal backgrounds of venture capitalists and entrepreneurial founders, the manual collection is conducted based on sources such as company annual reports, company (institution) official websites, and news articles.

Measurement of variables

Dependent variables

As the dependent variable, collusion behavior between venture capitalists and entrepreneurs has a covert nature and is difficult to directly observe and measure through contracts. Thus, according to the concept of collusion behavior, collusion behavior is characterized by entrepreneurs pursuing self-interest behavior, increased returns for venture capitalists, infringement of interests for minority shareholders, and increased corporate operational risk.

Entrepreneurial self-interest behavior

Entrepreneurial self-interest behavior can be represented by executive perks consumption (Cpc) and executive overcompensation (Overpay). Executive perks consumption (Cpc) is calculated by the natural logarithm of the sum of managerial expenses, including entertainment expenses, travel expenses, office expenses, and socialization expenses (Shi et al. 2022). Executive overcompensation (Overpay) refers to the difference value between actual compensation and expected compensation, and it includes both monetary compensation and stock-based incentives. As it is difficult to distinguish the purpose of stocks allocated to entrepreneurs for stock-based incentives from the disclosed financial statements, this study follows the approach used by Luo et al. (2014) and takes the natural logarithm of cash compensation received by their entrepreneurs. The executive overcompensation (Overpay) is calculated based on the entrepreneurial compensation model proposed by Guoyu (2019), as shown in Eq. (1).

Where \(Siz{e}_{it}\) is firm size, measured by the natural logarithm of total assets of firm i in year t. \(Ro{a}_{it}\) is the return on assets (ROA) of firm i in year t. \(I{A}_{it}\) is the ratio of intangible assets to total assets of firm i in year t. \(So{e}_{it}\) is a binary variable indicating whether the firm is state-controlled. 1 represents state-controlled, and 0 represents non-state-controlled. \(Ag{e}_{it}\) represents the age of the entrepreneur of firm i in year t. \(Dua{l}_{it}\) is a binary variable indicating whether the CEO and Chairman positions are held by the same person. 1 represents they are the same person, and 0 represents they are different individuals. \({\varepsilon }_{it}\) represents the error term.

Venture capitalists’ returns (VCself)

The returns obtained by venture capitalists from their investments specifically denote the profits that investors earn from selling their investments when the market value of the project increases. According to the research of Achleitner et al. (2014) and Zhang and Hartley (2018), the returns of venture capitalists are measured using the annual average investment return rate when venture capital exits. The higher the return rate, the higher the accompanying rights of the venture capitalists. The investment return rate is measured using the multiple of book value returns. The formula for the book value multiple is BVM = (BVR-IA)/IA. Where BVM represents the book value multiple, BVR indicates cumulative book value exit returns, and IA represents the cumulative investment amount.

Minority shareholders’ interests (Msexpr)

The measurement of damage to the interests of minority shareholders’ interests can be carried out by utilizing the voting rights of minority shareholders (Msexpr). Minority shareholders hold relatively few shares, and the cost and benefits of direct participation in the shareholders’ meeting do not match. They often take “voting with their feet” and “free-riding” behaviors, which creates conditions for collusion to harm the interests of minority shareholders (Yao et al. 2023). To protect the interests of minority shareholders, the China Securities Regulatory Commission and the Company Law both support listed companies in actively implementing online voting and cumulative voting systems (Cao et al. 2022). The online voting system provides a more direct and convenient platform for minority shareholders to participate in corporate governance, while the cumulative voting system enables minority shareholders to concentrate votes and increase the possibility of electing directors who represent their interests. However, both online voting and cumulative voting need to be implemented through the company’s articles of association or shareholder meeting resolutions, and managers who want to collude to harm the interests of minority shareholders will not actively promote the construction of relevant systems. Therefore, when the listed company adopts both the online voting system and the cumulative voting system, the value of this variable equals 1, otherwise, 0 (Ma et al. 2023).

Corporate operational risks (Risk)

Considering the high volatility of the Chinese stock market, earnings volatility (Roa) has been used by many scholars to measure corporate operational risks (Risk) in China. A higher earnings volatility indicates a higher level of firm operational risks. This study selects the coefficient of variation of the three-year return on assets as the measure of firm risk. Following the methodology of He et al. (2019), earnings volatility is calculated by dividing pre-tax profits by total assets at the end of the year. To mitigate the impact of industry and business cycles, Eq. (2) is used to calculate the adjusted Roa (Adj_Roa) by subtracting the industry average Roa for each year. Using a rolling three-year period (from year t to t + 2) as an observation period, Eq. (3) is used to calculate the standard deviation of the industry-adjusted Roa (Adj_Roa) and multiplied by 100 to obtain the corporate operational risks (Risk). This transformation is only for the sake of dimensionality and does not affect the significance level of the results.

