Abstract

Digital technologies such as artificial intelligence and industrial robots have diminished employment opportunities in manufacturing trade, prompting stakeholders to explore alternative tradable sectors that capitalize on low-cost labor advantages. This paper analyzes the impact of digital technology innovations and spillovers on the tradability of services by matching input-output data and patent data from 76 economies spanning from 1995 to 2020. The empirical results indicate that patent innovations in the information industry itself will inhibit the tradability of domestic services, whereas domestic and international digital technology utilizations facilitate it. Given that the positive effects of domestic digital technology spillover outweigh the negative ones, digital technology is poised to comprehensively empower the tradability of services. The impact of different digital technology patents on service tradability exhibits heterogeneity. Information industry patents with low relevance to digital technologies struggle to improve services tradability, while among those with high relevance, data and algorithm patents are more effective than computing power patents in enhancing service tradability. Labor reallocation between the secondary and tertiary industries and the increasing returns to scale in the service sector, are potent mechanisms through which digital technology can empower service tradability. This study provides researchers, policymakers, and entrepreneurs in major manufacturing exporting countries with actionable pathways and knowledge to transition to service trade, navigate merchandise trade tariffs, and sustain labor’s continued access to trade benefits.

Similar content being viewed by others

Introduction

Since the 1980s, technological innovation and technological spillovers have been regarded as critical factors driving globalization and vertical specialization in world trade (Hummels et al. 2001; Shahzad et al. 2022). However, the utilization of cutting-edge digital technology such as industrial robots and artificial intelligence (AI) has brought challenges to the export orders and jobs of the manufacturing sectors in developing countries. On one hand, the utilization of these digital technologies in developing countries has a substitution effect on manufacturing workers (Acemoglu and Restrepo 2019). On the other hand, the utilization of industrial robots in developed countries has led the “re-shore production” of outsourced manufacturing orders (Faber 2020). Mexico, Vietnam and other countries rely on their labor cost advantages to participate in manufacturing Global Value Chains (GVCs) and share the gains from value-added trade. The decline in the tradability of manufacturing has a negative impact on the economic growth and employment stability of these countries (Krenz et al. 2021). Policymakers, entrepreneurs and scholars have begun to explore other tradable sectors that take advantage of low labor costs.

According to the WTO, the proportion of services trade in global trade is projected to increase from 18% in 1995 to 30% by 2040 (World Trade Organization 2019). Moreover, the value-added share of services in global exports has now surpassed that of manufacturing (OECD 2023). Some scholars believe that the manufacturing industry will be replaced by the service sector for labor factors in developing countries to participate in GVCs (Das and Hilgenstock 2022), and digital technology has been pinpointed as pivotal factors influencing service tradability. In this paper, service tradability refers to a process empowered by technology innovation and technology spillovers that allow traditionally ___location-bound services to overcome geographical constraints and trade costs, achieving cross-border transactions, remote delivery, and global specialization, transforming localized services into globally tradable economic activities (Baldwin and Forslid 2023). First, digital technologies, including telecommuting and generative AI, have facilitated the “online transition” of cross-border labor mobility, overcoming barriers in traditionally non-tradable sectors like healthcare, education, and design, and enabling efficient collaboration among diverse linguistic and cultural workforces (Goos and Savona 2024). Moreover, although the utilization of industrial robots and AI technology in manufacturing industries in developed economies has led to the “substitution of humans by machines” and the “reshoring of production” effects (Krenz et al. 2021; Hang et al. 2024), the overall job substitution effect in the service industry is not significant (McLeay et al. 2021). Therefore, the shift of labor from manufacturing to services has led to deeper specialization and outsourcing in the service sector. However, whether the promotion of digital technology to the tradability of the service industry is universally applicable in economies with different stages of development and industrial bases should be further studied. (1) Paradoxically, while China ranks high in digital technology, it concurrently holds the position of the world’s largest service trade deficit economy (IMD 2024). Investigating the causal relationship between digital technology and the tradability of services can shed light on why some countries experience rapid digital technology development while their services sectors lag behind in tradability. It requires further optimization of measurement methodology for digital technology and service tradability. (2) Against the backdrop of deepening global trade servitization, service trade progression remains disproportionately slow in leading manufacturing-exporting nations (Huang et al. 2024). In 2021, the service trade of South Korea and Vietnam accounted for only 12% of their total foreign trade, which is below the global average of 20.4% (World Bank 2024). It is not yet clear how major manufacturing exporting countries can improve the tradability of their services through digital technologies. This shift has become particularly urgent and necessary for manufacturing surplus countries, as many now face the U.S. tariffs on goods.

