Abstract

Greenwashing, as a deceptive market behavior, not only undermines market order and credibility but also damage the environment. How to curb greenwashing is a critical issue for China as it enters an economic transition period and strives for sustainable development. In 2018, China implemented the Environmental Tax Law, imposing pollution fees on polluting enterprises for the first time in the form of mandatory taxation. Whether this measure can enhance real environmental benefits and curb greenwashing behaviors of companies is worth exploring. This paper utilizes panel data from listed companies from 2015 to 2021 and employs a Difference-in-Differences model to investigate the impact of the environmental tax law on greenwashing. Empirical results demonstrate that environmental tax law can effectively suppress greenwashing among heavily polluting enterprises. The Double Machine Learning model similarly validates this outcome. To explore the influence of mechanisms, we analyze the moderating effects of multidimensional (company, society, and government) digitization and confirm the dominant moderating role of government digitization. Furthermore, heavily polluting enterprises, particularly those in regions with higher tax rates, those required to disclose information, and high-tech firms, are more susceptible to the influence of environmental tax law in adopting real green production practices. This study confirms the positive role of environmental tax law and introduces the comprehensive digitalization moderation mechanism for the first time, providing important insights for China’s green transition and regional environmental governance.

Similar content being viewed by others

Introduction

Over the past decades, China has emerged as one of the fastest-growing economies globally, yet its traditional economic growth model has led to high energy consumption and pollution emissions (Luo et al. 2023). According to the Ecological Statistical Yearbook of the National Bureau of Statistics of China, industrial emissions of sulfur dioxide account for 79.6% of the national total, with the electricity and heat production, non-metallic mineral products, and ferrous metal smelting industries, which are categorized as heavily polluting industries, contributing 63% of the industrial sulfur dioxide emissions nationwide. The polluted emissions have resulted in losses equivalent to 8% of GDP (Li et al. 2017). To achieve green development and reduce pollution, more and more companies are required to report their environment, social, and governance (ESG) performance information, especially heavy polluting enterprises (Xu et al. 2023; Chen et al. 2024)Footnote 1. Nevertheless, some companies are conducting hypocritical environmental practices to gain a competitive advantage or evade regulatory responsibilities (Sun and Zhang 2019). They tend to omit crucial information in their disclosures, providing insincere ESG information to mask their adverse environmental impact, a phenomenon commonly known as “Greenwashing” (GW) (Lin et al. 2023; Hu et al. 2023a). GW refers to poor actual ESG performance while disclosing false ESG data for impression management (Yu et al. 2020). For example, some listed companies report capital expenditures for environmental protection in financial reports, but their actual spending is much lower than the disclosed figures (Zhang et al. 2023). ESG reports are not audited and lack standardized format requirements, leaving too much space for managerial discretion (Lin et al. 2023). Notably, some heavily polluting companies use greenwashing tactics to cover up their poor ESG performance and mislead external investors (Xu et al. 2023; García-Amate et al. 2023; Chen et al. 2024; Wang et al. 2024).GW not only undermines the interests of consumers and society but also disrupts the integrity and credibility of green markets (Zhang, 2023). It has fueled skepticism towards products (Nyilasy et al. 2014), influenced investor perceptions (Souguir et al. 2024), and perpetuated adverse environmental effects (Sun and Zhang, 2019).

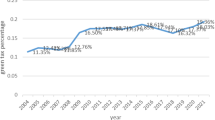

Since the environment is often considered a public good (Herbohn et al. 2014), the problem of negative externalities associated with environmental resources requires government intervention and guidance to mitigate the tragedy of the commons (Hu et al. 2021). Taking cues from practices in developed countries, the Chinese government has implemented a series of measures to alleviate ecological pollution (Zhang et al. 2022). For example, tax policies and environmental regulations include market-based environmental protection taxes, green-oriented environmental regulations, green credit, subsidies, green technology upgrades, and so on (Liu et al. 2021; Zhang and Kong 2022). The taxation is the preferred economic tool guided by the market orientation because tax reduces emissions by increasing the cost of pollution, it is both flexible and cost-effective (Zhao et al. 2022). In 2017, the Chinese government officially promulgated the Environmental Tax Law (ETL), which came into effect in 2018 to promote real environmental benefits. The law directly impose taxes on producers who release pollutants into the environment (Tan et al. 2022; Yu et al. 2022). ETL mainly includes two mechanisms: (1) positive emission reduction incentive mechanism, which means more emissions result in higher taxes, fewer emissions lead to lower taxes, and no emissions result in no taxes. (2) Dynamic tax quota adjustment mechanism, with the central government setting the baseline, while local authorities adjust upwards according to actual circumstances. According to the 2021 announcement by the Chinese Taxation Bureau, the implementation of ETL has resulted in a 25% reduction in the quantity of pollutants per ten thousand units of GDP (State Taxation Administration 2024a).

There are primarily two prevailing perspectives in existing research about ETL and GW. Some scholars argue that the current implementation of ETL has been brief and the tax rates are too low, leading to insufficient internalization of external costs (Qin et al. 2015). In the short term, there will be an increase in operating and management costs for highly polluting, energy-intensive resource industries, leading to financial burdens (Wang and Yu 2021). When the benefits of environmental governance are not directly proportional to the costs, and these benefits are predominantly social rather than economic, companies may still engage in GW (Hu et al. 2023b). However, supporters believe that ETL is a crucial measure for GW (Sun and Zhang 2019; Jin et al. 2024). Enterprises are facing institutional pressures to adhere to current environmental and social standards. Paying taxes is a fundamental social obligation for companies, and tax evasion can lead to damaged corporate reputation, increased external pressure, and loss of external investment (Wang et al. 2020; Souguir et al. 2024). Therefore, to ensure their legitimacy, companies will reduce fraudulent behaviors such as GW. One of the most important criteria for judging the success of ETL is their impact on curbing GW by businesses (Hu et al. 2023a), but existing research has not reached a consensus. Scientific assessment of the environmental impacts of ETL is crucial for addressing the environmental issues caused by heavily polluting industries and determining the future of sustainable development. It is also fundamental groundwork for further optimizing environmental taxes.

Based on the above analysis, most scholars focus on the causal relationship between ETL and GW but are unaware of the specific mechanisms involved. ETL is the first standalone tax law of China that explicitly includes departmental information sharing. It establishes a tax administration model of “enterprise declaration, tax collection, environmental monitoring, and information sharing,” emphasizing information cooperation among government departments and the role of public oversight. In this process, digitalization serves as a critical enabler, streamlining the integration and dissemination of environmental responsibility information (Seele and Lock 2017; Kalymbek et al. 2021). We also have reason to believe that digitalization is essential for ETL to effectively curb GW. Firstly, company digital transformation has led to a reduction in information asymmetry, making corporate transactions more traceable (Bendig et al. 2023), which can also enhance operational efficiency and competitive performance (Rialti et al. 2019; Matarazzo et al. 2021; Chen et al. 2023), while increasing internal information transparency, thereby reducing GW (Lu et al. 2023). Secondly, the rapid development of digital technologies such as the internet, big data, cloud computing, and artificial intelligence, have transformed the way information is disseminated and strengthening public social supervision (Saldanha et al. 2022). The public, through digital technology, has heightened awareness of environmental pollution and engaged in informal environmental monitoring through various digital platforms (Zhao et al. 2023). Lastly, the digitization has profoundly influenced traditional forms of environmental regulation (Estevez and Janowski, 2013), effectively enhancing the implementation of government environmental regulatory policies (Cao et al. 2021), enables efficient monitoring of taxation, further reducing the incidence of illegal activities (Bentley 2018; Grassi and Lanfranchi 2022; Bassey et al. 2022). Based on existing literature, while existing literature has confirmed that digitalization enhances regulation, it remains to be proven whether and how digitalization plays a moderating role in the “ETL-GW” relationship.