Independent variable

The independent variable is “guanxi” (Guanxi) between venture capitalists and entrepreneurs. Drawing on previous research such as Khedmati et al. (2020) and Bengtsson and Hsu (2015), “guanxi” is defined as alumni relationship, colleague relationship, hometown relationship, political relationship, and association relationship. Alumni relationship refers to individuals who have attended the same school, including undergraduate, graduate, doctoral, MBA, and EMBA programs. Colleague relationship refers to individuals who have worked in the same company. Hometown relationship refers to individuals who come from the same city or birthplace. Political relationship refers to individuals who have worked in the same regional government department. An association relationship refers to individuals who have participated in the same association. The variable “guanxi” (Guanxi) is set to measure the sum of different types of “guanxi”, when there are no above types of “guanxi”, the value is 0. For each additional type of “guanxi”, the value increases by 1. The value of this variable ranges from 0 to 5 as a natural number.

Moderator variables

Equity incentives (Hold) are beneficial in reducing agency costs within a company. Equity incentives can make entrepreneurs’ interests tied to the long-term interests of the company, motivating them to consider the alignment of the company’s short-term development and long-term benefits (Baker et al. 2019). The proportion of shares held by the chairman is used as a measure of equity incentives (Li et al. 2016).

Control variables

Control variables include characteristics of entrepreneurs (EPs), characteristics of invested firms (EP), characteristics of venture capitalists (VCs), and characteristics of venture capital institutions (VC). The characteristics of entrepreneurs include age (Entre_age), gender (Entre_gder), education level (Entre_edu), and work experience (Entre_exp). The characteristics of invested firms include firm size (Firm_size), firm profitability (Firm_profit), firm leverage (Firm_Lever), intangible asset ratio (Firm_itg), and earnings per share (Firm_eps). The characteristics of venture capitalists include gender (VCs_gder), education level (VCs_edu), and work experience (VCs_exp). The characteristics of venture capital institutions include reputation (VC_rep), investment experience (VC_size), and ownership type (VC_own). The regression also controls for year-fixed effects and industry-fixed effects. The industry classification of firms follows the “Guidelines for Industry Classification of Listed Companies” issued by the China Securities Regulatory Commission in 2012. The specific definitions and calculations of variables are presented in Table 1.

Modeling

Impact of “guanxi” on collusive behavior

This paper empirically investigates the impact of “guanxi” on collusive behavior between venture capitalists and entrepreneurs and the moderator effect of equity incentives.

Firstly, the dependent variables of entrepreneurial self-interest behavior and corporate operational risks are continuous variables that follow a normal distribution and the data structure is unbalanced panel, which applies to a fixed effect model. The study controls for individual effects of the companies, as well as virtual variables for years and industries. The probability function is shown in Eq. (4).

Where n represents the sample size, \({x}_{itK}\) denotes the i firm, in the t year, and the k explanatory variable (k = 1, 2, …, K).

Secondly, the dependent variable venture capitalist returns, is a continuous variable that follows a normal distribution and the data structure is cross-sectional, thus, the ordinary least squares (OLS) model is used, as seen in the Eq. (5).

Where n represents the sample size, while \({x}_{iK}\) indicates the i firm and the k explanatory variable (k = 1, 2…, K).

Thirdly, the dependent variable minority shareholders’ interests, which is a binary choice variable, and panel data, the xtlogit model is chosen. In this model, we set the reference group as companies that do not have the power for minority shareholders to participate in the online voting system and the cumulative voting system at shareholder meetings, indicating that the interests of minority shareholders are not protected. The specific probability function formula is shown in Eq. (6).

Moderating effects of equity incentives

To examine the moderating effects of equity incentives, this study adopts the moderation effect testing procedure proposed by Fang et al. (2022), as shown in Fig. 2. Where X represents the independent variable, Y represents the dependent variable, M represents the moderating variable, a, b, and c denotes the coefficients of the variables, and e represents the error term. When analyzing the moderation effect, both the independent variable and the moderating variable need to be centered. Subsequently, regression analysis is performed to estimate and test the significance of the coefficient c of the interaction term. If c is significant (i.e., the null hypothesis H0: c = 0 is rejected), it indicates a significant moderating effect of M.

The hierarchical regression model used in the moderation effect test in this study is represented by Eqs. (7) and (8). The significance of the moderation effect is determined by comparing whether there is a significant increase in R2 or if the coefficient of the interaction term η2 is significant after the inclusion of the interaction term.

