Abstract

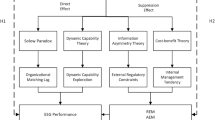

The study empirically examines the impact of firm digital transformation (DT) on the performance of Chinese-listed enterprises in the areas of environmental, social, and governance (ESG) from 2013 to 2022. We utilized OLS, IV 2SLS causal mediating effect, and moderating effect models to analyze the linkages and deep mechanisms between corporate DT and ESG performance. The empirical findings demonstrate that (i) DT has an effectively positive effect on the performance of firms’ ESG; (ii) DT enhances firms’ ESG performance by enhancing information transparency (TRANS), fostering green innovation (Green), and strengthening internal control (Inter) mechanisms; moreover, (iii) According to the study, common institutional ownership (CIO) effectively facilitates the positive effects of the DT impact on the ESG performance of listed enterprises, and firms’ subjective perception of economic policy uncertainty (SEPU) negatively influences the effect of digital change on firms’ ESG performance; (iv) the impact of DT on ESG performance is more significant in the listed companies of western region and state-owned enterprises. Our findings provide valuable insights into whether and how DT affects the firms’ ESG performance, providing practical recommendations for corporate managers and government decision-making agencies.

Similar content being viewed by others

Introduction

As the idea of sustainability becomes more widely accepted, there have been substantial changes to the patterns of economic development in many different countries. The digital economy is increasingly playing a substantial role in driving the expansion of the global economy and a crucial element in the high-quality growth of economics (Li et al. 2023). As a fundamental component of the macroeconomic system, business enterprises have a significant impact on the development of the macro-digital economy. Nowadays, DT is becoming a practical strategic alternative for the high-quality growth of businesses (Yang et al. 2024). And the basic purpose of high-quality enterprise development is the creation and transfer of value. It suggests that enhancing social and environmental value ought to be equally important to business success as maximizing commercial value. The existing literature has primarily focused on the economic value-creation effects of enterprise digitalization. It has been made clear that DT is predicated on digital technologies, which drastically change business structures and operational procedures. This, in turn, fosters technological innovation (Hao and He, 2022), lowers production costs (Cohen and Gil, 2021), and enhances operational efficiency (Lu et al. 2024). Lately, scholars have started giving considerable focus to the correlation between DT and the non-financial performance of companies.

Academics can utilize corporate ESG performance to find plainly how firms function and how devoted they are to sustainability (Li et al. 2018). A significant quantity of research has indicated the correlation between firms’ DT and sustainable development (Andriole, 2017). And the utilization of digital technologies is one extremely promising strategy for reaching sustainable development goals (Seele and Lock, 2017). Leveraging digital technologies to innovate in the green sector not only enhances resource efficiency but also reduces pollution (Ren et al. 2023). Moreover, DT strengthens the quality of businesses’ services, lessens the information asymmetry between them and other stakeholders, and encourages them to fulfill their social obligations (Robertsone and Lapiņa, 2023). Nonetheless, some academics have argued that using digital technology poses a risk (Kuntsman and Rattle, 2019). During the DT process, there is a direct correlation between it and increased energy consumption as well as the release of carbon dioxide emissions. While DT offers new approaches to achieving equitable growth, their effectiveness is still under discussion.

China integrates numerous aspects to create a good analytical framework for examining the aforementioned conflicts. Initially, China, being a developing country, has amassed the second-largest digital market worldwide (Chen and Hao, 2022). For developing countries to achieve economic progress, it is crucial to investigate the correlation between DT and ESG performance. Second, improving the ESG performance of Chinese corporations has become a crucial priority in China. Considering the particular features of China’s national context, it is crucial and appropriate to conduct an in-depth investigation into the manners in which DT affects enterprise's ESG performance.

However, the effects of DT on the ESG of Chinese corporations have not received much in-depth research, and the connections between these two aspects have not been sufficiently investigated. Fang et al. (2023) found that a mediating function is fulfilled by goodwill and corporate agency expenses in the process of DT enhancing ESG performance. Yang and Han (2024) employed financing restrictions as a moderating variable and discovered that they have a moderating influence on enterprises’ DT and ESG performance. In addition, Wang and Esperança (2023) examined medium-sized firms (SMEs) in China as a research sample and discovered that DT may considerably boost corporate ESG, whereas firm market performance and digital innovation culture show mediating and moderating effects, respectively. The connections between corporate ESG performance and DT go much beyond that as DT becomes increasingly complex. Furthermore, firms are facing the restructuring of externally held investments, as well as strengthened political and economic uncertainties. All the mentioned issues will exert a substantial influence on corporate DT and ESG performance. As a result, further research is required to gain an improved knowledge of the most likely links between DT and ESG performance, the relationship between them is mostly determined by common institutional ownership (CIO) and firms’ subjective perceptions of economic policy uncertainty (SEPU). To cover present research gaps, the paper investigated the following questions:

Q1: Can the DT of Chinese firms strengthen their ESG performance?

Q2: What are the likely mechanisms of the channel between enterprise DT and ESG performance?

Q3: Do CIO and SEPU influence the link from corporate DT to ESG performance?

To address the questions above, this paper analyzed 28,152 data samples from Chinese-listed companies from 2013 to 2022. To answer Q1, we used the OLS model with fixed effect to examine the link relating DT to ESG performance. For Q2, we investigated the intermediary roles of corporate information transparency (TRANS), internal control (Inter), and green innovation (Green) in the link between DT and ESG performance. For Q3, this paper evaluated the moderating impact of CIO and SEPU on DT and ESG performance.

The present study contributes several significant perspectives to the existing body of research. First, the literature currently in publication on the impact of DT on businesses is frequently ambiguous, especially when it comes to the controversial connection between DT and corporate sustainability. By investigating the links and underlying mechanisms between corporate DT and sustainable development, this paper contributes to a collection of literature on the subject by examining the influence of DT on the ESG performance of Chinese companies. Second, the paper creatively analyses the influence of the CIO and the firm’s SEPU on the moderating role between DT and ESG performance. Furthermore, by taking into consideration the firms’ external information communication, internal governance, and innovation governance, we investigate the mediating roles of internal control, information transparency, and green innovation. The results of these analyses can shed light on the mechanisms by which corporate DT affects ESG performance. Thirdly, existing research has frequently employed the traditional ‘three-step method’ to assess the mediating influence between DT and corporate ESG performance. Nevertheless, endogeneity problems can arise with this approach, potentially producing inaccurate outcomes. To explore the mediating effect, this research adopts a distinctive IV 2SLS casual mediating effect model, drawing on Dippel et al. (2020). Such an approach effectively solves the equation’s endogeneity problem, increasing the reliability of the analytical findings.

The remainder of this article is arranged as follows. Section “Literature review and hypothesize development” covers the literature review and hypotheses; section “Data and analysis methods” describes the data and analysis methods; section “Empirical results” presents the analytical findings; section “Robustness check” offers the discussion; and section “Discussion and conclusion” presents the conclusion and limitations.