In this paper, we take first steps towards documenting how economies service tradability evolves with digital technology innovations and spillovers spanning from 1995 to 2020. (1) This study employs the OECD-TiVA database to measure the tradability of total services across 76 economies. Given that most service subsectors have traditionally been classified as non-tradable, we assess the tradability of the entire service industry as an integrated whole (Borchert et al. 2014). Digital technology innovation is quantified by the ratio of patent grantsFootnote 1 to employment in information industriesFootnote 2, which illustrates the production of digital technology. By using matched World Intellectual Property Organization (WIPO) patent data and OECD’s Inter-Country Input-Output (ICIO) tables, we evaluate digital technology spillover, such as cross-border and cross-industry technology spillover, from information industries to services. (2) To investigate the causal relationship between digital technology and services tradability, this study incorporates data from the OECD-Employment database, including labor compensation gap between the secondary and tertiary industries and service consumption. The analysis demonstrates how labor reallocation toward services and scale economies in the service sectors shape digital technology’s impact on tradability enhancement. (3) In further analysis, digital technology spillovers are split into four categories based on the classification standards of the upstream, downstream, domestic and foreign countries of the value chains and OECD’s Inter-Country Input-Output (ICIO) tables. This paper reveals the feasible modes and time persistent paths for promoting service tradability with digital technology, which would improve the efficiency and possibility of the transformation from manufacturing exporters to service traders. Our results indicate that when digital technology remains concentrated within the information industry or when its spillover effects are primarily directed toward foreign markets, domestic service industries face significant challenges in developing international tradability.

The marginal contribution of this paper to existing research is reflected in three aspects: research methods, indicator design and mechanism analysis.

1) Improved measurement methodology of digital technology with patent database. Current digital technology quantification hinges critically on the Technological Sophistication Index (TSI), a composite measure integrating Revealed Comparative Advantage (RCA) with sectoral GDP per capita (Wang and Ramsey 2024). However, this method embeds systematic measurement distortions and conceptual oversimplifications. For instance, the per capita GDP exceeding USD 50,000 in select advanced economies in fact masks underperformance in digital innovation capabilities (IMD 2024). The TSI relies on national income information, which exaggerates the digital technology capabilities of some developed economies. Additionally, existing studies employing the TSI to assess technology spillovers cover the entire downstream or upstream value chain, yet fail to capture sector-specific digital technology diffusion patterns. In contrast, this study matches input-output data with the patent database of the WIPO to overcome the limitations of TSI in evaluating digital technology using indirect information, such as national income and international competitiveness. We further construct a pioneering dataset quantifying actively deployed digital technology patents across service sectors in 76 economies. This high-resolution evidence provides the necessary empirical foundation to test digital technologies’ role in activating service tradability.

2) Multidimensional impact of different digital technologies on the tradability of services. While existing literature analyzes the impact of digital technologies on GVCs participation and GVCs position, it primarily focuses on single aspect of openness. There is a lack of systematic service tradability analysis. To address this, our study constructs indicators of tradability contribution and openness return rate. We comprehensively analyze how digital technology empower the service sector, from GVCs participation to value-added enhancement, and from marginal engagement toward core competitive centrality. Furthermore, existing literature assumes that digital technology within the same industry is homogeneous, ignoring the heterogeneous effects of technology types (Cao et al. 2022). By categorizing patents based on sub-sectors and product relevance, we examine the robustness of the causal relationship between digital technology and tradability of services.

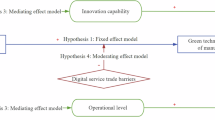

3) Labor market transition mechanism. In line with the trend of widening labor compensation share gap between manufacturing and service industries under the digital economy era (Baldwin and Forslid 2023), this paper studies how digital technology affects the tradability of services through two mechanisms: labor reallocation between the secondary and tertiary industries and the increasing returns to scale in the service sector.