Where \({Y}_{it}\) represents the dependent variable of firm i, \({X}_{it}\) represents the “guanxi” between venture capitalists and entrepreneurs in firm i, \({M}_{it}\) represents the moderating variable of firm i, and \(\sum {X}_{it}\times \sum {M}_{it}\) represents the interaction term between “guanxi” and the moderating variable. \({Z}_{it}\) represents the control variables of firm i, and \({\varepsilon }_{it}\) represents the error term.

Empirical analysis

Descriptive statistics

Before conducting the empirical analysis, this study first presents the descriptive statistics of the sample data. Tables 2 and 3 present the descriptive statistics results, which show that the data for each variable are relatively stable, without excessive dispersion or significant influence from extreme values.

Testing the impact of “guanxi” on collusion behavior

This section presents empirical evidence to validate the hypotheses, exploring the influence of “guanxi” on collusion behavior. The regression results are shown in Table 4.

Models (1)-(4) employ a fixed-effects model to assess the positive impact of “guanxi” on entrepreneurial self-interest behavior. Model (1) is a regression of the control variables on executive overcompensation. In Model (2), the independent variable “guanxi” is added. The coefficient of variable “guanxi” is significantly positive (β = 0.066, p < 0.01), which indicates that “guanxi” has a significant positive effect on executive overcompensation. Model (3) is a regression of the control variables on executive consumption. The independent variable of “guanxi” is added in Model (4). The regression results show a significant positive effect of “guanxi” on executive perks consumption (β = 0.092, p < 0.01). The empirical result of Models (1)–(4) indicates that hypothesis 1 is supported.

Model (5) and Model (6) are used to verify the positive impact of “guanxi” on venture capitalists’ returns. Model (5) is a regression of the control variables on venture capitalists’ returns, while Model (6) adds the independent variable of “guanxi” to Model (5). The regression results show that “guanxi” has a significant and positive impact on venture capitalists’ returns (β = 1.782, p < 0.01). Hypothesis 2 is supported.

Models (7) and (8) employ the xtlogit model to examine the impact of “guanxi” on the minority shareholders’ interests. Model (7) is a regression of the control variables on minority shareholders’ interests. The independent variable of “guanxi” is added in Model (8). The regression results show a significant negative effect of “guanxi” on minority shareholders’ interests (β = −0.127, p < 0.01). Hypothesis 3 is supported.

Models (9) and (10) employ a fixed-effects model to assess the influence of “guanxi” on corporate operational risks. Model (9) is a regression of the control variables on corporate operational risks. The independent variable of “guanxi” is added in Model (10). The regression results indicate a significant positive effect of “guanxi” on the level of business risks (β = 0.002, p < 0.01). Hypothesis 4 is supported.

Testing the moderator effect of equity incentives

Table 5 shows the test of the moderating effect of executive equity on the relationship between “guanxi” and collusive behavior which is used to verify hypothesis 5.

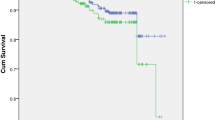

Model (1)–(4) verifies hypothesis 5-1. Model (1) adds the moderator variable to the main effect and Model (2) adds the interaction term between the moderating variable and the independent variable. The coefficient of the interaction term is significantly negative (η = −0.112, p < 0.10). In addition, the R2 increases from 0.069 to 0.076 after the inclusion of the interaction term, indicating a significant moderating effect. This study further plots the moderating effect in Fig. 3a. It can be seen that executive equity weakens the positive effect between “guanxi” and excess compensation.

a shows the negative impact of equity incentives on the relationship between "guanxi" and executive overcompensation. b presents the negative impact of equity incentives on the relationship between "guanxi" and executive perks consumption. c describes the negative impact of equity incentives on the relationship between "guanxi" and venture capitalists' returns. d illustrates the negative impact of equity incentives on the relationship between "guanxi" and minority shareholders' interests. e shows the negative impact of equity incentives on the relationship between "guanxi" and corporate operational risks.

Model (3) adds the moderator variable to the main effect and Model (4) adds the interaction term between the moderating variable and the independent variable. The regression results show a negatively significant coefficient for the interaction term (η = −0.580, p < 0.01). Comparing the R2 of Models (3) and (4), we observe an increase from 0.301 to 0.320 after adding the interaction term, indicating a significant moderating effect. Further graphical analysis in Fig. 3b reveals a weakening of the positive effect between equity incentives and executive consumption. Hypothesis 5-1 is supported.

Models (5)-(6) aims to verify hypothesis 5-2. The regression results show a negatively significant coefficient for the interaction term (η = −4.596, p < 0.1). Comparing the R2 of Models (5) and (6), we observe an increase from 0.159 to 0.163 after adding the interaction term, indicating a significant moderating effect. Further graphical analysis in Fig. 3c reveals a weakening of the positive effect between equity incentives and venture capitalist returns. Hypothesis 5-2 is supported.