Literature review and hypothesize development

DT and ESG performance

In the given context of the worldwide phenomena of DT, companies DT has emerged as an essential issue of interest for both scholars and managers (Hanelt et al. 2021; Sachs et al. 2019). DT is a novel approach that uses digital resources, including big data and blockchain, to improve corporate management. It aims to improve factor allocation efficiency and strengthen the core competitiveness of firms (Verhoef et al. 2021). Specifically for business sustainability, digital transformation has made it possible to improve corporate ESG performance while also facilitating advances in financial outcomes (Wang et al. 2023a). Firms are becoming more likely to implement ESG principles, especially as stakeholders pay greater attention to corporate ESG performance. Companies’ propensity to adopt ESG practices has risen significantly as stakeholders pay greater focus to corporate ESG performance. In the current situation, a rising proportion of firms are utilizing DT to achieve sustainable development goals and improve sustainability performance (Lu et al. 2024). In the first place, digitalization permits businesses to be more active in their ESG plans. The implementation of different forms of digital technology supports firms in predicting and deducing the validity of ESG decisions, creating a favorable environment for attaining ESG goals (Ding et al. 2024). On the other hand, Companies dealing with DT may interact with stakeholders in a constantly evolving network (Xinbo et al. 2021), improving ESG performance. Given that ESG performance contains environmental, social, and governance factors, we investigated the influence of DT on each of these categories independently.

From the environmental point of view, environmental performance may be affected by a variety of factors. At the pollution management level, firms can monitor, evaluate, and estimate their carbon emissions through digital technology, providing significant technical assistance for high-emission industries (Wang et al. 2023a). The method also enables accurate tracking of carbon emissions and dynamic environmental challenges like air pollution (Kanabkaew et al. 2019). Concurrently, DT accelerates sustainable industrial restructuring (Yin, 2022), assisting businesses in reducing the spatial distribution of carbon emissions. In other words, adopting the DT enables enterprises to facilitate the upgrade of industrial structures while precisely controlling pollution emissions, enhancing their environmental performance. At the resource allocation level, DT has an enabling effect. DT helps to improve green technological innovation within businesses, achieve greener manufacturing processes, and reduce pollution control expenses (Cohen and Gil, 2021; Kurniawan et al. 2021). Additionally, the effective use of digital technologies has increased resource allocation efficiency (Fang et al. 2023), supporting the capacity for information integration and information-sharing (Guo et al. 2022), and increasing environmental performance.

Socially, DT encourages businesses to integrate multiple entities to meet the complete demands of stakeholders while also establishing positive relationships and improving information processing capacities (Ding et al. 2024). Managers face pressure from stakeholders to engage in CSR activities to build trust (Meng et al. 2022). DT strengthens firms’ commitment and capacity to meet their social duties, boosting reputation, product quality, and service awareness (Tuyen et al. 2023). Moreover, the high adoption of digital technology enhances transparency, eliminates information asymmetry, and lowers interaction costs, therefore improving social performance (Andronie et al. 2023).

From a governance perspective, DT improves organizational efficiency and provides a transparent governance environment (Dai and Zhu, 2024). New digital technologies optimize processes, enhance internal regulation, and proactively include stakeholders in the company’s management (Wang et al. 2023c). This leads to more integrated and streamlined organizational structures, which promote effective communication among executives, investors, employees, and other stakeholders. As a result, costs are reduced while governance quality improves (Zhai et al. 2022). Better governance quality results from more effective information transmission and decision-making accuracy (Yang et al. 2024). Additionally, DT optimizes the connection between information gathering, analysis, and application (Hao et al. 2023). It increases corporate governance efficacy by lowering information gathering and processing costs for institutional investors (Wang et al. 2023b). Therefore, we hypothesize that:

H1: DT of corporations can enhance their ESG performance.

The mediating effect of TRANS

DT fundamentally alters how businesses gather and use data, substantially improving their capacities and enabling prompt information sharing (Lu et al. 2023). During the procurement phase, by diversifying sources and strengthening comprehension of the requirements of stakeholders, DT guarantees reliable, and effective data collecting (Li et al. 2021). While processing, transparency is improved when digital technology covers the place of human techniques, boosting quickness and precision and encouraging timely disclosure.

According to Signaling theoryFootnote 1, in the capital market, information asymmetry can help businesses stand out from the competition by sending strong signals (Ndofor and Levitas, 2004), which means that evaluators can evaluate enterprise development through their public reports (Luo and Wu, 2022). In general, the firm’s performance improves with increased informational transparency (Moreno-Enguix et al. 2019). As a result, enterprises make use of DT benefits to become more competitive by drawing in more investors through increased information openness. Businesses can improve their ESG scores by providing ESG rating organizations with finished corporate data by improving their data disclosure policies. Thus, we propose a hypothesis:

H2: DT of businesses can increase TRANS while enhancing ESG performance.

The mediating effect of Green

DT also promotes enterprise informatization by enhancing data transparency both inside the business and across its value chain. This facilitates a timely and comprehensive understanding of market demands and technological trends, encouraging innovative products and green technologies (Hao et al. 2023). Concurrently, digital technology can facilitate efficient data gathering relevant to green innovation, accelerating product development (Karhade and Dong, 2021). Further, DT minimizes company innovative costs by optimizing creation processes (Liu et al. 2023). It motivates businesses to invest much more resources in innovation, thereby improving efficiencies and encouraging green innovation (Yoo et al. 2012).

Green innovation enables the development of new goods, improves production for superior use of resources, and reduces ecological impact, therefore enhancing sustainability (Porter and Linde, 1995). Furthermore, it assists businesses in meeting their environmental objectives while also minimizing the legal risks related to pollution (Liu, 2023), thus safeguarding their social reputation. Finally, green innovation supports green governance and low-carbon transformation, thereby improving ESG performance (Tan and Zhu, 2022). Consequently, we propose the following hypothesis:

H3: DT of firms can increase their ESG performance by enhancing their Green.

The mediating effect of Inter

Enterprise DT promotes the integration of digital technology with traditional industries, leading to disruptive innovations in enterprise management that impact internal controlsFootnote 2. First, DT tends to flatten and de-layer organizational structures, increasing employee communication and coordination efficiency, thereby increasing the value of human resources (Zhao et al. 2023). Second, DT enhances enterprises’ ability to acquire and process information, and thereby improving risk assessment and response efficiency (Li et al. 2021). Furthermore, DT promotes effective leadership by increasing the quickness and flexibility of control actions. Finally, DT incorporates internal oversight mechanisms throughout the process, which improves regulating efficiency (Chen and Xu, 2023). In summary, DT effectively promotes corporate internal control.

The efficacy of a company’s internal controls has immediate effects on its resource usage efficiency (Cheng et al. 2013), governance capacity (Cohen et al. 2010), and operational risk (Bargeron et al. 2010). High-quality internal controls normalize capital processes and connect administration regulations with entrepreneur growth needs (Li and Li, 2024). Effective internal control mechanisms enable efficient distribution of resources and increased attention to stakeholder interests, hence improving business ESG performance (Boulhaga et al. 2023). Thus, we propose the hypothesis:

H4: DT enhances its ESG performance by improving Inter.