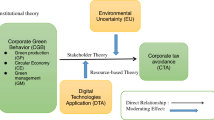

This research investigates the relationship between ETL and GW using a Difference-in-Differences (DID) model with data from Chinese-listed companies from 2015 to 2021. Our analysis shows that the ETL has significantly reduced greenwashing behavior among pollution-intensive companies. To ensure robustness and address potential multicollinearity, we employed a Double Machine Learning (DML) model, which further supports these findings. Next, we introduce digitalization as a moderating variable to explore the underlying mechanisms. The results reveal that government digitalization plays a dominant moderating role in enhancing the inhibitory effect of the tax, surpassing the moderating roles of both company and society digitalization. Finally, we use the Triple Difference (DDD) model to examine the impact of heterogeneous factors. Our findings indicate that firm-specific characteristics such as regional tax rates, mandatory ESG disclosures and high-tech status significantly influence how companies respond to the ETL. Figure 1 outlines the conceptual framework.

The research makes theoretical and methodological contributions in these aspects:

In terms of theoretical contributions: Prior studies on digitalization have mostly been confined to a single dimension, such as company-level or government-level digitalization (Clarkson et al. 2015; Lemma et al. 2022). We are the first to establish a three-dimensional framework encompassing company-level, society-level, and government-level digitalization, offering a more comprehensive analysis. Specifically, digitalization moderates the ETL-GW relationship through three key mechanisms: (1) Company digitalization enhances real-time tracking of environmental performance, reducing discrepancies between actual practices and disclosed information. (2) Society digitalization empowers the public to scrutinize corporate claims through digital tools and platforms, amplifying external accountability. (3) Government digitalization strengthens regulatory oversight by leveraging real-time data to detect and penalize non-compliance. These mechanisms collectively explain how digitalization strengthens the effectiveness of the ETL in curbing greenwashing behavior.

In terms of methodological contributions: (1) While previous research has recognized the connection between ETL and GW, the underlying mechanisms remain unclear (Peng et al. 2023; Hu et al. 2023a). By empirically incorporating digitalization as a moderating variable, this study provides a novel explanation of how ETL reduces GW under different levels of digitalization. (2) This study integrates a series of analytical approaches: (i) uses the DID model and DML to study the direct impact of ETL on GW, (ii) explores the impact mechanism of multidimensional digitalization through a moderated effects model, and (iii) further extends the analysis to the DDD model to explore the heterogeneous impact of different firm types.

The remaining structure of this paper is as follows: Section “Policy, theoretical background and hypothesis” primarily focuses on the policy, theoretical background and hypothesis. Section “Data, methods, and variables” describes the methodology and data processing. Section “Results and discussion” discusses empirical results, and Section “Conclusion” concludes the paper.

Policy, theoretical background and hypothesis

Policy and theoretical background

Policy background

ETL in China originates from the pollution discharge fee system (Shang et al. 2022). The pollution fee system has a too low charging standard and faces significant difficulties in collection, which hinders its effectiveness in reducing pollutant emissions (Tan et al. 2022; Yu et al. 2022). Before the introduction of the ETL, pollution discharge fee only accounted for 2.5–3% of the cost of pollution treatment (China News 2024b). Moreover, the lack of effective regulatory measures and lax enforcement have also created favorable conditions for GW by businesses (Shang et al. 2022). After 2018, ETL formally replaced pollution discharge fees, establishing stricter taxation standards. The transition from traditional emission fees to ETL has not only altered the pollution costs for businesses but has also legally constrained their environmental behavior. Paying the relevant fees has become an obligation for businesses, significantly increasing their pollution costs (Song et al. 2019). Almost all enterprises, institutions, and other producers or operators that directly discharge taxable pollutants into the environment within China are required to pay environmental protection tax. These pollutants are categorized into four main types: air pollutants, water pollutants, solid waste, and noise. The tax rate is determined by the amount and concentration of pollutants dischargedFootnote 2. This means that companies that take measures to reduce pollutant emissions or improve discharge standards can benefit from lower tax rates or even tax exemptions. The base tax rate is set by the central government, while local governments can adjust it upward according to local conditions. Previously, environmental tax revenues were shared between the central and local governments at a ratio of 1:9, but now all environmental tax revenues belong entirely to local governments. This change enhances local governments’ incentives to enforce environmental policies, reduces their motivation to collude with enterprises to increase tax revenues, strengthens enforcement efforts, and better encourages companies to invest in environmental protection (Maxwell and Decker 2006).

ETL and the Pigou tax theory

The existing theoretical literature on ETL primarily revolves around the Pigou tax theory. The Pigou tax theory suggests that ETL has the dual role of legal deterrence and emission reduction incentives. It can internalize external costs and enhance corporate environmental awareness (Hu et al. 2023a). On one hand, previously, the environmental costs generated by business activities were borne by society. By imposing environmental taxes, these external costs of the environment are internalized, further enhancing the effectiveness of cost internalization. Enterprises will face higher cost pressures, and the costs of GW will also increase accordingly. Faced with the uncertainty of GW benefits, enterprises may choose to abandon it (Sun and Zhang 2019). On the other hand, when the marginal cost of emission reduction is lower than the emission costs, businesses are incentivized to reduce pollutant emissions (Pigou 1920). The internal costs incurred by companies in reducing emissions can be eligible for corresponding tax incentives or deductions.

GW and the institutional theory

GW as a strategic choice for companies is influenced by their institutional environment (Zhang et al. 2023; Souguir et al. 2024). According to Institutional Theory, companies operate as open systems, their development is influenced by institutions, such as beliefs, and norms (Testa et al. 2018). Those institutional factors can significantly influence company’s environmental strategies and preferences (Souguir et al. 2024). Legitimacy is a core concept in Institutional Theory, referring to the perception that a company’s actions are appropriate, desirable, and aligned with socially accepted norms and values (Zhang et al. 2023). Suchman (1995) identifies three dimensions of legitimacy: pragmatic legitimacy, based on the self-interested evaluation of stakeholders; moral legitimacy, grounded in normative approval; and cognitive legitimacy, reflecting a broader acceptance of an organization as necessary or inevitable. Companies seek legitimacy to ensure survival and growth, often adapting their environmental strategies to align with institutional expectations.

When facing external pressures, companies do not always comply with institutional demands (Zhang et al. 2023). If they perceive that GW could yield greater benefits, they may opt to hide negative information, provide only symbolic responses, or reduce the level of external scrutiny to mitigate institutional pressure. However, if the cost of GW is too high due to regulatory penalties, companies are more likely to comply with institutional influences to achieve long-term economic returns and social legitimacy (Khan et al. 2020). To establish or maintain institutional legitimacy, companies must at least appear to comply with institutional requirements (Lee and Raschke 2023). GW involves selectively disclosing certain information to meet external institutional demands and gain greater market legitimacy (Cheng et al. 2024). This means that even proactive ESG disclosures do not guarantee the quality and depth of the information provided (Wang et al. 2018). Some scholars also believe that companies with poor environmental performance face more political and social pressure, as well as threats to their legitimacy. Therefore, they are more likely to disclose more information and use GW to send positive signals in order to change how investors perceive them (Clarkson et al. 2008). Moreover, the greater the legitimacy pressure from stakeholders, the more likely companies are to adopt truly green strategies (Murillo-Luna et al. 2008).

Hypothesis development

ETL and GW

According to the Institutional Theory and Pigou Tax, companies face institutional pressure to comply with current environmental and social standards (Aguilera et al. 2007). Tax evasion is considered unethical and damaging a company’s reputation which makes it less likely to evade taxes (Souguir et al. 2024). Therefore, when strict regulations are enforced, companies are more likely to engage in green activities for high-emission corporates, the high tax rates and strong legal constraints increase the illegal cost (Jin et al. 2024). In contrast, low-emission corporates receive tax relief, further undermining the incentive for businesses to greenwash (Zhao et al. 2022).This differential collection approach helps to promote environmentally friendly behaviors among enterprises more effectively, fostering green development improve efficiency to alleviate the pressure from tax (Hu et al. 2023b; Jin et al. 2024).