Models (7)-(8) aim to verify hypothesis 5-3. The regression results show a positively significant coefficient for the interaction term (η = 3.965, p < 0.01). Comparing the Chi2 of Models (7) and (8), we observe an increase from 32.80 to 70.32 after adding the interaction term, indicating a significant moderating effect. Further graphical analysis in Fig. 3d reveals a weakening of the negative effect between equity incentives and the minority shareholders’ interests. Hypothesis 5-3 is supported.

Models (9)-(10) aim to verify hypothesis 5-4. The regression results show a negatively significant coefficient for the interaction term (η1 = −0.015, p < 0.01). Comparing the R2 of Models (9) and (10), we observe an increase from 0.194 to 0.203 after adding the interaction term, indicating a significant moderating effect. Further graphical analysis in Fig. 3e reveals a weakening of the negative effect between equity incentives and the level of corporate operational risk. Hypothesis 5-4 is supported.

Endogeneity analysis and robust check

The formation of “guanxi” between venture capitalists and entrepreneurs has exogenous characteristics, as the formation of “guanxi” is independent of investment decisions and company performance. Existing research also supports this point, for example, alumni relationship formed due to attending the same school can influence the behavior of both parties involved in a transaction, but the transaction itself does not lead to the formation of alumni relationship (Qi et al. 2020). Therefore, this study does not suffer from endogeneity issues arising from a two-way causality. However, the potential endogeneity issues might include sample selection bias and omitted variable bias.

Propensity score matching correction

The study employs a 1:1 nearest neighbor matching method, using the presence or absence of “guanxi” between venture capitalists and entrepreneurs as the criterion for dividing the observed sample into the “experimental group” and the “control group”. Within the control group, the most similar sample to the experimental group is selected for matching. When the basic information of the company, the characteristics of the entrepreneur, and the characteristics of the venture capitalist are more similar, the bias is smaller. The specific model is as Eq. (9):

In the model, firm represents variables related to company characteristics, including company size, profitability, debt level, intangible asset ratio, and earnings per share. Entre represents variables related to the characteristics of entrepreneurs, including age, gender, education, and work experience. VC represents variables related to the characteristics of venture capitalists, including gender, education, and work experience. Additionally, industry variables are controlled in this study.

The sample included companies with “guanxi” between venture capitalists and entrepreneurs, as well as companies without “guanxi”. Descriptive statistical results show that the number of samples with “guanxi” accounts for 42.81% of the total sample, indicating a certain difference in sample size between the experimental group and the control group. In addition, there are differences in enterprise, entrepreneur characteristics, venture capital institution, and venture capitalist characteristics between the two groups, which may lead to sample selection bias. To alleviate the endogeneity problem of sample selection bias, this article uses a propensity score matching model with a 1:1 nearest neighbor matching method to test and correction. The results are shown in Tables 6, which indicates that the regression result is stable.

System GMM model correction

The panel data used in this study is dynamic panel data, where the dependent variables are affected by their lagged values, and the lagged values of the dependent variables are correlated with the error term. To address potential endogeneity issues, this study employs the system generalized method of moments (GMM) estimator to estimate the regression model. The specific model used for the system GMM is shown in Eq. (10), where \({Y}_{it}\) represents the collusion behavior dimensions of firm i in year t, \({Y}_{it-1}\) represents its lagged value, \({X}_{it}\) represents a vector of variables including predetermined variables, endogenous variables, and exogenous variables, which includes variables related to firm characteristics, venture capital institutional characteristics, entrepreneur and venture capitalist characteristics, and “guanxi”, αi represents firm fixed effects, δt represents time fixed effects, and εit represents the disturbance term.

The regression results are shown in Table 7. According to the p-value of the Sargan test, it can be concluded that there is no overidentification problem in the GMM estimation, indicating that the model specification is reasonable and the instrumental variables are valid. The results of the AR (2) test show that there is no second-order autocorrelation, confirming the validity of the estimates. Moreover, the p-value of the joint significance Wald test indicates that the overall linear relationship of the model is significant. The lagged values of the dependent variable are significant at the 0.01 level, indicating that the dependent variables in this dynamic panel data are indeed influenced by their lagged values, suggesting the presence of endogeneity issues. Additionally, the use of the system GMM estimator reveals that the impact of “guanxi” on entrepreneurial self-Interest behavior, minority shareholders’ interests, and corporate operational risks remains significant at the 1% level, confirming the robustness of the main regression results. It should be noted that the impact of “guanxi” on returns for venture capitalists is analyzed using cross-sectional regression, so there is no need to conduct the robustness test using the system GMM method.

Changing the proxy of the dependent variable

Using a virtual variable indicates the presence of “guanxi”. When “guanxi” exists between venture capitalists and entrepreneurs, the independent variable is labeled as 1, otherwise, it is labeled as 0. The regression results are shown in Table 8, which indicated a significant influence of “guanxi” on collusive behavior, and showed that the regression results are robust.