The moderating effect of CIO

Common institutional investors have substantial experience in the same company, providing a clear informational advantage (Schnatterly et al. 2008). They assist shareholder companies in having access to advanced digital information and skills, hence aiding their DT ambitions. Additionally, common institutional owners are key sources of external finance (Shi et al. 2024), providing financial support during the DT process. They work as external monitors, assuring enterprises comply with the demands of stakeholders. As public interest in sustainability issues expands (Liu, 2024), institutional investors increasingly prioritize environmental sustainability. They urge corporations to satisfy their social responsibilities and promote ESG performance (Chen et al. 2020; Dyck et al. 2019). Thus, we propose the hypothesis:

H5: CIO positively moderates the link between DT and ESG performance.

The moderating effect of firm’s SEPU

When SEPU rises, firms suffer higher uncertainty about investment returns. Firms tend to defer investments as economic policy uncertainty increases (Huang et al. 2023). According to liquidity preference theory, managers like to keep resources in cash to reduce risk. Consequently, high SEPU encourages enterprises to scale back their DT activities to handle uncertain economic policies, restricting their potential to use DT to improve ESG performance. Moreover, because ESG initiatives are costly and may not yield immediate benefits, firms in high SEPU conditions concentrate on projects that add value above ESG activities to optimize investment efficiency and performance (Akbar et al. 2021). Thus, we propose the hypothesis:

H6: SEPU acts as a negative moderator in the relationship between DT and ESG performance.

Data and analysis methods

Data

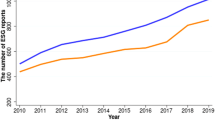

Indeed, 2013 signified the advent of the Chinese digital economy (Kayikci, 2018). Accordingly, the initial analysis object was constituted by Chinese corporations from 2013 to 2022 and eliminated the following: (1) companies with financial difficulties or suspension of listing; (2) financial companies and overseas companiesFootnote 3; (3) companies with missing ESG scores. Ultimately, we retained 28,152 firm-year data items (including 3866 firms). For this study, ESG data have been collated for analysis from the Sino-Securities database. The requisite corporate financial data is obtained from the CSMAR database. The corporation’s annual report is derived from Cninfo.com.cn, which is compiled for the purpose of constructing the DT index. And all continuous variables are winsorized at 1% and 99%.

Variables description

Dependent variable

Corporate ESG performance. Drawing from the literature (Mu et al. 2023), we utilized the ESG ranking from Sino-Securities. The scores are classified within a nine-point scale, encompassing the spectrum from “C” to “AAA”. A descending numerical value is attributed to each level: “AAA” is rated 9, “AA” is rated 8, and so forth, down to “C” which is rated 1. Detailed information on the ESG scoring system can be found in SUPPLEMENTARY INFORMATION Part 1. Additionally, we used ESG scores from the Bloomberg database for robustness checks.

Independent variable

Enterprise DT intensity. To achieve full DT, companies must transition through the phases of digitization, digitalization, and application of digital technology (Verhoef et al. 2021). We measured DT intensity by evaluating the accumulation of digitally held assets and the utilization of digital resources, which correspond to these stages. While most researchers assess DT levels using questionnaires (Matarazzo et al. 2021), this method can be limited by the sample size and the quality of the responses, potentially skewing the results. Therefore, following Wu et al. (2021), we measured DT strength by analyzing the frequency of specific words in the firms’ annual reports (details on characteristic words and data processing are provided in SUPPLEMENTARY INFORMATION Part 2).

Mediator variable

Corporate transparency (TRANS). It refers to the degree of information disclosed by a company that can be effectively obtained by external information users (Gaa, 2009). Disclosure can affect firm performance through mediation (Faisal et al. 2023). Therefore, referring to Dechow and Dichev (2002), we used the indicators of surplus quality (DD), the Shenzhen Stock Exchange’s annual rating of the information disclosure of listed companies (DSCORE), the number of analysts following the company (ANA) and whether the company hired one of the four major international firms as an auditor for its annual report (BIG4) as indicators of corporate transparency. Finally, following the methodology of Lang et al. (2012), we construct a composite indicator of firm transparency, TRANS, which is equal to the mean of the sample percentile rank of the four indicators. In the case of missing data, TRANS is equal to the mean of the percentiles of the remaining variables. Obviously, the more transparent the company, the higher the TRANS.

Internal control (Inter): Referring to Wang et al. (2018), we employed the internal control index provided by the Dibo database and applied the method of natural logarithm as a proxy variable. A greater value of Inter is indicative of a higher level of effectiveness of internal controls within the firm.

Green innovation (Green): Referring to Zhao et al. (2015), green innovation was measured using five indicators obtained from CSMAR. These indicators include whether the listed company has passed ISO14001 certificationFootnote 4, and ISO9001 certificationFootnote 5, has a certified environmental or sustainability management program, conducts environmental or sustainability training, and undertakes unique projects or initiatives that benefit the environment. Each indicator is attributed a rating of 1 when the enterprise demonstrates the requisite green behaviors, and a rating of 0 when it does not. The total score is summed to obtain a comprehensive proxy for the enterprise’s green innovation.

Moderator variable

Common institutional ownership (CIO). In line with existing research (He and Huang, 2017), CIO occurs when institutional block holders simultaneously hold ownership in at least two firms in the same industry (as defined by the four-digit SIC code). If at least one institutional block holder holds the focus firm and at least one industry peer for a minimum of one quarter of the year, the indicator variable CIO is designated a numeric value of 1; in contrast, it is 0.

Firm’s subjective economic policy uncertainty (SEPU). In line with the approach set forth by Yu et al. (2021) and Li et al. (2024), we employed a keyword-based analysis of the Management Discussion and Analysis section of firms’ annual reports as a means of measuring SEPU. We constructed SEPU keywords (see SUPPLEMENTARY INFORMATION Part 3) and calculated the percentage of keyword frequency relative to the total word frequency, with a higher value indicating greater SEPU.

Control variables

In light of existing research, control variables that may impact corporate ESG were incorporated into the analysis. The size of the firm (Size) and the age of the firm (FirmAge) have been identified as factors that influence ESG practices. (Agarwala et al. 2023), because larger and older firms are generally more willing to undertake social responsibility (Drempetic et al. 2020). Furthermore, companies with better financial conditions and profitability are more willing to participate in ESG investments (DasGupta, 2022). Therefore, we chose the asset-liability ratio (Lev), and return on assets (ROA) as proxies to measure enterprises’ financial status and profitability. Finally, corporate ESG may also be affected by the concentration of corporate ownership (Xie et al. 2019). Therefore, the shareholding ratio of the top three shareholders (TOP3) was selected as an indicative measure of the extent of shareholding concentration. Furthermore, the equity structure exerts a significant influence on the enterprise’s sustainability development. Thus, we incorporated the firm’s equity (SOE) as a control variable. It is also the case that the size of the board (Board) can have an appreciable effect on the ESG, thus we included it. The provenance and explanation of all variables are detailed in Table 1.