Existing literature on ETL and GW is limited and mainly focuses on environmental costs and corporate strategies. Peng et al. (2023) argue that the implementation of ETL effectively promotes genuine environmental performance. However, Hu et al. (2023a) claim that ETL increases the economic burden on companies, leading some to engage in GW for short-term gains. Sun and Zhang (2019) further differentiate between advantaged and disadvantaged companies, finding through a game-theoretic model that environmental penalties including ETL effectively curb GW behavior in both types of companies. Arouri et al. (2021) demonstrated that a company’s GW is negatively affected by increasing environmental costs. These varying perspectives do not reach a consensus on the direction of ETL’s impact on GW. We propose a possible hypothesis.

H1: ETL can effectively curb GW of corporates.

The moderating role of digitalization

GW is fundamentally related to the disclosure of environmental information (Zhang et al. 2023). Most of the content in ESG reports consists of non-financial information, which requires high coordination between departments and is difficult to collect and assess. Therefore, a breakthrough in addressing GW lies in reducing the cost of environmental responsibility information and improving the efficiency of integrating this information (Bai and Sarkis 2017). Digitalization is now the main method for information dissemination and processing. Digitization improve the quality of sustainable information disclosure by companies (Kong et al. 2022). Enhancing the credibility of information to create a comprehensive monitoring environment throughout the process of enterprise fundraising, capital investment, and green innovation. This not only contributes to the implementation of environmental projects but also ensures the effective enforcement of environmental taxes (Shank 2022). The key role of digitalization can be divided into three aspects:

First, company digitalization refers to the use of digital technologies by companies to improve internal management efficiency and the transparency of external information disclosure. Regarding internal management efficiency, company digitalization promotes environmental collaboration and innovation, enhancing resource utilization efficiency. Melander and Pazirandeh (2019) pointed out that company digitalization promotes environmental collaboration between companies and their upstream and downstream supply chain partners by enhancing the efficiency of environmental information transmission. Companies can foster green technology innovation, reduce resource waste, and fundamentally reduce the likelihood of GW (Anthony Jnr 2020). Regarding transparency in information disclosure, Lu et al. (2023) proposed that companies can more efficiently convey environmental performance information through digital means, ensuring transparency and reducing the motivation for companies to engage in GW to cover up environmental problems.

Second, society digitalization primarily reflects the public’s capacity and awareness in the application of digital technologies. Through social media, environmental apps, and online reporting platforms, the public has enhanced its ability to monitor corporate environmental behavior. Lyon and Montgomery (2013) introduced the phenomenon of “Tweetjacked,” where the public can expose and comment on corporate GW via social media, rapidly influencing corporate reputations and increasing corporate environmental responsibility. Social media empowers the public with supervisory power, reducing the likelihood of companies taking risks by engaging in GW. Wu et al. (2022) found that the widespread use of the internet has facilitated public participation in environmental issues, enabling the public to report corporate environmental violations more promptly, thereby exerting external supervisory pressure and reducing the occurrence of GW. Xu et al. (2023) noted that public skepticism toward corporate environmental disclosures has intensified in the digital environment. Through social media platforms, the public can not only expose corporate GW but also disseminate related information, creating broader social pressure. This form of collective oversight based on digital platforms has significantly increased the transparency of corporate information disclosure, reducing companies’ motivation to engage in GW.

Finally, government digitalization is primarily reflected in the enhancement of environmental regulation efficiency through e-government platforms. The government can accurately monitor corporate environmental behavior through real-time data monitoring and remote sensing technologies. Marquis and Qian (2014) emphasized that government-led digital platforms significantly reduce corporate misconduct, including falsified CSR reports, by improving public scrutiny and making it harder for companies to manipulate or hide their environmental data. Additionally, Chang et al. (2021) pointed out that government digitalization enables the collection and analysis of corporate environmental data, allowing for more timely detection of corporate violations and swift corrective actions. This digital regulatory model ensures that companies find it difficult to evade regulation through GW, thereby enhancing the effectiveness of ETL. Hao et al. (2024) further emphasized that digital government initiatives not only streamline regulatory processes but also encourage corporate green innovation by increasing transparency and accountability, which pressures firms to comply with environmental standards.

In summary, company, society, and government digitalization each regulate the effectiveness of environmental tax policy enforcement at different levels. Thus, under a higher level of digitalization, the implementation of ETL can more effectively curb corporate GW. Based on this, we propose the following hypothesis:

H2: Company digitization will enhance the enforcement of ETL and curb GW by corporates.

H3: Society digitization will enhance the enforcement of ETL and curb GW by corporates.

H4: Government digitization will enhance the enforcement of ETL and curb GW by corporates.

Data, methods, and variables

Data sources

GW typically refers to the disparity between a company’s disclosed ESG and its actual ESG performance, measured by the difference between the company’s standardized ESG disclosure score and its standardized actual ESG performance score (Lin et al. 2023; Hu et al. 2023a). According to Yu et al. (2020) and Lin et al. (2023)’s research, Bloomberg’s ESG score reflects the amount of ESG data a company publicly discloses but does not measure its actual ESG performanceFootnote 3. The ESG performance scores are from the Huazheng ESG scores.

Financial information is obtained from CSMAR and Wind databases. The research period covers both pre-implementation of environmental taxes (2015–2017) and post-implementation (2018–2021). This research excludes financial companies as well as those labeled as ST, *ST, and PTFootnote 4. After trimming all continuous variables at the 1% and 99% levels, a total of 1275 listed companies with 6607 observations were obtained.

Variable definition and summary description

Dependent variable

We define GW as the normalized gap between ESG disclosure scores and ESG performance scores. This metric highlights discrepancies between a company’s reported environmental commitments and its actual performance. By normalizing the gap, we ensure comparability across different organizations, allowing us to identify instances where high disclosure scores may mask poor performance, thereby indicating potential GW. GW can be expressed as:

where \(i\) and \(t\) are abbreviations of individual and time. \({{ESG}}_{i,t}^{* }\) is the company’s ESG disclosure score, \({{ESG}}_{i,t}\) is the company’s actual ESG score. \(\overline{{{ESG}}^{* }}\), and \(\overline{{ESG}}\) represent the mean ESG disclosure scores and actual performance scores, \({\sigma }^{* }\) and \(\sigma\) represent the standard deviation of disclosure score and performance score. A larger disparity indicates a higher degree of GW, suggesting inefficiencies in sustainable performance. We use the same method to calculate the GW scores in environment, social and governance sub-dimensions.

Independent variable

Heavily polluting enterprises, due to their poor environmental performance and higher emissions of waste gas, wastewater, and solid waste, are more likely to engage in GW to improve their public image (Chen et al. 2024; Wang et al. 2024). However, with the introduction of ETL, these companies face significantly higher compliance costs, as the tax directly targets enterprises that discharge taxable pollutants into the environment. This increases their potential legal and financial risks associated with non-compliance, making them more susceptible to the deterrent effects of ETL. Heavily polluting enterprises are more likely to alter their behavior under the pressure of ETL, making them an ideal experimental group for studying the impact of ETL on GW, and other enterprises including non-heavily polluting enterprises as the control groupFootnote 5. Therefore, the independent variable is “heavily polluting enterprises following the implementation of ETL”, denoted as the time-pollution interaction term. The implementation of ETL constitutes an exogenous shock event. A binary dummy variable, denoted as Post, is introduced, taking the value of 1 for ETL occurring in 2018 or later years and 0 for those preceding 2018. Polluted enterprises are denoted as Treat and classified in accordance with the industry categorization standards outlined by the 2008 Listed Company Industry Classification Standards and the 2012 Listed Company Environmental Inspection Industry Classification Management CatalogFootnote 6. When a company is a heavy polluter, Treat = 1; otherwise, Treat = 0.

Moderating variable

Company digitalization (Digital_c)

Following Yuan et al. (2021)’s approach, the degree of digitalization at the company level is measured by dividing the total frequency of digitalization-related terms by the length of the Management Discussion and Analysis (MD&A) section in the annual reportsFootnote 7.