The remainder of this paper is organized as follows: The second section consists of literature review and hypothesis formulation; the third section covers model design, variable selection, and data sources; the fourth section presents stylized fact; the fifth section analyzes empirical results; the sixth section further discusses the comprehensive effects of digital technology empowering tradability of services; the seventh section contains conclusion and discussion.

Literature review and hypothetical formation

The direct effects of digital technology innovation on the tradability of services

The interplay between digital technologies and tradable services has garnered attention since the internet’s ascent in the 1990s. Scholars identified service sector opportunities available for vertical specialization, particularly those heavily reliant on information technology (Apte and Mason 1995). Presently, digital technology, a hallmark of the latest industrial revolution, not only signifies the future trajectory of technological and industrial development but also the reshaping of the global industrial framework and GVCs participation (Nyagadza et al. 2022). The service trade that was originally difficult to separate vertically is now expected to be affected by digital technology (Nath and Liu 2017; Gnangnon 2020; Li et al. 2023). Nonetheless, the advent of new statistical indicators and quantitative methods has cast doubt on the contribution of digital technology innovations to the tradability of services. Digital technology differentially mediates service tradability through knowledge intensity, including offshore and dispersion of high-knowledge activities while driving onshore and concentration of low-knowledge counterparts (Autio et al. 2021). Hence, it is posited that greater sophistication in digital technology may correlate with reduced tradability of services (Meltzer 2024). Studies underscore that digital technologies paradoxically reshape service tradability across geospatial boundaries, with digital technologies enhancing the intra-EU flows more than the extra-EU ones (Giunta et al. 2025). Scholars also introduced the concept of “proximity” between digital enterprises and traditional enterprises (Song et al. 2022). Some service industry businesses have poor compatibility with digital enterprises, making it challenging to directly utilize digital technology to optimize export service strategies.

First, the extensive substitution of pre-existing jobs, such as communication services, in information industry by digital technologies has diminished the impetus for offshoring and vertical specialization within certain service sectors (Antràs 2020). Roles such as customer service and operator positions, previously outsourced by developed economies to emerging ones like India and the Philippines, are now increasingly supplanted by language models and chatbots. Consequently, the tradability of communication services is curtailed, and GVCs participation is reduced (Kshetri 2021). Robotic Process Automation (RPA) is being implemented in routine text and image editing services within publishing, audio-visual, and broadcasting activities (Baldwin and Okubo 2024). The rise of generative AI has not only supplanted numerous low-skilled, routine service jobs but also hastened the automation of many skilled, white-collar roles (Eloundou et al. 2023). In fields such as computer programming, consulting, and information services, positions like testers, account administrators, and data analysts are at risk of AI replacement (Webb 2019).

Furthermore, the “winner-take-all” pattern of trade gains distribution in information industry under the digital divide has obstructed the tradability of services (Wolk and Landry 2022). Studies analyzed the bilateral trade of 140 countries using PPML and OLS methods, finding that a pronounced digital divide impedes the service sectors of developing nations from engaging in exports (Myovella et al. 2021; Chai and Wang 2023). Europe and the United States, leading in digital technology, have maintained a long-standing surplus in service trade, considered a result of their technological edge. Developing countries resist when these leaders advocate for digital trade rules focused on service liberalization (Foster and Azmeh 2020). The proliferation of the internet has only augmented the export value in the U.K. service sector, without definitive evidence of a positive import impact (Kneller and Timms 2016). Under the definition of GVCs activities as transactions involving intermediate goods or services crossing national borders at least once (Wang et al. 2017), the internet has failed to enhance backward participation in GVCs for the UK service sector. Collectively, omitting the cross-industry and cross-border spillovers of digital technologies triggers a paradoxical outcome: digital technology innovation suppresses the tradability of domestic services. The following hypothesis is posited:

H1: The tradability of domestic service sectors is adversely affected by the technological innovation within the information industry itself.