Conclusions, implications, and limitation

This study utilizes unethical pro-relational behavior and social network theory to empirically examine the collusion behavior between venture capitalists and entrepreneurs using Chinese-listed entrepreneurial firms supported by venture capital from 2009 to 2019. The study finds that the “guanxi” between venture capitalists and entrepreneurs can facilitate their collusion behavior, which manifests as entrepreneurial self-interest behavior, increased venture capitalists’ returns, infringing minority shareholders’ interests, and increased corporate organizational risks. Furthermore, equity incentives can weaken the influence of “guanxi” on collusion behavior. To address endogeneity concerns and make the empirical result robust, the propensity score matching method, system GMM model, and changing the proxy of the dependent variable are used. These results support the conclusions.

Our research yields different results from existing studies on the impact of “guanxi” between venture capitalists and entrepreneurs in the venture capital process. Several studies suggest that “guanxi” between venture capitalists and entrepreneurs can positively affect venture capital transactions. Zacharakis and Andrew (2001) found that venture capitalists and entrepreneurs tend to utilize “guanxi” to balance the level of control and trust-building mechanisms, thereby strengthening the optimal level of confidence and cooperation. Yang and Li (2018) suggested that “guanxi” tends to foster cooperation, as it enables a deeper mutual understanding, which in turn enhances the predictability of each party’s actions. Dash and Panda (2016) insist that “guanxi” between venture capitalists and entrepreneurs facilitates informal communication, allowing venture capitalists and entrepreneurs to acquire critical information promptly and enhancing cooperation.

Our study proposes that “guanxi” between venture capitalists and entrepreneurs may facilitate collusive behavior through enhanced communication and trust-building, negatively impacting venture capital transactions. This offers a more comprehensive understanding of the impact of “guanxi” between venture capitalists and entrepreneurs on venture capital transactions and enriches the theoretical, practical, and policy implications.

Theoretical implications

This research is inherently interdisciplinary, integrating theories from management, sociology, psychology, and economics. It revisits the role of social networks within the entrepreneurial ecosystem, presenting significant theoretical contributions and research insights by examining collusive behavior and governance mechanisms between venture capitalists and entrepreneurs based on “guanxi”.

Firstly, this study extends the scope of research on collusive behavior to the realm of venture capital transactions and enriches theoretical comprehension of collusive behavior. Existing literature studying collusive behavior refers to manager and worker collusion (And and Sewell 2014), shareholder and manager collusion (Zhang et al. 2014), enterprises and media entities collusion (Kupatadze 2015), chairmen and senior executives collusion (Choi et al. 2020). However, the collusion behavior between venture capitalists and entrepreneurs in the venture capital process is scarcely addressed by scholars. Venture capital is a bilateral selection process wherein the collaboration and sustained interaction between venture capitalists and entrepreneurs. During this bilateral selection process, the “guanxi” between venture capitalists and entrepreneurs may induce collusion behavior.

This study explores collusive behavior based on “guanxi” attributes of venture capitalists and entrepreneurs by defining collusive behavior between venture capitalists and entrepreneurs, identifying the actors involved in it, and delineating the conditions under which collusive behavior arises. Our findings suggest that “guanxi” may foster moral hazards, leading to mutually beneficial collusive behavior that compromises minority shareholder interests and heightens corporate operational risks. This research proposes a multidimensional framework for representing collusive behavior, which elucidates the mechanisms by which “guanxi” fosters collusive behavior between venture capitalists and entrepreneurs, enhancing theoretical comprehension of collusive behavior, and provides methodological and conceptual frameworks for conducting empirical studies on collusive behavior in diverse fields.

Secondly, this study provides empirical evidence on mitigating the negative impacts of “guanxi” on venture capital, expanding the “guanxi” theoretical comprehension of venture capital. Existing literature predominantly examines the positive influence of “guanxi” at the early stages of venture capital transactions. Because “guanxi” facilitates trust and mutual understanding between transaction parties, enhancing the efficiency and effectiveness of information and resource acquisition. As a result “guanxi” can form interest communities, facilitate the various conflicts in collaboration, and bring cooperation (Ljungkvist and Boers 2017). However, the role of “guanxi” between venture capitalists and entrepreneurs in the late stages of venture capital transactions has received limited attention. Transactions involving “guanxi” tend to employ informal governance mechanisms, where mutual trust and implicit reciprocal contracts create the potential for collusive behavior at the late stages of the venture capital process.