Model setting

Combined with the literature Jiang et al. (2024), we used the OLS model for the regression analysis. The equation is as follows:

where α0 represents a constant term; α1–α8 are the coefficients of different variables; \({{{\rm {Industry}}}}_{{{\rm {fe}}}}\) indicates the industry fixed effects; \({{\rm {Yea}{r}}}_{{{\rm {fe}}}}\) shows the year fixed effects and \({\epsilon }_{{it}}\) denotes the random error term.

Considering the endogeneity problem of the traditional mediation model, following Dippel et al. (2020), we tested the validity of the mediation effect by adopting the IV 2SLS causal mediating effect model, and the specific formula is referenced as follows:

This study employed an instrumental variable construct causal mediating effect model, as proposed by Dippel et al. (2020), to examine the causal effect between the mediating variable and the dependent variable. The equations are tested in the following manner: initially, the link between the independent variable and the mediating variable is established. In Eq. (2), we obtain the fitted value (\({{{\rm{IV}}}_{{it}}}^{{\prime} }\)) by regression using the instrumental variable method. In Eq. (3), the fitted value (\({{{\rm{IV}}}_{{it}}}^{{\prime} }\)) is regressed against the mediating variable (\({{{\rm{Mediator}}}_{{it}}}^{{\prime} }\)). Secondly, the causal link from the mediating variable to the core explanatory variables is tested. The fitted value of the mediator variable (\({{{\rm{Mediator}}}_{{it}}}^{{\prime} }\)) is found in Eq. (4) and is then brought into Eq. (5) to be regressed with the core explanatory variable (\({\rm{ES}}{{\rm{G}}}_{{it}}\)). The other variables in Eqs. (2)–(5) remains the same as in Eq. (1).

Next, we examined the moderating effect of CIO and SEPU by adding interaction terms of CIO with DT and SEPU with DT. Similar to Eq. (1), we can express the model as follows:

Empirical results

Descriptive statistics

Before performing the regression analysis, we calculated the descriptive statistics of the data. The results are shown in Table 2. And the detailed description of the summary of data are shown in Table 3.

In addition, to identify multicollinearity issues, we examined the correlation coefficients of the various variables. The analysis results are shown in Table 4. The coefficients of each variable are very small, indicating that the possibility of multicollinearity is low. We also presented the result of VIF to test in SUPPLEMENTARY INFORMATION Part 4.

Baseline regression

We first estimated the impact of corporate DT on ESG performance based on Eq. (1), and the results are shown in Table 5.

The coefficients of DT in Table 5 are significantly positive at the 1% level, and it suggests that enterprises’ DT can enhance their ESG performance, confirming H1.

About control variables, the results of controls of columns (1), (3) and (4) are basically the same. From the results of columns (1), (3) and (4), the Size’s coefficients are significantly positive. Thus, enterprises with a larger scale are more willing to adopt social responsibility (Drempetic et al. 2020). Additionally, Lev’s coefficients are significantly negative, which shows that when the financial performance of the enterprise is better, the ESG score is higher. This is because enterprises engage in sustainable development only when they do not have serious financial burdens. The coefficient of TOP3 is positive, indicating that an increase in ownership concentration can improve ESG performance. Shareholders with significant holdings are increasingly focusing on corporate sustainability, which could explain this trend. Additionally, the coefficients of FirmAge are unexpectedly and significantly negative. This could be because longer-established companies can rely on other corporate strengths to attract investors and ignore corporate ESG. The SOE’s coefficients are significantly positive, indicating that state-owned enterprises exhibit superior ESG. Finally, the Board’s coefficients are significantly negative, which indicates that corporate ESG performance is not favored by larger corporate board sizes. However, some of the control variables in column (2) have results that are contrary to other results. To illustrate, Lev is positively correlated with environmental performance, suggesting that firms with higher corporate gearing tend to prioritize environmental performance as a means of attracting investors. In addition, the longer the firm has been established approximately the more attention is paid to environmental performance.

Mediating effect test

We utilized a causal mediating effect model to examine the mediating impact of TRANS, Green, and Inter between DT and ESG performance. Referring to Du et al. (2023), we used provincial data from 1984 on the total volume of post and telecommunications business to construct instrumental variables for DT. The level of post and telecommunications business volume significantly affects the development and process of DT in the region, which in turn affects the degree of DT of firms in the region. Therefore, the instrumental variable satisfied the correlation assumption. Additionally, as a social infrastructure, postal and telecommunications services primarily promote general communication with the public, which has no direct impact on a firm’s ESG. Therefore, the instrumental variable satisfies the exclusion assumption. However, as this paper is based on panel data, using the total post and telecommunications business in 1984 as an instrumental variable directly would result in an unestimated fixed effects model.

In reference to Nunn and Qian (2014), the authors introduced a time-varying variable to construct the panel instrumental variable. Referring to Tao et al. (2024), the data on the number of provincial Internet accesses in the previous year are employed in the construction of interaction terms with the total volume of postal and telecommunications business in each province in 1984. These interaction terms serve as instrumental variables for DT in that year.

The results were shown in columns (1), (3) and (5) of Table 6, which demonstrate that DT significantly improves TRANS, Inter, and Green. Additionally, the results of columns (2), (4), and (6) show that the coefficients of DT and the Mediator are still significantly positive, suggesting that DT can enhance corporate ESG performance by improving TRANS, Inter, and Green. Furthermore, we assessed the total direct and indirect effects of the equation, and the results are presented in Table 7. The combined effect of all mediators, both direct and indirect, is significantly positive. Therefore, all mediators exert a partial mediating effect between DT and ESG, confirming hypotheses H2, H3, and H4.

Moderating effect test

Columns (1) and (2) of Table 8 present the results of Eq. (6), which explore the moderating effect of CIO and SEPU on the link between DT and ESG performance. The coefficients of CIO*DT and SEPU*DT are significantly positive and negative respectively, which suggests CIO and SEPU play a positive and negative role respectively between DT and ESG performance. Thus, H5 and H6 are confirmed.