Social digitalization (Digital_s)

There is no standardized metric for measuring social digitalization in academia. To assess the foundational level of society digitalization, we utilize the digitalization indicators from Peking University’s Inclusive Finance Index. This indicator reflects the convenience level of digital services across 337 cities (Bai et al. 2024), which comprising four sub-indicators: mobility, affordability, creditworthiness, and convenienceFootnote 8(details provided in Supplementary Appendix Table 2).

Government digitalization (Digital_g)

The Integrated Government Service Capability Assessment Index for Provincial and Key City Governments index reflects the level of digitalization in governmentFootnote 9 (Zhang and Li 2022) (detailed information is shown in Supplementary Appendix Table 3).

All the mentioned data are continuous variables, and for uniformity, they have undergone standardization processing.

Control variables

We reference previous research and include the following variables in our model to minimize potential biases. Hu et al. (2023b) argued that company size and asset scale influence green innovation capabilities and GW. Drawing from their research, we use the natural logarithm of total assets to represent company size (Size) and the proportion of fixed assets (Fix). Furthermore, we incorporate net inventory to further measure asset scale (Inv). To assess the impact of a company’s financial condition on GW, we refer to the study by Xie et al. (2023). We use the following financial metrics: Roe, represented by the return on equity, represents the profitability; Cash, expressed as the proportion of cash assets, indicates the cash flow; and Lev, determined by total liabilities/total assets, means debt rate. In addition, we incorporate a binary variable, indicating whether the company was profitable in the current year (Loss). Refer to He and Jing (2023)’s study, company’s growth rate and age have an impact on the ESG performance. The former (Growth) represented by the current year’s revenue/ the previous year’s revenue -1, and the later (Age) indicated by the establishment time of the enterprise. Wang et al. (2020) argued that the board structure affects the impact of digitization on a company. In this study, this was measured using the proportion of independent directors (Indep) and the shareholding percentage of the largest shareholder (Top 1). Table 1 lists all variables and the descriptive statistics. The last column of Table 1 displays the p-values of Randomization Check for each control variable. All p-values are greater than 0.1, suggesting no significant differences under random sampling. Therefore, the roles of these variables in the study are likely reasonable and consistent.

Model design

Effect of the ETL on GW(H1)

We employ a DID model to observe whether heavily polluting enterprises exhibit significantly different GW behavior compared to other enterprises after ETL implemented. The DID model is widely used in policy evaluation, because it uses the exogenous impact of a policy to divide the subjects into a treatment group and a control group. By comparing the differences between these two groups before and after the policy implementation, the causal effect of the policy can be identified. Since policies are generally exogenous to microeconomic agents, the DID model effectively addresses potential endogeneity problems associated with key explanatory variables. Considering ETL as exogenous policy factors, we can overcome endogeneity issues by constructing virtual variables through grouping, thereby better addressing, and resolving differences in trend biases and reflecting the net effects of environmental taxes. According to Zhang and Zhao (2022)’s research, ETL are considered external policies, and we adopt the DID model. The specific model specifications are as follows:

In this context, subscripts \({\delta }_{t}\), \({\tau }_{c}\), \({\lambda }_{i}\) respectively represent the fixed effects at time, city and company, \({\varepsilon }_{i,t}\) represents the error term in the model. The coefficient \({\beta }_{1}\) in formula (1) reflects the main effect of the environmental tax law on corporate greenwashing behavior, which tests H1. Specifically, if \({\beta }_{1}\) is significantly negative, this would confirm the hypothesis H1, indicating that the implementation of the ETL leads to a reduction in corporate greenwashing.

However, the DID model also faces some notable challenges. Firstly, the validity of the DID model heavily relies on the parallel trends assumption, which posits that, in the absence of the treatment, the trends of the treatment and control groups would have evolved similarly over time (Guo et al. 2020). To validate this assumption, we employ Jacobson et al. (1993)’s method to conduct the parallel trends test. The expression of this model is as follows:

Secondly, while the parallel trends assumption validates the DID model’s fundamental premise, DID still encounters practical challenges. When controlling for high-dimensional explanatory variables, DID may face multicollinearity issues. Furthermore, researchers are often limited to controlling for only a few factors, which increases the risk of omitting important explanatory variables. Additionally, the DID model generally assumes a linear functional form for non-core explanatory variables. While this assumption simplifies estimation, the relationships between variables in real-world economic contexts are often complex and diverse. A simple linear assumption may lead to model specification errors, thereby affecting the accuracy of the estimates. To address these shortcomings, the Double Machine Learning (DML) method has been introduced as a robustness check for DID (Chernozhukov et al. 2018). Compared to traditional models, the DML method is well-suited for high-dimensional data and does not require a pre-specified functional form for covariates. Therefore, causal effect estimation based on DML addresses the limitations of traditional methods and offers significant advantages in handling nonlinear relationships between variables. This study primarily employs the Random Forest (RF) model as a robustness check for the DID approach. RF is a supervised, non-parametric, and nonlinear ensemble machine learning method based on decision trees, capable of handling complex nonlinear relationships in data without requiring any predefined model form (Breiman 2001). Its strong robustness helps avoid the overfitting issues commonly associated with traditional regression methods. By combining machine learning with DID, we retain DID’s strong capability for causal inference while overcoming its limitations regarding high-dimensional control variables and model specification, leading to more accurate and reliable estimates when evaluating policy effects. DML combines the causal inference advantages of DID with the ability of machine learning algorithms to handle high-dimensional data, thereby enhancing the effectiveness of policy effect evaluations. Specifically, DML allows non-core explanatory variables to take a semi-parametric form, avoiding bias from mis-specified functional forms, and it can incorporate a larger set of control variables (Chernozhukov et al. 2018).

Moderating effect of digitalization and ETL on GW (H2-H4)

The DID model can validate the impact of ETL implementation on company’s GW before and after but cannot verify the specific mechanism of this effect. We employ a moderation effect model, using digitalization as the moderating variable to address this issue. Moderation effect refers to the extent to which a moderating variable affects the relationship between another variable and its causal effect, i.e., how the moderating variable moderates the impact of another variable on the outcome. In this paper, we refer to (Huang et al. 2023)’s research and constructed formula (3), wherein Digital is the regulating variable.

The coefficient \({\beta }_{3}\) in formula (2) reflects the moderating effects of digitalization (company, society, and government) on the ETL-greenwashing relationship, which tests H2, H3, and H4. A significant and negative \({\beta }_{3}\) would support these hypotheses, indicating that higher levels of digitalization enhance the ability of the ETL to curb greenwashing.

Exploratory analysis: regional tax rates, mandatory disclosure, and technology classification

DID model assume a uniform treatment effect across groups. However, in real-world situations, some heterogeneous factors may not be identified. DDD models can account for variations across another dimension, such as time, region, or group characteristics, allowing for a more in-depth analysis of how effects differ. By introducing a third difference, DDD models can better distinguish the true treatment effects, thereby improving the accuracy of causal inferences. For example, Hering and Poncet (2014) found that the impact of environmental regulations on corporations varies with different pollution levels. To address this, they introduced a third difference “industry pollution levels” to enhance the DID model for more precise policy identification. In this research, we utilize the DDD model to analyze the impact of heterogeneity factors, focusing on three key aspects:

First, there are variations in environmental tax rates across different regions. ETL evolved from the previous pollution discharge fees, and while most regions retained the same tax rates, some increased them. For example, regions with lower environmental carrying capacities have implemented higher rates on top of the baseline tax rate. We define firms located in regions with increased tax rates as Groupi 1 = 1 and those in regions with unchanged tax rates as Groupi 1 = 0.