This study not only uncovers the mechanisms through which “guanxi” affects venture capital during the “exit for profit” stage but also explores how corporate governance can constrain the negative effects from the perspective of equity incentives. The collusive behavior between venture capitalists and entrepreneurs emerges when there is an insufficient internal incentive for agents in venture capital transactions. Therefore, it can be managed and prevented through equity incentives. The research further corroborates Laffont and Martimort (1997), who posited that collusive behavior depends on poor corporate governance environments, especially when there is insider control and inadequate incentives. This study contributes to the theoretical understanding of the negative effects of “guanxi” in the “exit for profit” stage of venture capital transactions, enriching the research on the impacts of this bilateral relationship.

Thirdly, this study extends theories related to social relationships and unethical behavior, offering a more comprehensive analysis of how social networks influence corporate financial decision-making. Existing literature predominantly relies on social identity and social exchange theories to explain the influence of “guanxi” on corporate decision-making (Ed-Dafali and Bouzahir 2022). However, less attention has been paid to the unethical behavior where venture capitalists and entrepreneurs collude to harm the interests of other stakeholders. In venture capital research, a common form of unethical behavior involves venture capitalists and entrepreneurs engaging in opportunistic actions that harm each other’s interests.

Building on theories of unethical behavior and financial ethics, this study introduces the concept of unethical pro-relational behavior, exploring the logical connection between “guanxi” and ethical issues from the perspective of moral psychological mechanisms. This extends the theoretical research on social relationships and unethical behavior. By analyzing unethical pro-relational behavior, this study provides a more comprehensive understanding of how close relationships affect corporate financial decision-making, which offers a holistic examination of the role of “guanxi” within the entrepreneurial ecosystem, thereby enriching and complementing theoretical research on unethical behavior.

Practical and policy implications

This research holds practical implications. Firstly, to achieve the goals of risk prevention and financial stability in economic development, relevant government regulatory agencies should enhance the identification, prevention, and governance of collusion behavior in venture capital transactions. The study demonstrates that “guanxi” between venture capitalists and entrepreneurs facilitates collusion, disrupting the healthy operation of the capital market. To prevent its negative effects, regulatory agencies should improve corresponding regulations and policies to deter collusion behavior, increase the cost of collusion, and reduce the probability of collusion between venture capitalists and entrepreneurs.

Secondly, entrepreneurs should critically evaluate the dual effects of venture capital in the development of their firms and make rational assessments when considering introducing venture capital. In the early stages of entrepreneurship, when funding is scarce, entrepreneurs often rely on venture capital to support their business ventures. Indeed, venture capital injects vitality into entrepreneurial firms and actively promotes their development. However, this study reveals the potential negative impact of collusion behavior between venture capitalists and entrepreneurs during the management and exit stages of venture capital, stemming from the trust established through “guanxi”. Entrepreneurs should be aware of the dual effects of venture capital and leverage corporate governance strategies to safeguard healthy corporate operations. If weak management and inadequate corporate governance structures are in place, the probability of collusion behavior increases. In such cases, entrepreneurs should carefully weigh the pros and cons, and rationalize whether introducing venture capital is suitable for their firms.

Thirdly, entrepreneurs are advised to utilize robust corporate governance practices to effectively manage their interactions with venture capitalists, thereby mitigating the occurrence of collusion. Research highlights that the implementation of equity incentives serves as an effective deterrent against collusion between venture capitalists and entrepreneurs. Therefore, entrepreneurs can proactively reduce the risk of collusion by strengthening institutional constraints and enhancing internal governance mechanisms. This includes the establishment of stringent regulatory frameworks to govern executive expenditures and remuneration policies. Moreover, defining explicit guidelines for the roles and responsibilities of venture capitalists in corporate management processes further minimizes the potential for collusion. By integrating these measures, entrepreneurs foster transparency, accountability, and ethical conduct within their enterprises, thereby safeguarding shareholder interests and promoting sustainable business practices.

Limitations and future research

This study holds both theoretical and practical value but also presents certain limitations. Based on these limitations, several directions for future research are proposed.

Firstly, the future empirical sample could be enriched. the empirical sample of this study includes only companies listed on the Growth Enterprise Market (GEM), excluding non-listed entrepreneurial firms. Not all startups backed by venture capitalists ultimately go public; some may fail during the investment process (Deakins and North 2016). These companies should also be included in the observation sample. As data on such firms are typically not publicly available, future research could collect relevant data through surveys to expand the sample size. Additionally, future studies should consider the diversity and representativeness of the sample, including venture capital cases from different countries and regions. By incorporating big data analytics, researchers can more effectively handle and analyze large-scale, diverse datasets, thereby enhancing the precision and depth of the research.