Heterogeneity analysis

Heterogeneity analysis of the region

China’s regions exhibit significant disparities in terms of resource allocation, economic development, and market accessibility. Therefore, to explore the relationship between DT and ESG performance in different regions, we divided the analysis samples into three regionsFootnote 6, and generated dummy variables (eastern = 3, central = 2, and western = 1). We examined the heterogeneity by adding interaction terms of the region with DT following the model as follows:

The results of the analysis, as presented in column 3 of Table 8, indicate that the coefficient of the interaction terms (Region*DT) is significantly negative. The findings of the study indicate that the proximity of a company to the western region is associated with a more pronounced impact of DT on the enhancement of its ESG performance. Additionally, the coefficient of region is significantly positive, which indicates that the closer the ___location to the east, the more favorable the ESG performance of the firms. The potential causes for the above results are as follows. First, the eastern region is more open to the outside world, and enterprises’ overseas markets are larger. To meet the requirements of expanding overseas markets, companies in the eastern region pay more attention to ESG practices than do those in the central and western regions much earlier. Second, areas with relatively strict environmental regulations tend to be more effective in controlling pollution emissions and achieve better environmental performance. Judging from reality, the environmental supervision in the eastern region is more stringent, while that in the central and western regions is relatively loose. The aforementioned factors contribute to the ESG performance of firms close to the East. Consequently, the ESG performance improvement of firms close to the East is not solely a consequence of DT. In contrast, the situation is quite different for firms in the west. Indeed, there is an institutional deficit in the promotion of ESG in western enterprises. In contrast, DT represents a significant avenue for enhancing ESG performance among firms in the West.

Heterogeneity analysis of enterprise ownership

In order to investigate the differing consequences of DT on the ESG performance of enterprises with varying ownership structures, we have divided the companies into two categories: state-owned (SOEs) and private (POEs). Companies with different ownership types place different emphases on ESG (Zahid et al. 2023), which may consequently give rise to discrepancies in the impact of DT on ESG. We examined the heterogeneity by adding interaction terms of SOE with DT following the model as follows:

The analysis findings were shown in column (4) Table 8. The interaction term’s coefficient is found to be significantly positive, implying that the extent of enhancement in corporate ESG performance resulting from the DT of SOEs is statistically significant. The explanations are as follows. SOEs benefit from institutional support (such as low-interest loans), and their behavior and decision-making are greatly influenced by national policies (Zhao et al. 2024). However, private enterprises receive relatively little support from the government and face fierce market competition (Dai and Cheng, 2015). Therefore, these enterprises have the initiative to undertake environmental responsibilities (such as increasing investments in environmental governance, improving the transparency of environmental information, etc.) to increase stakeholders’ expectations of enterprises. This also helps enterprises gain social attention and a good social reputation, which promotes enterprise development (Akbar et al. 2021).

Robustness check

Alternative metrics for DT

We used the logarithm of the word frequency of all DT features to describe firm DT in the baseline regression. Additionally, the accumulation of digital assets is the foundation of the company’s DT. We selected the keyword +1 logarithm of word frequency from the “accumulation of digital assets” section for robustness testing. The results displayed in column (1) of Table 9 are markedly positive, thereby demonstrating the robustness of the analytical outcomes.

Alternative metrics for ESG performance

Following Buchanan et al. (2018), this paper used the ESG score of the Bloomberg database for robustness checks. The findings are presented in column (2) of Table 9, and they are in alignment with the results of the bassline regressions.

Multiple fixed effects

We re-estimated the baseline regression after controlling for company, industry, year, and province fixed effects to account for unobservable characteristics that fluctuate over time at the firm and province levels. The findings are presented in columns (3) and (4) in Table 9, which indicate that the results of baseline regression are robust.

Transformation analysis sample test

The benchmark regression included firms from the Main Board, Growth Enterprise Market (GEM), and Technology Venture Capital Market (TVCM). However, since the DT levels of GEM and TVCM firms are generally higher, we only used firms from the Main Board for robustness purposes. This eliminates any bias in the results due to the excessive DT level of the sample. The results are shown in Table 9, column (5), which is the same as the findings of the baseline regression.

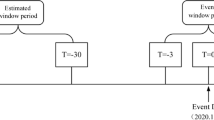

Endogeneity test

PSM

This paper used the propensity score matching (PSM) method to address possible problems arising from sample selection bias. We classify enterprises that the DT less than the median DT of the research sample as the control group (Treat = 0) and the other as the treatment group (Treat = 1). The selected characteristic variables are all the control variables, and the samples are matched using nearest-neighbor matching (1:4) and kernel matching, respectively. To guarantee the quality of the matching process and the precision of the resulting empirical data, the samples are subjected to a pre and post-matching balance test. The results are shown in Table 10. The t-tests demonstrated that the variables within the experimental group exhibited comparable characteristics to those within the control group following matching. Furthermore, the standard deviations of all matched variables after nearest-neighbor matching were <2%. Thus, the match is satisfactory. The results of the nearest-neighbor and kernel matching are presented in columns 1 and 2 of Table 11.

IV-regression

We also employed IV regression for testing, and the instrumental variable is the same as in section 4.4 (=Total volume of postal and telegraphic business in 1984*the number of Internet accesses in the previous 1 year). The first stage result of IV regression is reported in column (3) of Table 11. Our analysis revealed a statistically significant positive coefficient for IV, suggesting a positive correlation between IV and DT. Column (4) demonstrates the second-stage result of IV regression, which shows a significantly positive DT coefficient, consistent with the results in Table 5. And the LM statistic is 64.766, rejecting the under-identified hypothesis. The Wald F statistic is 64.835, which is greater than the threshold statistic, indicating no significant weak instrumental variable.

Heckman two-stage regression

We used the Heckman 2SLS regression to mitigate the potential sample selection bias problem. In the first stage, the dummy variable of whether a firm’s DT is more than the median of research samples (denoted as Treat = 1) is constructed as the independent variable. Then we used Probit regression and estimated Mills ratio (IMR) in columns (5). Then, we add IMR to the model for the second-stage regression. Column (6) in Table 11 shows that the coefficient of DT is still significantly positive.

Lag effect

Due to the possibility of reverse causality between variables, companies with exceptional environmental, social, and governance performance are more inclined to employ digital transformation. Therefore, referring to Lin and Zhang (2023), this study used lagged independent variables for the regression. The results presented in column (7) of Table 11 are supporting with the findings of the baseline regression.

Robustness check of mediating effect and moderating effect

Referring to Preacher and Hayes (2008), we use the traditional “three-step approach” for the mediating effect test as a robustness test. We show the mediating effect results for TRANS, Inter, and Green in columns (1) and (2), (3) and (4), (5) and (6) of Table 11. As evidenced in Table 12, a significant positive association is observed between DT, TRANS, Inter and Green and ESG. This suggests that all of the above mediating variables exert a mediating effect on the relationship between DT and ESG. In addition, we put all the mediating variables into the same equation to further test the role played by the mediating variables, and the results are presented in the first column of Table 13. The coefficient values for all the mediating variables are found to be significantly and positively correlated, thereby providing support for the results of the aforementioned mediating effect test.

In addition, we put all the moderating variables and their interaction terms into the equation to further test the moderating effects, and the results are presented in the second column of Table 13. Finally, we put all mediating and moderating variables into the equation, and the results are presented in the third column of Table 13. All of these results support the results in the sections “Moderating effect test” and “Heterogeneity analysis” above.