The indirect effects of digital technology innovation on the tradability of services

The existing literature extends the impact of information industry innovation on service tradability to the role of knowledge exchange and technology spillover between the information industry and other sectors (Lin et al. 2019). Digital technology spillovers exert a compounding effect on industrial development, enhancing domestic service trades such as telemedicine, online education, and digital finance (Cao et al. 2022). The literature on indirect effects can be bifurcated into the following categories based on the origin and destination of digital technologies: domestic cross-industry spillovers and international cross-border spillovers.

Regarding domestic cross-industry spillovers, Small and Medium-sized Enterprises (SMEs) in both developed economies like Australia and New Zealand, and developing countries such as Malaysia and Vietnam, have gained access to international markets through the empowerment of their domestic wholesale and retail services by digital platforms and E-commerce (Ipsmiller et al. 2022; Mohamad et al. 2022). China has leveraged cross-border E-commerce and industrial digitization not only to internationalize its wholesale and retail services but also to enhance its trade in logistics, finance and payment, and research and design (R&D) (Li et al. 2019). The digital technology spillover has significantly increased the digital delivery capacity of China’s service trade, contributing to the tradability of its service sectors and narrowing the competitiveness gap with service trade leaders like the U.S. The U.S. has responded by shifting its service trade mode from commercial presence to cross-border services, utilizing digital finance and high-standard RTA rules (Mattoo and Meltzer 2018). The U.K. focuses on people-oriented digital applications, promoting technology-assisted human services, and transitioning from product-centric to people-centric approaches, thereby achieving a breakthrough in cultural and creative trade (Bauer et al. 2023).

In terms of international cross-border spillovers, the enhanced absorption of foreign digital technologies by emerging economies empowers their service trade to develop from a more advanced starting point (Liang and Tan 2024). China and South Korea import digital intermediate services from developed economies and export digital services to many developing economies, utilizing digital intermediate imports for cross-border technology spillover (Sturgeon 2021). China has surpassed most Northern countries to become the primary source of digital technology for Sub-Saharan African countries (Botchie et al. 2022). The technological spillover from foreign information industries has progressively improved the tradability of local cross-border E-commerce and mobile payment services (Naradda Gamage et al. 2020). However, scholars caution emerging economies against becoming overly dependent on foreign digital technologies, which could lead their service sectors into a “Trap of Functional Specialization” (Akbari and Hopkins 2022). Specifically, the backward participation of domestic services in GVCs makes them susceptible to “capture and lock” by the chain master (Wang et al. 2020). The critical threshold of the “Trap of Functional Specialization” at per GDP of $14,800, revealing that economies surpassing this benchmark exhibit heightened susceptibility to technological stagnation (Stöllinger 2019). The U.S. institutionalization of techno-decoupling—specifically targeting advanced digital technology transfer to China—has generated measurable disruptions in China’s service sectors. Considering the performance of cross-industry and cross-border digital technology spillover in enhancing service tradability, this paper proposes the following hypothesis:

H2: Cross-industry and cross-border digital technology spillovers have a positive effect on the tradability of domestic services.

The comprehensive impact of digital technology on the tradability of services

Given that the direct and indirect effects of digital technologies differ, studies have investigated their cumulative effects on the tradability of services (Pergelova et al. 2019). One line of studies evaluates the substitutability and complementarity of digital technologies and service trade jobs, particularly in terms of job quantity changes (Mondolo 2022). Digital technologies have been found to increase trade in intermediate services while simultaneously automating and replacing numerous service trade jobs (Tschang and Almirall 2021). According to the Boston Consulting Center, the U.S. is projected to face a shortfall of 6 million math and computer science majors by 2030, with over 3 million office and administrative positions expected to be supplanted by AI (Strack et al. 2021). Digital technology acts more as a complement to tradable services than as a substitute. By 2025, it is anticipated that 97 million new jobs, better suited to AI, algorithms, and GVCs, will be created across 26 major economies, while 85 million jobs may be displaced by digital technologies (The World Economic Forum 2020). This trend of complementarity over substitution is not exclusive to large nations but is even more pronounced in smaller economies. For instance, Estonia has leveraged digital technology to generate more service trade jobs and deepen its participation in service GVCs compared to other former Soviet states (Kerner and Kitsing 2023).