Second, to enhance corporate social responsibility awareness, in 2008, the Shanghai and Shenzhen Stock Exchanges issued notices requiring certain companies to disclose CSR reports, specifically emphasizing the need to disclose environmental information as part of their non-financial responsibilities and performance. This requirement applied to companies in the SSE “Corporate Governance Sector,” those issuing foreign-listed shares, financial companies, and constituents of the SZSE 100 Index. According to the China Listed Company Social Responsibility Research Database, companies required to disclose such information are categorized as Groupi 2 = 1, while those not required are defined as Groupi 2 = 0. To account for the frequency of a firm’s inclusion in the CSR disclosure list, we assign weights based on the number of appearances during the observation period. Specifically, companies appearing once in the list are assigned a weight of 1, those appearing twice are assigned a weight of 2, and so on. Firms appearing twice or more account for approximately 70% of the sample, ensuring that firms consistently subject to mandatory disclosure requirements are better represented in the analysis.

Third, GW by high-tech firms tends to be more covert and misleading (Chen 2024). Unlike traditional polluting industries such as petroleum and chemical sectors, some high-tech companies have been found to engage in GW. This phenomenon is observed even among global renewable energy companies such as Shell, BP, and Total Energy. Given the various criteria for classifying high-tech enterprises, we use the mainstream classification methods based on the Catalog of Strategic Emerging Industries and the 2012 Classification of Strategic Emerging Industries (Trial) to identify high-tech firms, where high-tech firms are defined as Groupi 3 = 1 and non-high-tech firms as Groupi 3 = 0.

The DDD model is constructed as follows:

Results and discussion

Empirical research consists of four parts. Firstly, the relationship between ETL and GW is verified through the DID baseline regression to test H1. Secondly, robustness tests are conducted to further support H1. Thirdly, digitalization is used as a moderating variable for analyzing the impact mechanism to verify H2-4. Finally, heterogeneity tests are performed.

Effects of ETL on GW

The results of DID analysis are presented in Table 2. In column (1), no control variables are included, showing a significant coefficient (b = −0.024, p < 0.01). Upon the addition of other control variables, as shown in column (2), the coefficient remains significant (b = −0.021, p < 0.01).

These findings suggest that ETL effectively mitigates GW among heavily polluting firms, H1 is confirmed. However, upon the inclusion of control variables, the inhibitory effect of ETL diminishes, indicating that these factors’ interference is controlled. Potential explanations for the results in Table 2 are as follows: Firstly, from a policy perspective, ETL as a mandatory tax policy signifies heightened government oversight of firms’ environmental performance. Consequently, deceptive environmental behaviors are more likely to be uncovered, prompting firms to abandon GW in favor of enhancing genuine environmental performance. Secondly, from a corporate standpoint, companies with different characteristics may respond differently to environmental behaviors. Larger firms typically possess greater resources and capabilities to adopt more effective environmental technologies, while companies with a higher proportion of independent directors tend to prioritize corporate social responsibility and sustainability, thus favoring environmental measures. Conversely, firms with higher leverage face greater economic pressure and may prioritize short-term profitability.

Robustness test

This research conducts four robustness tests from various perspectives to ensure the robustness of the baseline regression, including parallel trends test, placebo test, adjusting the Observation Interval, and DML model. The results of these tests all confirm the robustness of the baseline regression, providing further support for H1.

Parallel trends test

We utilized the pre-policy implementation data from the preceding period, 2017, as the baseline (pre1), and omitted this baseline to ensure the validity of differential treatment between the experimental and control groups before and after policy implementation. As illustrated in Fig. 2, the results of parallel trends tests show that the estimated coefficients of the pre-treatment dummy variables are not significant, indicating no significant differences between the experimental and control groups, implying identical trends. However, post-policy implementation, significant differences between the experimental and control groups emerge within the sample, with these differences further expanding over time. Consequently, our study passed the parallel trends test, signifying comparability between the experimental and control groups after the implementation of ETL.

Placebo test

The study also conducted a placebo test, a commonly used method to examine whether observed results are caused by the policy rather than incidental differences or systematic biases due to other factors. Firstly, based on existing data and experimental designs, we constructed a virtual experimental group and a virtual control group similar to the actual experimental and control groups. We randomly selected 238 out of 1275 enterprises as the pseudo-experimental group. Secondly, we applied the treatment to the virtual treatment group and repeated the pseudo-experiment 1000 times. Finally, the results were compared. Figure 3 illustrates the outcome of the placebo test. The mean coefficients hover around zero, indicating that the DID regression results concerning the use of the virtual experimental group and the policy implementation time are not significant, suggesting that firms’ GW is not influenced by other random factors. This study passed the placebo test, rendering its conclusions relatively reliable.

Adjusting the observation interval

In practical scenarios, the timing of policy implementation may exert influence on outcomes. Hence, adjusting the sample time window can assist in identifying the most appropriate timing of treatment implementation to ensure that the observed effects are attributable to the policy. To minimize potential inaccuracies in the estimation due to window period selection (Guo et al. 2020), we adopted 5 shortened periods for regressing the baseline model, as Table 3 presents. After altering the window period, the test results show a slight change but a significant negative correlation, indicating the robustness of H1.

DML analysis results

This study employs DML to further validate the policy inhibitory effect of ETL on GW. Initially, we partition the sample into a 1:4 ratio, using RF to predict the main regression. The results in columns (1) and (2) of Table 4 indicate that the policy effect slightly attenuates after the inclusion of control variables but remains significant at the 0.05 level. To further ensure robustness and minimize the risk of overfitting, we employ additional sample divisions, splitting the data into 1:2 and 1:7 ratios (Belloni et al. 2014; Chernozhukov et al. 2018). Specifically, the splitting process involves dividing the entire dataset into two subsets: one for model training and the other for prediction. In the 1:2 ratio, one-third of the data (1/3) is used for training the model, while the remaining two-thirds (2/3) are reserved for prediction. Similarly, in the 1:7 ratio, one-eighth of the data (1/8) is used for training, with seven-eighths (7/8) retained for prediction. This cross-fitting process ensures that the model is trained on a smaller subset, allowing it to learn the underlying patterns, while the larger prediction set tests its performance on unseen data, thereby enhancing the generalizability of the results. The coefficients continue to be significantly negative at the 0.05 level, reaffirming H1.

Mechanism tests: digitalization’s moderating effect

To investigate the moderating roles of digitization (Digital_c, Digital_s, and Digital_g), they were incorporated into the regression model, as shown in Table 5. As shown in Column (1) of Table 5, the increase in company digitalization (Digital_c) enhances the suppressive effect of ETL on GW (b = −0.020, p < 0.1), H2 is proved. This indicates that company digitalization, by improving internal management efficiency and information transparency, effectively reduces companies’ motivation for engaging in GW. This result is consistent with previous research, which suggests that digital technologies help companies better track and manage their environmental performance, while reducing environmental pollution through innovation, thus lowering the likelihood of GW (Lu et al. 2023; Tang et al. 2023). Social digitalization (Digital_s) shows a significant moderating effect in Column (2) of Table 5 (b = −0.026, p < 0.05), H3 is proved. Which indicating that public digital literacy and platform participation significantly curb GW. When society digitalization is high, the public can more effectively monitor companies’ environmental behavior through social media and digital platforms, forcing companies to take more responsible environmental actions, thereby enhancing the effectiveness of ETL (Zhao et al. 2023). As shown in Column (3) of Table 5, government digitalization (Digital_g) is the most significant moderating factor (b = −0.024, p < 0.01), and H4 is proved. Government digitalization, through e-government platforms and data-driven regulatory systems, improves the efficiency of policy enforcement, effectively curbing companies’ attempts to evade responsibility through GW. This is consistent with the findings of Zhang et al. (2023), who noted that government digitalization enables better monitoring of companies’ emission data and allows for the rapid handling of violations through intelligent means, thus strengthening policy enforcement.

After considering all three dimensions of digitalization, the results in Column (4) of Table 5 show that, although company digitalization and society digitalization exhibit significant moderating effects when analyzed individually, only government digitalization remains significant in the multidimensional digitalization context (b = −0.024, p < 0.05). This suggests that government digitalization plays a dominant role in moderating the relationship between ETL and corporate GW behavior. Compared to digitalization at the company and society levels, government digitalization is more authoritative and has broader coverage. Through stringent data monitoring and efficient enforcement mechanisms, it makes it difficult for companies to evade regulatory responsibilities through false information.