Discussion and conclusion

This study utilized OLS, IV 2SLS causal mediating, and moderating models to explore the link connecting corporate DT and ESG performance, identifying the underlying mechanisms in Chinese listed firms. Our key findings are: (i) the implementation of DT has been demonstrated to markedly jump the ESG performance of firms; (ii) DT enhances ESG performance through enhanced transparency of information, the promotion of green innovation, and the reinforcement of internal controls; (iii) The impact of DT on ESG performance is enhanced when there is a high level of CIO, while SEPU negatively moderates this relationship. Additionally, (iv) The influence of DT on ESG performance is more discernible among firms situated in the western region and state-owned enterprises.

Contributions

This paper presented a comprehensive analysis of the implications of corporate DT for ESG performance, exploring both mediating and moderating effects.

First, we employed an innovative IV 2SLS causal mediating model to test the mediating effects of firm information transparency, green innovation, and internal control to ascertain their impact on the association of firm DT to ESG performance. The current literature about mediating effects mainly focuses on dynamic capabilities (Zhang et al. 2024), agency costs, and goodwill (Fang et al. 2023).

Second, all previous studies primarily used the traditional “three-step approach” to test for mediation effects, which suffers from endogeneity problems and lacks credibility. By contrast, we provided a full and detailed assessment of the impact of firm DT on ESG performance, examining the phenomenon from three dimensions: corporate and external information transfer, internal governance systems, and green innovation governance. We employed the IV 2SLS causal mediating effect model Dippel et al. (2020) proposed to assess the mediator. This approach permits a more exact comprehension of how corporate DT affects ESG performance. Furthermore, the method adopted in this paper effectively alleviates the concern of model endogeneity, making the research results more reliable.

Third, this paper investigated the moderating effects of the CIO and the firm’s SEPU regarding the link between DT to ESG performance. The existing literature has primarily concentrated on the way that financial limitations moderate the impact of corporate DT and ESG (Yang and Han, 2024). With the increasing prevalence of firms with common institutional ownership (Li et al. 2024) and rising economic policy uncertainty (Vural‐Yavaş, 2021), both CIO and SEPU have emerged as significant factors affecting corporate behavior. Nevertheless, there remains a research gap regarding how CIO and SEPU influence the connection between corporate DT and ESG performance. This research fills a gap in the existing literature by examining the moderating effects of SEPU and CIO. The results of this study contribute to the existing body of academic literature on the topics of CIO and SEPU and their impact on corporate DT and sustainability. This paper offers a more detailed and sophisticated understanding of the phenomenon.

Practical implication

The results from this paper offer practical suggestions for enterprise managers and governmental bodies.

First, the findings presented a novel avenue for enterprises to bolster their ESG performance by leveraging DT to enhance corporate transparency, accelerate green innovation, and fortify internal control. Enhancing these factors will assist enterprises in improving their ESG performance. Specifically, regarding corporate information transparency, DT significantly enhances the capacity of enterprises to access and process information, enabling them to acquire and handle information more rapidly and efficiently, both internally and externally. Additionally, DT facilitates the accurate and expedient transmission of processed information to external audiences via digital channels, markedly improving assessments by external organizations and attracting investment attention, thereby boosting business performance.

Second, it is recommended that firms adopt DT in order to enhance their sustainable performance and competitiveness. During the digital transformation process, businesses should leverage digital technology to strengthen internal control, foster green innovation, and improve information transparency to boost ESG performance.

Third, companies should seek investment from shareholding organizations with stakes in multiple enterprises within their industry. These firms can benefit from the successful digital transformation experiences of other companies, facilitating better development. Governmental organizations should aim to create a stable economic policy environment to effectively promote DT and enhance corporate ESG performance.

Limitations and future research

The main limitations of this study are as follows: First, we only examined the linear relationship between DT and ESG performance, overlooking potential non-linear relationships. Second, while the mechanisms between DT and ESG performance have been discussed extensively, some remain unexplored. Future research could explore them from different perspectives (such as situational regulation) and using various analytical methods (GMM, etc.). Third, based on the results of this study, it may be meaningful to investigate the impact of DT on the ESG performance of corporations in other countries.

Data availability

Data are available on request from the authors.

Notes

Signaling theory stems from Spence’s assessment of the labor market (Spence, 1973); later, the theory was applied to the field of financial markets related to enterprises. This theory is used to explain how organizations use signal transmission to reduce the negative impact of information asymmetry.

The concept of internal control encompasses five key components: the internal environment, control operations, risk evaluation, information and communication, and the impact of internal oversight.

Because these companies have different reporting rules in terms of regulatory environment and accounting (Luo and Wu, 2022).

ISO 14001 is the globally recognized standard for environmental management systems across all organizational sizes. The ISO 14001 standard provides a systematic framework for integrating environmental management practices, offering a systematic approach to supporting environmental protection, pollution prevention, waste minimization and reduced energy and material consumption.

ISO 9001 is a standardized quality management system initially established by the International Organization for Standardization. Its objective is to assist enterprises in the establishment and implementation of an optimal and efficient quality management system, with the aim of continuously improving the quality of products and services and satisfying customers’ needs and expectations. Certification to ISO 9001 enables enterprises to demonstrate to external stakeholders their capability for stable quality management, thereby enhancing their market competitiveness and customer trust.

According to the classification standard of the China Health Statistical Yearbook, the eastern regions of China include Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan; the central regions include Heilongjiang, Jilin, Shanxi, Anhui, Jiangxi, Henan, Hubei, and Hunan; the western regions include Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia, and Xinjiang.

References

Agarwala N, Pareek R, Sahu TN (2023) Do firm attributes impact CSR participation? Evidence from a developing economy. Int J Emerg Mark [ahead-of-print No]

Akbar A, Jiang X, Qureshi MA, Akbar M (2021) Does corporate environmental investment impede financial performance of Chinese enterprises? The moderating role of financial constraints. Environ Sci Pollut Res 28(41):58007–58017

Andriole SJ (2017) Five myths about DT. MIT Sloan Manag Rev 58(3):20–22

Andronie M, Iatagan M, Uță C, Hurloiu I, Dijmărescu A, Dijmărescu I (2023) Big data management algorithms in artificial Internet of Things-based fintech. Oecon Copernic 14(3):769–793

Bargeron LL, Lehn KM, Zutter CJ (2010) Sarbanes–Oxley and corporate risktaking. J Account Econ 49(1):34–52

Boulhaga M, Bouri A, Elamer AA, Ibrahim BA (2023) Environmental, social and governance ratings and firm performance: the moderating role of internal control quality. Corp Soc Responsib Environ Manag 30(1):134–145

Buchanan B, Cao CX, Chen C (2018) Corporate social responsibility, firm value, and influential institutional ownership. J Corp Financ 52:73–95

Chen P, Hao Y (2022) DT and corporate environmental performance: the moderating role of board characteristics. Corp Soc Responsib Environ Manag 29(5):1757–1767

Chen T, Dong H, Lin C (2020) Institutional shareholders and corporate social responsibility. J Financ Econ 135(2):483–504

Chen Y, Xu J (2023) DT and firm cost stickiness: evidence from China. Financ Res Lett 52:103510