Another line of research concentrates on data flow constraints and the potential of digital technology spillovers to bridge the digital divide and enhance tradable services (Kaplinsky and Kraemer-Mbula, 2022). Restrictive regulations on data flows and digital spillovers can limit the accessibility of digital technologies and impede service tradability (OECD 2023). A unified domestic market and high-standard RTAs are instrumental in overcoming the digital divide and fostering service trade (Makhdoom et al. 2022). Despite having the highest service trade restriction index, particularly in data transmission and communications, China has made strides in liberalizing its services and closing the digital delivery capacity gap with the U.S. through initiatives such as bolstering independent innovation, aligning with high-standard RTAs, and expanding international cooperation (Zhang 2024).

Considering the significant disparity between the positive and negative impacts of direct and indirect effects, it presents a considerable challenge to accurately gauge the overall influence of digital technology innovation and spillovers on service tradability. The implications of this research are profound for the direction of service trade development and the advancement of digital technologies. Based on the aforementioned data and perspectives, this paper proposes the following hypothesis:

H3: The aggregate impact of digital technology innovation exerts a positive influence on the tradability of domestic services.

Analyzing the mechanism of digital technology innovation affecting the tradability of services

Current literature not only focuses on the impact of digital technology concerning the tradability of services, but also examines the mechanisms through which digital technologies empower the tradability of services. The analysis of the mechanisms revolves around two aspects: labor reallocation between the secondary and tertiary industries and the increasing returns to scale in the service sector.

In terms of labor reallocation between the service industry and manufacturing, the utilization of digital technologies has replaced millions of manufacturing jobs, but the substitution effect on service sector jobs has not been significant (Baldwin and Forslid 2023). New technology like robotics enable other production factors substitute labor in manufacturing, while unskilled labors lack reciprocal substitution capacity (Rodrik 2018). This asymmetric substitutability thereby restricts unskilled labors’ ability to persistently access trade gains through manufacturing. Notably, robot taxation has emerged as a proposed policy response to mitigate workforce displacement in manufacturing (Carbonara et al. 2024). Since April, 2022, the employment index of China’s manufacturing industry published by the National Bureau of Statistics has only been in the expansion range for two months, and the other of months have been below the boom-bust line. Given agriculture’s constrained labor absorption capacity, the service sector emerges as the critical transitional ___domain for manufacturing workers (Rodrik 2018). Consumer-facing services directly absorb unskilled labor, while producer-oriented services achieve industrial symbiosis with manufacturing through data integration and platform ecosystems (Butollo and Schneidemesser 2022). As manufacturing jobs decrease, service industry jobs increase, which corresponds to a widening labor compensation share gap between services and manufacturing (Frank et al. 2019). Having lost the labor-factor rent value differential as a basis for North-South trade and a driving force for deepening the GVCs, the importance of manufacturing in the GVCs has continued to diminish (Kong et al. 2021). In contrast, the intensive use of labor factors has led to an increasing GVCs participation in services empowered by digital technologies. Labor rental value differentials in North and South countries continue to incentivize digital technologies to create conditions for outsourcing services (Cieślik 2022). Information from the OECD show that services have generated more than 50% export value-added and inflow of jobs in GVCs (OECD 2023).

In perspective from increasing returns to scale in the service sector, the Smith-Young Theorem, which describes the relationship between division of labor and market size, posits that “the division of labor depends on the extent of the market, while the extent of the market in turn depends on the division of labor.” This creates a dynamic cumulative feedback loop (Youno and Notes 1928, Sun et al. 2004). The market size is both the starting point and the end point of the tradability and specialization. First, economies of scale drive specialization in the service sector, spreading the costs of technology adoption (Buera and Kaboski 2012). For instance, the vast E-commerce markets in China and the U.S. have spurred professional divisions in logistics, payment systems, and cloud services, lowering digital spillover costs and boosting the export of these services to Southeast Asia (Kathuria et al. 2019). Then, large market scale fosters technological upgrading through capital and knowledge accumulation, driving advanced specialization and enhancing bargaining power in GVCs (Lee et al. 2018). India’s vast digital payment demand has formed specialized divisions in areas like fraud detection algorithms and cross-border settlement modules. Domestically validated services are modularized into exported solutions, enabling India to lead payment protocol design in markets like the Middle East and Southeast Asia (Nambisan and Luo 2022). Furthermore, increasing returns to scale and service clusters foster specialization networks that reduce transaction costs, attracting more participants (Akbar and Tracogna 2022). For example, Silicon Valley’s digital service clusters form technology ecosystems through collaborative specialization, drawing in global clients (Trincado-Munoz et al. 2024). Based on the above studies, the following research hypotheses are proposed in this paper.