Unlike previous studies that primarily focused on company digitalization as a single dimension, our analysis, by introducing society and government digitalization, reveals a deeper mechanism of influence. Specifically, while company digitalization helps improve internal management transparency and reduce GW, it often depends on the degree of self-regulation and is mostly limited to internal processes. In contrast, society digitalization exerts external pressure through public oversight, while government digitalization provides a top-down regulatory system that ensures policy enforcement. Therefore, multidimensional digitalization analysis allows us to better understand that policy enforcement requires not only transparent information transmission within companies but also external oversight from both government and society. Particularly under the leadership of government digitalization, the synergy between company and social digitalization can be maximized, creating a more comprehensive system for enforcing environmental policies. This multidimensional digitalization perspective provides a more comprehensive framework for understanding the mechanisms of policy enforcement.

Based on these research findings, policymakers should focus more on the pivotal role of government digitalization in environmental governance. While company and society digitalization play important roles in enhancing information transparency and public oversight, truly curbing corporate GW requires prioritizing the enhancement of the government’s digital regulatory capabilities. This can be achieved by further investing in and developing e-government platforms, big data environmental monitoring systems, and other digital tools. By enhancing the level of government digitalization, policymakers can not only increase the effectiveness of environmental policy enforcement but also significantly shorten regulatory response times, ensuring that companies find it difficult to evade legal responsibilities through GW. Moreover, the advancement of government digitalization should work in synergy with company and society digitalization to create a comprehensive supervision and management system that promotes corporate transparency and public participation. In a broader digitalized environment, this collaborative effort will help achieve sustainable development in environmental governance.

Exploratory analysis of heterogeneous factors affecting greenwashing

We have identified the inhibitory effect of ETL on GW and have confirmed the significant moderating role of digitalization at the company, society, and government levels. Considering that companies are located in regions with different tax rates, some are required to disclose information mandatorily, and there are differences among companies (such as being high-tech firms), it is necessary to further examine whether the impact of ETL on corporate GW varies across different contexts.

Different tax rates

Based on marginal cost theory, a firm’s decision-making is influenced by the comparison between marginal costs and marginal benefits (Birchall 1991). ETL implements a dynamic tax adjustment mechanism. In provincial regions with higher environmental carrying capacitiesFootnote 10, such as Xinjiang, Jilin, and Anhui, the tax rates are set at the minimum threshold. Conversely, in regions with lower environmental carrying capacities-often economically developed areas like Beijing-the tax rates are set at the upper limit, which is ten times the minimum rate. Higher ETL rates in these regions reflect stronger environmental intentions and stricter regulatory efforts by local governments, including more rigorous supervision and information disclosure requirements. Firms in these regions face higher pollution costs (Zhang et al. 2020) but also have higher risks and lower returns from GW. As a result, firms weigh the costs of reducing emissions against the costs of continuing to pollute. Therefore, we expect that firms in regions with higher ETL rates will have a stronger incentive to reduce GW compared to firms in regions with unchanged tax rates.

In the sample, 571 cases are from companies in regions with increased tax rates after 2018, accounting for about 50% of the experimental group. The result of columns (1) of Table 6 shows that the correlation coefficient is significantly negative at the 1% significance level, aligning with our expectations. Which reaffirms the nature of ETL as a Pigou tax, stimulating genuine environmental actions by increasing company costs and thereby curbing GW. Similarly, Zárate-Marco and Vallés-Giménez (2015) indicate that companies in regions with higher tax rates may recognize the importance of improving production efficiency and adopting clean technologies earlier, thereby reducing the marginal cost of pollution reduction. As a result, when the ETL is officially implemented, local companies are more likely to respond to tax pressure through actual emission reductions rather than GW.

Differences in information disclosure methods

From the perspective of Signaling Theory, companies use environmental information disclosure to signal their environmental performance to outsiders. In theory, companies with better environmental performance are more motivated to voluntarily disclose this information to showcase their environmental management capabilities and market competitiveness (López-Santamaría et al. 2021). However, when disclosure is mandatory, especially for heavily polluting companies, the nature of this signaling process changes. Companies required to disclose information must reveal their environmental data, regardless of their actual performance. This means these companies might resort to GW to present a favorable image and attract more investors.

To ensure the robustness of the results, we assign weights to companies based on the frequency of their inclusion in the CSR disclosure list during the observation period. Specifically, firms appearing once are assigned a weight of 1, firms appearing twice are assigned a weight of 2, and so forth. This approach ensures that firms consistently subject to mandatory disclosure requirements are better represented in the analysis. Companies appearing twice or more account for approximately 70% of the sample, reflecting the higher transparency pressure faced by these firms. Column (2) of Table 6 presents the weighted results, showing a correlation coefficient of −0.028 at the 5% significance level. This indicates that under mandatory disclosure, the introduction of ETL significantly reduces GW among heavily polluting companies. This indicates that under mandatory disclosure, the introduction of ETL significantly reduces GW among heavily polluting companies. Previous studies have shown that mandatory disclosure cannot effectively prevent GW, as even mandatory information disclosure does not guarantee the quality and depth of the information disclosed (Meng et al. 2014). However, unlike mandatory disclosure, the ETL directly increases the cost of emissions, forcing companies to face real economic pressure. This direct economic penalty and constraint mechanism is stricter than simply relying on information disclosure, making it more effective in curbing GW. Moreover, the mandatory disclosure policy brings greater transparency pressure, forcing these companies to take more substantial environmental actions when faced with the ETL. This helps them avoid greater reputational damage or economic penalties under the dual pressure of the ETL and disclosure policies. This combination of policies strengthens the ETL’s effectiveness in regulating these companies.

Technology classification

In China, some “dirty” high-tech industries may contribute more to pollution than is often thought, such as electronic equipment manufacturing, semiconductor chips, and electronic components, as their production processes release hundreds of chemicals, posing significant but hidden environmental risks (Tu 2023). These sectors, characterized by high-tech pollution, entail substantial environmental costs due to extensive energy consumption and chemical usage during production processes. However, they are also regarded as symbols of technological innovation, with their products intricately linked to future and green technologies. Consequently, companies in these industries tend to engage in GW to enhance their corporate image (Liu et al. 2023).

To clarify the overlap between high-tech and heavily polluting industries, this study adopts China’s Strategic Emerging Industries (SEIs) classification, as defined by the Guidelines for Strategic Emerging Industry Classification issued by the National Bureau of Statistics of China. SEIs encompass sectors such as information technology, high-end equipment manufacturing, and new energy vehicles. However, a significant proportion of SEIs, including electronic manufacturing and chemicals, are inherently resource-intensive and pollution-heavy. In our data, 594 samples (over 53% of the experimental group samples) are categorized as both heavily polluting and high-tech enterprises after 2018 (the number of overlapping firms between heavily polluting enterprises and high-tech enterprises in the observed sample is shown in Supplementary Appendix Table 4). This overlap highlights the complexity of balancing innovation with environmental responsibility.

In column (3) of Table 6, we examine whether ETL also exert a deterrent effect on GW among high-tech enterprises within heavily polluting industries. As anticipated, our findings align with our hypothesis: ETL exhibit a stronger deterrent effect on GW among high-tech enterprises at the 1% significance level, whereas they do not significantly affect heavily polluting non-high-tech enterprises. This outcome can be explained by several factors. Firstly, high-tech industries typically possess higher production efficiency and technological capabilities, which enable them to adopt pollution-reducing measures more effectively. This technological advantage often translates to lower marginal abatement costs compared to their low-tech counterparts. Consequently, with the implementation of ETL, high-tech industries may feel less compelled to resort to GW, as they are already better positioned to manage and reduce pollution (Xu and Lin 2018). Secondly, high-tech industries are generally newer and have access to more market opportunities than their traditional, low-tech counterparts. This relative market advantage allows them to focus on innovation and long-term sustainability, whereas older, more established industries often face intense market competition and may prioritize short-term gains over sustainable practices.