Secondly, the representation and connotation of “guanxi” could be more perfected. To avoid overgeneralizing “guanxi”, this study defines the independent variable “guanxi” as the presence of alumni, hometown, colleague, political, and association relationships. However, “guanxi” developed through social interactions, cooperation, and reciprocal exchanges may also have the potential for cooperation or collusion due to trust and the exchange of social resources. With the advancement of digital and information technologies, social interactions on online platforms provide new avenues for the formation of “guanxi”. Future research should explore the impact and consequences of “guanxi” on decision-maker behavior in the new economic context to comprehensively understand its mechanisms. Researchers can utilize network analysis methods to investigate the formation and evolution of “guanxi” in virtual spaces and its impact on real-world business activities.

Thirdly, future research could explore the impact of external governance mechanisms, such as media oversight, market governance, and the legal regulatory environment, on collusive behavior. External governance can interact and coordinate with internal governance to jointly influence the normalization, supervision, and restraint of corporate collusion. The macro environment’s impact on venture capital behavior is crucial, and understanding the interaction between factors driving venture capital transactions at the national and corporate levels is an important direction for future research.

Finally, while this paper focuses on the interactive relationship between venture capitalists and entrepreneurs, future research could go beyond bilateral relationship analysis to focus on the overall coherence and synergy of the venture capital ecosystem. By analyzing the interactions and feedback mechanisms among various participants in the venture capital ecosystem, scholars can research how to shape the dynamic processes and long-term outcomes of venture capital activities. Such research can provide a more comprehensive understanding of the complexity and diversity of venture capital activities, offering more scientific and systematic theoretical guidance for venture capital practices.

Data availability

The key data underpinning this study were collectively gathered by the research team. Due to ongoing related research based on this data, access to the datasets is currently restricted and not publicly accessible. The datasets are available from the corresponding author upon reasonable request.

References

Achleitner A, Braun R, Lutz E et al. (2014) Industry relatedness in trade sales and venture capital investment returns. Small Bus Econ 43:621–637

And DN, Sewell G (2014) Collaboration, co-operation or collusion? Contrasting employee responses to managerial control in three call centers. Brit J Ind Relat 52(2):308–332

Azar J, Schmalz MC, Tecu I (2018) Anticompetitive effects of common ownership. J Financ 73(4):1513–1565

Baker B, Derfler-Rozin R, Pitesa M et al. (2019) Stock market responses to unethical behavior in organizations: An organizational context model. Organ Sci 30(2):319–336

Barbalet J (2021) Where does guanxi come from? Bao, shu, and renqing in Chinese connections. Asian J Soc Sci 49(1):31–37

Bengtsson O, Hsu DH (2015) Ethnic matching in the US venture capital market. J Bus Venturing 30(2):338–354

Bian H, Kuo J-M, Pan H et al. (2023) The role of managerial ownership in dividend tunneling: Evidence from China. Corp Gov -Oxf 31(3):307–333

Bonini S, Capizzi V (2019) The role of venture capital in the emerging entrepreneurial finance ecosystem: future threats and opportunities. Ventur Cap 21(2-3):137–175

Burchardt J, Hommel U, Kamuriwo DS et al. (2016) Venture capital contracting in theory and practice: implications for entrepreneurship research. Entrep Theor Pr 40(1):25–48

Butt AS (2019) Personal relationship in supply chains. Intern J Integrat Sup Manag 12(3):193–204

Cai G, Shao Z, Xu X (2015) Is there collusion between the company and the media: from indirect evidence of media coverage on listed companies in China. Manag World 7:158–169

Cao Q, Fang M, Pan Y (2022) Minority shareholders protection and corporate financial leverage: Evidence from a natural experiment in China. Pac -Basin Financ J 73:101742

Cao Z, Lv D, Sun Z (2021) Stock price manipulation, short-sale constraints, and breadth-return relationship. Pac -basin Financ J 67:101–556

Choi D, Chung CY, Hong SIS et al. (2020) The role of political collusion in corporate performance in the Korean market. Sustain 12(5):2031–1-2031-18

Christensen E, Wuebker R, Wustenhagen R (2009) Of acting principals and principal agents: goal incongruence in the venture capitalist-entrepreneur relationship. Intern J Entrep Small Bus 7(3):367–388

Cohen A, Keren D (2008) Individual values and social exchange variables: Examining their relationship to and mutual effect on in-role performance and organizational citizenship behavior. Group Organ Manag 33(4):425–452

Colombo MG, D’adda D, Quas A (2019) The geography of venture capital and entrepreneurial ventures’ demand for external equity. Res Policy 48(5):1150–1170

Dash S, Panda S (2016) Exploring the venture capitalist - entrepreneur relationship: evidence from India. J Small Bus Enterp D 23(1):64–89

Deakins D, North D (2016) The role of finance in the development of technology-based SMEs. J Entrep Bus Econ 1(1/2):82–100