Cheng M, Dhaliwal D, Zhang Y (2013) Does investment efficiency improve after the disclosure of material weaknesses in internal control over financial reporting? J Account Econ 56(1):1–18

Cohen J, Gil J (2021) An entity-relationship model of the flow of waste and resources in city-regions: improving knowledge management for the circular economy. Resour Conserv Recycl Adv 12:200058

Cohen J, Krishnamoorthy G, Wright A (2010) Corporate governance in the PostSarbanes–Oxley era: auditors’ experiences. Contemp Account Res 27(3):751–786

Dai J, Zhu Q (2024) ESG performance and green innovation in a DT perspective. Am J Econ Sociol 83(1):263–282

Dai X, Cheng L (2015) Public selection and research and development effort of manufacturing enterprises in China: state owned enterprises versus nonstate owned enterprises. Innovation 17(2):182–195

DasGupta R (2022) Financial performance shortfall, ESG controversies, and ESG performance: evidence from firms worldwide. Financ Res Lett 46:102487

Dechow PM, Dichev ID (2002) The quality of accruals and earnings: the role of accrual estimation errors. Account Rev 77(s-1):35–59

Ding X, Sheng Z, Appolloni A, Shahzad M, Han S (2024) DT, ESG practice, and total factor productivity. Bus Strategy Environ 33(5):4547–4561

Dippel C, Ferrara A, Heblich S (2020) Causal mediation analysis in instrumental-variables regressions. Stata J 20(3):613–626

Drempetic S, Klein C, Zwergel B (2020) The influence of firm size on the ESG score: corporate sustainability ratings under review. J Bus Ethics 167(2):333–360

Du J, Shen Z, Song M, Zhang L (2023) Nexus between digital transformation and energy technology innovation: an empirical test of A-share listed enterprises. Energy Econ 120:106572

Dyck A, Lins KV, Roth L, Wagner HF (2019) Do institutional investors drive corporate social responsibility? Int Evid J Financ Econ 131(3):693–714

Faisal F, Ridhasyah R, Haryanto H (2023) Political connections and firm performance in an emerging market context: the mediating effect of sustainability disclosure. Int J Emerg Mark 18(10):3935–3953

Fang M, Nie H, Shen X (2023) Can enterprise digitization improve ESG performance? Econ Model 118:106101

Gaa JC (2009) Corporate governance and the responsibility of the board of directors for strategic financial reporting. J Bus Ethics 90(2):179–197

Guo Q, Geng C, Yao N (2022) How does green digitalization affect environmental innovation? The moderating role of institutional forces. Bus Strategy Environ 32(6):3088–3105

Hanelt A, Bohnsack R, Marz D, Marante CA (2021) A systematic review of the literature on DT: insights and implications for strategy and organizational change. J Manag Stud 58(5):1159–1197

Hao J, He F (2022) Corporate social responsibility (CSR) performance and green innovation: evidence from China. Financ Res Lett 48:102889

Hao X, Li Y, Ren S, Wu H, Hao Y (2023) The role of digitalization on green economic growth: does industrial structure optimization and green innovation matter? J Environ Manag 325:116504

He J, Huang J (2017) Product market competition in a world of cross-ownership: evidence from institutional blockholdings. Rev Financ Stud 30(8):2674–2718

Huang J, Jin Y, Duan Y, She Y (2023) Do Chinese firms speculate during high economic policy uncertainty? Evidence from wealth management products. Int Rev Financ Anal 87:102639

Jiang F, Shen Y, Xia X (2024) The spillover effect of advertising on the capital market: evidence from financial constraints. J Corp Financ 84:102529

Kanabkaew T, Mekbungwan P, Raksakietisak S, Kanchanasut K (2019) Detection of PM2.5 plume movement from IoT ground level monitoring data. Environ Pollut 252(Part A):543–552

Karhade P, Dong JQ (2021) Information technology investment and commercialized innovation performance: dynamic adjustment costs and curvilinear impacts. Mis Q 45(3):1007–1024

Kayikci Y (2018) Sustainability impact of digitization in logistics. Procedia Manuf 21:782–789

Kuntsman A, Rattle I (2019) Toward a paradigmatic shift in sustainability studies: a systematic review of peer reviewed literature and future agenda setting to consider environmental (un)sustainability of digital communication. Environ Commun 13(5):567–581

Kurniawan TA, Lo W, Singh D, Othman MHD, Avtar R, Hwang GH, Shirazian S (2021) A societal transition of MSW management in Xiamen (China) toward a circular economy through integrated waste recycling and technological digitization. Environ Pollut 277:116741

Lang M, Lins KV, Maffett M (2012) Transparency, liquidity, and valuation: international evidence on when transparency matters most. J Account Res 50:729–774

Li H, Wu Y, Cao D, Wang Y (2021) Organizational mindfulness toward DT as a prerequisite of information processing capability to achieve market agility. J Bus Res 122:700–712

Li J, Nie H, Ruan R, Shen X (2024) Subjective perception of economic policy uncertainty and corporate social responsibility: evidence from China. Int Rev Financ Anal 91:103022

Li S, Gao L, Han C, Gupta B, Alhalabi W, Almakdi S (2023) Exploring the effect of DT on Firms’ innovation performance. J Innov Knowl 8(1):100317

Li Y, Li S (2024) ESG performance and innovation quality. Int Rev Econ Financ 92:1361–1373

Li Y, Gong M, Zhang X-Y, Koh L (2018) The impact of environmental, social, and governance disclosure on firm value: the role of CEO power. Br Account Rev 50(1):60–75

Lin B, Zhang Q (2023) Corporate environmental responsibility in polluting firms: does DT matter? Corp Soc Responsib Environ Manag 30(5):2234–2246

Liu L (2024) Green innovation, firm performance, and risk mitigation: evidence from the USA. Environ Dev Sustain 26(9):24009–24030

Liu L (2024) Environmental performance factors: insights from CSR-linked compensation, committees, disclosure, targets, and board composition. J Sustain Financ Invest 1–36

Liu X, Liu F, Ren X (2023) Firms’ digitalization in manufacturing and the structure and direction of green innovation. J Environ Manag 335:117525

Lu HT, Li X, Yuen KF (2023) DT as an enabler of sustainability innovation and performance—information processing and innovation ambidexterity perspectives. Technol Forecast Soc Change 196:122860

Lu Y, Xu C, Zhu B, Sun Y (2024) Digitalization transformation and ESG performance: evidence from China. Bus Strategy Environ 33(2):352–368

Luo K, Wu S (2022) Corporate sustainability and analysts’ earnings forecast accuracy: evidence from environmental, social and governance ratings. Corp Soc Responsib Environ Manag 29(5):1465–1481

Matarazzo M, Penco L, Profumo G, Quaglia R (2021) DT and customer value creation in made in Italy SMEs: a dynamic capabilities perspective. J Bus Res 123:642–656

Meng S, Su H, Yu J (2022) DT and corporate social performance: how do board independence and institutional ownership matter? Front Psychol 13:915583