Conclusion

This paper employs the implementation of China’s 2018 Environmental Tax Law as a quasi-natural experiment, constructing a greenwashing score by examining the gap between disclosed ESG scores and actual ESG performance. We primarily investigate the impact of the environmental tax on greenwashing among pollution-intensive companies, while, for the first time, incorporating the moderating role of multi-dimensional digitalization (company, social, and government) into the analysis of the impact mechanism.

Our findings are as follows: Firstly, the Environmental Tax Law demonstrated a significant inhibitory effect on the greenwashing behavior of pollution-intensive companies. Secondly, the introduction of government digitalization as a moderating factor was particularly impactful in enhancing the inhibitory effect of the tax on greenwashing. While company and society digitalization also played notable roles in increasing transparency and public accountability, government digitalization emerged as the dominant factor, due to its capacity to enforce stringent, real-time monitoring and compliance measures. Thirdly, heavily polluting companies in regions with higher tax rates, those required to disclose ESG information, and high-tech heavily polluting companies significantly reduced their greenwashing practices when subject to environmental taxes, underscoring the importance of policy interventions for firms in specific regions and with specific attributes.

By introducing the multidimensional digitalization moderating effect, this study further enriches the theoretical framework on the impact of Environmental Tax Law on corporate green behavior. First, this study reaffirms the Pigou nature of environmental taxes, demonstrating their effectiveness in curbing corporate greenwashing and encouraging companies to improve their environmental performance. Second, by deconstructing different levels of digitalization, we identified the dominant role of government digitalization in promoting the implementation of Environmental Tax Law. Compared to company and society digitalization, government digitalization, through comprehensive data monitoring and information tracking, effectively enhances policy enforcement, minimizing corporate greenwashing to the greatest extent. Finally, we further explored the impact of corporate heterogeneity. The results indicate that the effectiveness of the policy varies significantly depending on firm characteristics. Notably, high-tech firms, due to their stronger innovation capabilities, are better able to respond to environmental requirements, while companies that voluntarily disclose information are more reliant on environmental policies due to increased pressure from disclosure. This finding further expands our understanding of the differential effects of environmental tax policies in different corporate contexts, providing a new theoretical perspective for future research.

This study offers important practical implications for policymakers, corporate managers, and the public. For policymakers, priority should be given to strengthening government digitalization to enhance the enforcement of environmental tax policies through big data regulation, real-time monitoring, and automated enforcement, thereby further reducing corporate greenwashing. For corporate managers, especially in high-tech firms, digital transformation and green innovation will become key pathways for reducing carbon emissions and improving environmental performance. Companies should actively invest in digital tools and innovative technologies to gain a competitive edge in future markets. Finally, for the public, the advancement of social digitalization enables more active participation in environmental oversight, increasing the transparency of corporate environmental disclosures. Encouraging the public to monitor corporate environmental behavior through digital platforms will help build a more transparent and accountable corporate ecosystem.

However, this study has certain limitations. Firstly, due to data availability constraints, we only analyze A-share listed companies in China, even though the environmental tax applies nationwide. Future research could incorporate data from a broader range of companies. Secondly, we focus on digitization at the company, society, and government levels, but digitization may encompass more diverse dimensions. Future research could explore additional definitions and roles of digitization. Finally, due to the lack of effective measurement methods, we selected the digitalization level from the Inclusive Finance Index and the government information integration index to represent society and government digitalization. This choice may introduce bias in the results, and future research should consider using more comprehensive measurement approaches.

Data availability

Data can be obtained from the following website: https://github.com/Vicky-ding1218/greenwashing.

Notes

To promote sustainable development, the China Securities Regulatory Commission, Shanghai Stock Exchange, and Shenzhen Stock Exchange introduced a new regulation in December 2008. This regulation mandates that sample companies, companies listed both domestically and abroad, and financial firms must disclose corporate social responsibility (CSR) reports, including information on Environmental (E), Social (S), and Governance (G) factors. Other eligible listed companies are encouraged to do the same. The number of A-share listed companies in China disclosing ESG information increased from 589 in 2011 to 1738 in 2023.

For air pollutants, the tax ranges from 1.2 to 12 yuan per pollution equivalent; for water pollutants, it ranges from 1.4 to 14 yuan per pollution equivalent. For solid waste, the tax varies by type, ranging from 5 to 1000 yuan per ton. For noise pollution, the tax is based on decibel levels exceeding standards, ranging from 350 to 11,200 yuan per month (55 decibels during the day, 45 decibels at night).

Bloomberg’s ESG disclosure score covers more than 900 key disclosure indicators (e.g., direct CO2 emissions, total energy consumption, total water use, hazardous waste, minority percentage in the workforce, labor accidents, board meeting attendance, and political donations), whether favorable or unfavorable. ESG disclosure scores range from 0.1 to 100. Huazheng ESG performance scores are based on an ESG rating system using integrated semantic analysis and natural language processing algorithms. This system includes 3 primary indicators, 14 secondary indicators, 26 tertiary indicators, and over 130 lower-level data indicators, comprehensively evaluating a company’s actual performance across multiple dimensions, such as carbon footprint, green products, social contribution, governance structure, and operational risk. Listed companies’ ESG performance scores are calculated quarterly, with nine rating levels ranging from AAA to C (with AAA defined as 9 and C as 1), and the average of the four quarters is used as the annual ESG score.

Considering that the main business activities of financial companies do not directly impact the environment, their ESG scores may focus more on investment decisions and risk management for clients, so companies in the financial sector are excluded. We also excluded are companies under Special Treatment (ST), which have had losses for two consecutive years and face delisting risk warnings, *ST companies, which have had losses for three consecutive years, and Particular Transfer (PT) companies, whose stocks are under special transfer due to suspension. These labels usually indicate financial difficulties or significant violations, complicating their ESG assessments.

The enterprises in heavily-polluting industries before 2018 are still in the treatment group but have not yet received the treatment before 2018.

The 2008 Listed Company Industry Classification Standards identified the category and sub-category codes for industries, while the 2012 Listed Company Environmental Inspection Industry Classification Management Catalog defined which industries are considered heavily polluting. Based on these two documents, heavily polluting industry and their corresponding codes can be identified (the list of industries for heavily polluting enterprises can be found in Supplementary Appendix Table 1). Although the classification is based on industry-level definitions, but GW strategies can vary significantly even within the same industry. Focusing on company-level allows for a better understanding of how ETL impact GW within firms.

Following Yuan et al. (2021), 197 digitalization-related terms were selected from 30 national policy documents on the digital economy, constructing a comprehensive digitalization dictionary. Using machine learning techniques within the Python “jieba” text analysis package, we then incorporated this dictionary to analyze the MD&A sections of corporate reports to gauge digitalization levels accurately.

The extent to which residents engage in digital financial services is closely linked to their overall digital literacy and the broader digital landscape in which they operate. By utilizing this indicator, we aim to capture not only the financial dimension but also the general society context of digitalization.

Through this multi-dimensional assessment, the index effectively captures the service and regulatory capabilities of digital government. For example, Jiangsu Province’s integrated construction market supervision and integrity platform includes functions such as company information inquiries, incident reports, and records of company misconduct. These integrated services and transparency features reflect both system integration and enhanced regulatory effectiveness of digital governance. Real-time information updates also have a supervisory effect on companies.

In China, municipalities directly under the central government and provinces belong to the same administrative unit, such as Beijing and Hubei being at the same level.