Ding S, Kim M, Zhang X (2018) Do firms care about investment opportunities? Evidence from China. J Corp Financ 52:214–237

Ed-Dafali S, Bouzahir B (2022) Trust as a governance mechanism of the relationship between venture capitalists and managers of venture capital-backed firms in Morocco. Transnatl Corp Rev 14(2):210–226

Fang J, Wen Z, Ouyang J et al. (2022) Methodological research on moderation effects in China’s mainland. Adv Psychol Sci 30(8):1703–1714

Feng H, Li JY (2019) Evaluation of effect of inter-organizational dependence and relational governance mechanism on performance: regulatory role based on opportunistic behavior. Nankai Bus Rev Nt 22(3):103–111

Flicker SM, Sancier-Barbosa F, Moors AC et al. (2021) A closer look at relationship structures: Relationship satisfaction and attachment among people who practice hierarchical and non-hierarchical polyamory. Arch Sex Behav 50(4):1401–1417

Froehlich DE, Van Waes S, Schäfer H (2020) Linking quantitative and qualitative network approaches: A review of mixed methods social network analysis in education research. Rev Res Educ 44(1):244–268

Fu H, Yang J, An Y (2019) Contracts for venture capital financing with double-sided moral hazard. Small Bus Econ 53:129–144

Gompers P, Kaplan SN, Mukharlyamov V (2016) What do private equity firms say they do? J Financ Econ 121(3):449–476

Gompers PA, Gornall W, Kaplan SN et al. (2020) How do venture capitalists make decisions? J Financ Econ 135(1):169–190

Grilli L, Mrkajic B, Latifi G (2018) Venture capital in Europe: social capital, formal institutions and mediation effects. Small Bus Econ 51:393–410

Grilli L, Latifi G, Mrkajic B (2019) Institutional determinants of venture capital activity: an empirically driven literature review and a research agenda. J Econ Surv 33(4):1094–1122

Gu W, Qian X, Lu J (2018) Venture capital and entrepreneurship: A conceptual model and research suggestions. Int Entrep Manag J 14:35–50

Guoyu Z (2019) Will CEOs profit from multiple major shareholders’ equity balance? Empirical evidence from CEO overcompensation. Foreign Econ Manag 41(08):126–139

Guoyu Z, Wei Y (2018) The corporate governance effect of large shareholders’ equity balance: Evidence from private listed companies. Foreign Econ Manag 40(11):60–72

He Y, Yu WL, Yang MZ (2019) CEOs with rich career experience, corporate risk-taking and the value of enterprises. China Ind Econ 33:155–173

Hogg MA, Van Knippenberg D, Rast Iii DE (2012) The social identity theory of leadership: Theoretical origins, research findings, and conceptual developments. Eur Rev Soc Psychol 23(1):258–304

Hongdan Z, Jun Z (2017) Corporate hypocrisy, moral disengagement and unethical pro-organizational behavior: Moderated mediating effect. Foreign Econ Man 39(01):15–28

Hou JZ, Zhu Y (2020) Social capital, guanxi and political influence in Chinese government relations. Public Relat Rev 46(1):101885

Hu GX, Wang J (2022) A review of China’s financial markets. Annu Rev Financ Econ 14:465–507

Jeon E, Maula M (2022) Progress toward understanding tensions in corporate venture capital: A systematic review. J Bus Venturing 37(4):106226

Kaiser M, Berger ESC (2021) Trust in the investor relationship marketing of startups: a systematic literature review and research agenda. Manag Rev Q 71:491–517

Khedmati M, Sualihu MA, Yawson A (2020) CEO-director ties and labor investment efficiency. J Corp Financ 65:101492

Kong D (2019) Minority shareholder participation and earnings management: A test of catering theory. China Financ Rev Int 9(1):73–109

Kupatadze A (2015) Political corruption in Eurasia: Understanding collusion between states, organized crime and business. Theor Criminol 19(2):198–215

Kwok F, Sharma P, Gaur SS (2019) Interactive effects of information exchange, relationship capital and environmental uncertainty on international joint venture (IJV) performance: An emerging markets perspective. Int Bus Rev 28(5):101481

Laffont JJ, Martimort D (1997) Collusion under asymmetric information. Econometrica: J Econ Soc 65(4):875–911

Lahr H, Mina A (2016) Venture capital investments and the technological performance of portfolio firms. Res Policy 45(1):303–318

Lee HS (2017) Peer networks in venture capital. J Empir Financ 41:19–30

Li X, Pukthuanthong K, Walker MG et al. (2016) The determinants of IPO-related shareholder litigation: The role of CEO equity incentives and corporate governance. J Financ Mark 31:81–126

Ljungkvist T, Boers B (2017) Another hybrid? Family businesses as venture capitalists. J Fam Bus Manag 7(3):329–350