Moreno-Enguix MDR, Lorente-Bayona LV, Gras-Gil E (2019) Social and political factors affect the index of public management efficiency: a cross-country panel data study. Soc Indic Res 144(1):299–313

Mu W, Liu K, Tao Y, Ye Y (2023) Digital finance and corporate ESG. Financ Res Lett 51:103426

Ndofor HA, Levitas E (2004) Signaling the strategic value of knowledge. J Manag 30(5):685–702

Nunn N, Qian N (2014) US food aid and civil conflict. Am Econ Rev 104(6):1630–1666

Preacher KJ, Hayes AF (2008) Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav Res Methods 40(3):879–891

Porter ME, Linde CVD (1995) Toward a new conception of the environment-competitiveness relationship. J Econ Perspect 9(4):97–118

Ren X, Zeng G, Sun X (2023) The peer effect of DT and corporate environmental performance: empirical evidence from listed companies in China. Econ Model 128:106515

Robertsone G, Lapiņa I (2023) DT as a catalyst for sustainability and open innovation. J Open Innov: Technol Mark Complex 9(1):100017

Sachs JD, Schmidt-Traub G, Mazzucato M, Messner D, Nakicenovic N, Rockström J (2019) Six transformations to achieve the sustainable development goals. Nat Sustain 2(9):805–814

Schnatterly K, Shaw KW, Jennings WW (2008) Information advantages of large institutional owners. Strateg Manag J 29(2):219–227

Seele P, Lock I (2017) The game-changing potential of digitalization for sustainability: possibilities, perils, and pathways. Sustain Sci 12(2):183–185

Shi WZ, Hsiao MC, Huang TY, Yu MT (2024) Common institutional ownership and the cost of debt in Taiwan. Pac-Basin Financ J 83:102201

Spence A (1973) Labor market signaling. Q J Econ 87(3):355–374

Tan Y, Zhu Z (2022) The effect of ESG rating events on corporate green innovation in China: the mediating role of financial constraints and managers’ environmental awareness. Technol Soc 68:101906

Tao Y, Lu H, Ye Y, Wu H (2024) Does the firms’ digital transformation drive environmental innovation in China? Sustain Dev 32(3):2139–2152

Tuyen BQ, Phuong Anh DV, Mai NP, Long TQ (2023) Does corporate engagement in social responsibility affect firm innovation? The mediating role of DT. Int Rev Econ Financ 84:292–303

Verhoef PC, Broekhuizen T, Bart Y, Bhattacharya A, Dong JQ, Fabian N, Haenlein M (2021) DT: a multidisciplinary reflection and research agenda. J Bus Res 122:889–901

Vural‐Yavaş Ç (2021) Economic policy uncertainty, stakeholder engagement, and environmental, social, and governance practices: the moderating effect of competition. Corp Soc Responsib Environ Manag 28(1):82–102

Wang F, Xu L, Zhang J, Shu W (2018) Political connections, internal control and firm value: evidence from China’s anti-corruption campaign. J Bus Res 86:53–67

Wang H, Jiao S, Bu K, Wang Y, Wang Y (2023a) DT and manufacturing companies’ ESG responsibility performance. Financ Res Lett 58:104370

Wang J, Ma M, Dong T, Zhang Z (2023b) Do ESG ratings promote corporate green innovation? A quasi-natural experiment based on SynTao Green Finance’s ESG ratings. Int Rev Financ Anal 87:102623

Wang L, Qi J, Zhuang H (2023c) Monitoring or collusion? Multiple large shareholders and corporate ESG performance: evidence from China. Financ Res Lett 53:103673

Wang S, Esperança JP (2023) Can DT improve market and ESG performance? Evidence from Chinese SMEs. J Clean Prod 419:137980

Wu DX, Yao X, Guo JL (2021) Is textual tone informative or inflated for firm’s future value? Evidence from Chinese listed firms. Econ Model 94:513–525

Xie J, Nozawa W, Yagi M, Fujii H, Managi S (2019) Do environmental, social, and governance activities improve corporate financial performance? Bus Strategy Environ 28(2):286–300

Xinbo S, Yuan Z, Yongxia W, Haobo S (2021) Digital value creation: research framework and prospects. Foreign Econ Manag 43(10):35–49

Yang Y, Han J (2024) Digital transformation, financing constraints, and corporate environmental, social, and governance performance. Corp Soc Responsib Environ Manag 30(6):3189–3202

Yang P, Hao X, Wang L, Zhang S, Yang L (2024) Moving toward sustainable development: the influence of DT on corporate ESG performance. Kybernetes 53(2):669–687

Yin Y (2022) Digital finance development and manufacturing emission reduction: an empirical evidence from China. Front Public Health 10:973644

Yoo Y, Boland Jr RJ, Lyytinen K, Majchrzak A (2012) Organizing for innovation in the digitized world. Organ Sci 23(5):1398–1408

Yu Z, Xiao Y, Li J (2021) Firm-level perception of uncertainty and innovation activity: textual evidence from China’s A-share market. Pac-Basin Financ J 68:101555

Zahid RMA, Saleem A, Maqsood US (2023) ESG performance, capital financing decisions, and audit quality: empirical evidence from Chinese state-owned enterprises. Environ Sci Pollut Res 30(15):44086–44099

Zhai H, Yang M, Chan KC (2022) Does DT enhance a firm’s performance? Evidence from China. Technol Soc 68:101841

Zhang L, Ye Y, Meng Z, Ma N, Wu CH (2024) Enterprise DT, dynamic capabilities, and ESG performance: based on data from listed Chinese Companies. J Glob Inf Manag 32(1):1–20

Zhao X, Zhao Y, Zeng S, Zhang S (2015) Corporate behavior and competitiveness: impact of environmental regulation on Chinese firms. J Clean Prod 86:311–322

Zhao J, Pan J, Xie X, Su M (2024) Green outward foreign direct investment and host country environmental effects: the home country’s carbon emission reduction system is crucial. Energy 290:130182

Zhao T, Yan N, Ji L (2023) DT, life cycle and internal control effectiveness: evidence from China. Financ Res Lett 58:104223

Acknowledgements

This research was funded by the Youth Program of the National Social Science Foundation of China, grant number (22CGJ018).

Author information

Authors and Affiliations

Contributions

Xiangwei Xie: Methodology, writing, original draft, software, formal analysis, and funding acquisition; Hongyu Zhu: investigation, data curation, and writing; Jinjing Zhao—data curation, original draft, review, and editing.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

Ethical approval was not required as the study did not involve human participants

Informed consent

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

41599_2024_4039_MOESM1_ESM.docx

Supplementary materials - How effective is digital transformation? Heterogeneous insights from listed companies’ ESG performance

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Xie, X., Zhu, H. & Zhao, J. How effective is digital transformation? Heterogeneous insights from listed companies’ ESG performance. Humanit Soc Sci Commun 11, 1534 (2024). https://doi.org/10.1057/s41599-024-04039-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-04039-5