References

Aguilera RV, Rupp DE, Williams CA, Ganapathi J (2007) Putting the S back in corporate social responsibility: A multilevel theory of social change in organizations. Acad Manag Rev 32:836–863. https://doi.org/10.5465/amr.2007.25275678

Anthony Jnr B (2020) Examining the role of green IT/IS innovation in collaborative enterprise-implications in an emerging economy. Technol Soc 62:101301. https://doi.org/10.1016/j.techsoc.2020.101301

Arouri M, El Ghoul S, Gomes M (2021) Greenwashing and product market competition. Financ Res Lett 42:101927. https://doi.org/10.1016/j.frl.2021.101927

Bai C, Sarkis J (2017) Improving green flexibility through advanced manufacturing technology investment: Modeling the decision process. Int J Prod Econ 188:86–104. https://doi.org/10.1016/j.ijpe.2017.03.013

Bai H, Huang L, Wang Z (2024) Supply chain financing, digital financial inclusion and enterprise innovation: Evidence from China. Int Rev Financ Anal 91:103044. https://doi.org/10.1016/j.irfa.2023.103044

Bassey E, Mulligan E, Ojo A (2022) A conceptual framework for digital tax administration - A systematic review. Gov Inf Q 39:101754. https://doi.org/10.1016/j.giq.2022.101754

Belloni A, Chernozhukov V, Hansen C (2014) High-Dimensional Methods and Inference on Structural and Treatment Effects. J Econ Perspect 28:29–50. https://doi.org/10.1257/jep.28.2.29

Bendig D, Schulz C, Theis L, Raff S (2023) Digital orientation and environmental performance in times of technological change. Technol Forecast Soc Change 188:122272. https://doi.org/10.1016/j.techfore.2022.122272

Bentley D (2018) Timeless Principles of Taxpayer Protection: How They Adapt to Digital Disruption. EJournal Tax Res 16:679

Birchall A (1991) 14 - Marginal cost approach to pricing. Butterworth-Heinemann, London. pp 150–161. https://doi.org/10.1016/B978-0-7506-0133-7.50018-8

Breiman L (2001) Random Forests. Mach Learn 45:5–32. https://doi.org/10.1023/A:1010933404324

Cao S, Nie L, Sun H et al. (2021) Digital finance, green technological innovation and energy-environmental performance: Evidence from China’s regional economies. J Clean Prod 327:129458. https://doi.org/10.1016/j.jclepro.2021.129458

Chang X, Huang Y, Li M et al. (2021) Efficient Detection of Environmental Violators: A Big Data Approach. Prod Oper Manag 30:1246–1270. https://doi.org/10.1111/poms.13272

Chen L (2024) Unraveling the drivers of greenwashing in China’s new energy sector: A PLS-SEM and fsQCA analysis. Manag Decis Econ 45:1528–1546. https://doi.org/10.1002/mde.4089

Chen X, Wan P, Ma Z, Yang Y (2024) Does corporate digital transformation restrain ESG decoupling? Evidence from China. Humanit Soc Sci Commun 11:1–15. https://doi.org/10.1057/s41599-024-02921-w

Chen Z, Xiao Y, Jiang K (2023) The impact of tax reform on firms’ digitalization in China. Technol Forecast Soc Change 187:122196. https://doi.org/10.1016/j.techfore.2022.122196

Cheng Z, Gao H, Liu ZF (2024) Treepongkaruna S Strategic choices in going public: ESG performance implications in China. Bus Strategy Environ, https://doi.org/10.1002/bse.3887

Chernozhukov V, Chetverikov D, Demirer M, et al. (2018) Double/debiased machine learning for treatment and structural parameters. ECONOMET J 21:1–68. https://doi.org/10.1111/ectj.12097

Clarkson PM, Li Y, Richardson GD, Vasvari FP (2008) Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Acc Organ Soc 33:303–327. https://doi.org/10.1016/j.aos.2007.05.003

Clarkson PM, Li Y, Pinnuck M, Richardson GD (2015) The Valuation Relevance of Greenhouse Gas Emissions under the European Union Carbon Emissions Trading Scheme. Eur Acc Rev 24:551–580. https://doi.org/10.1080/09638180.2014.927782

Deputy Minister of the Ministry of Environmental Protection: Pollution charges are far lower than the cost of environmental governance investment - China News, 2024. https://www.chinanews.com/gn/2014/04-06/6034730.shtml. Accessed 23 Sep

Estevez E, Janowski T (2013) Electronic Governance for Sustainable Development — Conceptual framework and state of research. Gov Inf Q 30:S94–S109. https://doi.org/10.1016/j.giq.2012.11.001

Firmansyah D, Susetyo DP (2022) Financial Behavior in the Digital Economy Era: Financial Literacy and Digital Literacy. J Ekon Dan Bisnis Digit 1:367–390. https://doi.org/10.55927/ministal.v1i4.2368

García-Amate A, Ramírez-Orellana A, Rojo-Ramírez AA, Casado-Belmonte MP (2023) Do ESG controversies moderate the relationship between CSR and corporate financial performance in oil and gas firms? Humanit Soc Sci Commun 10:1–14. https://doi.org/10.1057/s41599-023-02256-y

Grassi L, Lanfranchi D (2022) RegTech in public and private sectors: the nexus between data, technology and regulation. J Ind Bus Econ 49:441–479. https://doi.org/10.1007/s40812-022-00226-0

Guo F, Wang J, Wang F et al. (2020) Measuring China’s digital financial inclusion: Index compilation and spatial characteristics. China Econ Q 19:1401–1418

Hao X, Miao E, Sun Q et al. (2024) The impact of digital government on corporate green innovation: Evidence from China. Technol Forecast Soc Change 206:123570. https://doi.org/10.1016/j.techfore.2024.123570

He X, Jing Q (2023) The influence of environmental tax reform on corporate profit margins—based on the empirical research of the enterprises in the heavy pollution industries. Environ Sci Pollut Res 30:36337–36349. https://doi.org/10.1007/s11356-022-24893-7

Herbohn K, Walker J, Loo HYM (2014) Corporate Social Responsibility: The Link Between Sustainability Disclosure and Sustainability Performance. Abacus 50:422–459. https://doi.org/10.1111/abac.12036

Hering L, Poncet S (2014) Environmental policy and exports: Evidence from Chinese cities. J Environ Econ Manag 68:296–318. https://doi.org/10.1016/j.jeem.2014.06.005

Hu S, Wang A, Du K (2023a) Environmental tax reform and greenwashing: Evidence from Chinese listed companies. Energy Econ 124:106873. https://doi.org/10.1016/j.eneco.2023.106873

Hu S, Wang M, Wu M, Wang A (2023b) Voluntary environmental regulations, greenwashing and green innovation: Empirical study of China’s ISO14001 certification. Environ Impact Assess Rev 102:107224. https://doi.org/10.1016/j.eiar.2023.107224

Hu Y, Sun S, Dai Y (2021) Environmental regulation, green innovation, and international competitiveness of manufacturing enterprises in China: From the perspective of heterogeneous regulatory tools. PLOS ONE 16:e0249169. https://doi.org/10.1371/journal.pone.0249169

Huang J, Xu X, Zhao T (2023) The moderating effect of clean technology innovation in the process of environmental regulation affecting employment: Panel data analysis based on 22 industrial sectors in China. J Clean Prod 414:137672. https://doi.org/10.1016/j.jclepro.2023.137672

Jacobson LS, LaLonde RJ, Sullivan DG (1993) Earnings losses of displaced workers. Am Econ Rev 83:685–709

Jin Y, Wang S, Cheng X, Zeng H (2024) Can environmental tax reform curb corporate environmental violations? A quasi-natural experiment based on China’s “environmental fees to taxes. J Bus Res 171:114388. https://doi.org/10.1016/j.jbusres.2023.114388

Kalymbek B, Yerkinbayeva L, Bekisheva S, Saipinov D (2021) The Effect of Digitalization on Environmental Safety. J Environ Manag Tour 12:1299–1306

Khan HZ, Bose S, Johns R (2020) Regulatory influences on CSR practices within banks in an emerging economy: Do banks merely comply? Crit Perspect Acc 71:102096. https://doi.org/10.1016/j.cpa.2019.102096