H4a. The labor reallocation between the secondary and tertiary industries is one of the mechanisms for digital technology to promote the tradability of the domestic services.

H4b. The increasing returns to scale in the service sector is one of the mechanisms for digital technology to promote the tradability of the domestic services.

Methods

This paper attempts to analyze whether digital technologies would promote the tradability of services. The benchmark regression model shown in Eq. (1) not only considers the direct effect of digital technology advances shaped by innovations in the information industry on the tradability of the domestic services, but also discusses the indirect effect of the cross-industry and cross-border digital technology spillover on the tradable services. The model incorporates country and year fixed effects to control for unobserved heterogeneity across nations and time-specific shocks.

Explained variables

GVCs participation is a classic indicator to depict the fragmentation of value chains, the refinement of specialization, and the level of trade liberalization (Hummels et al. 2001;Koopman et al. 2014). However, some scholars believe that these indicators are not specifically designed for measuring tradability (Baldwin et al. 2023). The GVCs participation in the service industry fails to reflect the importance of the service industry in the domestic trade structure. In some countries, the main export sector is not service, but the GVCs participation in service is extremely high. For example, South Korea primarily exports manufacturing products, yet its service sector GVCs participation surpasses that of the U.S., with a GVCs participation rate of 20.80% versus 12.44% for the U.S. in 2020 (OECD-TiVA 2023). Therefore, it is necessary to comprehensively consider the specialization and contribution of service trade when designing the tradability index. In Eq. (1), the explained variable \(STrad{e}_{rt}\) represents the tradability of services in economy r in period t, which is expressed as the tradability contribution of the domestic service sectors (\(STradeCon\)) and the openness-up return rate of the service sectors (\(STradereturn\)).

Tradability contribution of service (\(STradeCon\)) measures whether a country’s service sector participation in GVCs is the primary mode of its international trade. For example, India’s integration into GVCs through software outsourcing-with its IT service exports constituting over 40% of national total exports. This demonstrates a shift from traditional goods trade to service-driven GVCs specialization. As shown in Eq. (2), this paper proposes replacing the service sector export value (\({E}_{rt}^{Service}\)) in service GVCs participation with gross export (\({E}_{rt}\)). \(I{V}_{rt}^{Service}\) means value-added absorbed by the domestic service industry’s exports. \(F{V}_{rt}^{Service}\) measures foreign value-added embedded in domestic service industry’s exports.

Openness return rate of service (\(STradereturn\)) measures the comprehensive economic contribution of a country’s service sector participation in GVCs. For instance, the Philippines’ engagement in global customer service outsourcing has created over 1.2 million jobs and contributes 8%-10% of its GDP, reflecting the domestic economic benefits of service-driven GVC specialization (OECD, 2023). As shown in Eq. (3), the denominator of this indicator represents the proportion of the length of the intermediate product value chain undertaken by overseas countries in the service industry of economy r to the total length of the intermediate product value chain in the domestic service industry. The numerator of the openness-up return rate is the contribution of service net exports to the total economic output of this country. This indicator evaluates the relative magnitude between the share of the service trade in the GDP and the exposure of the service sectors’ value chain to foreign risks. Specifically, for every 1% increase in a country’s service sector openness, the contribution of service trade to its GDP will change by a certain percentage.

Core explanatory variables

In Eq. (1), the core explanatory variable digital technology innovation (\(Dig{T}_{rt}^{i\text{'}}\)) stands for the technological level of the information industry i’ in economy r during period t, which is expressed by the patent density of the information industries. Since the information industry includes digital infrastructure and digital services that form the foundation for successful cross-industry and cross-border utilization of digital technologies, technological process in the information industry becomes a crucial indicator of digital innovation (Constantinides et al. 2018). Drawing on the method of construct industrial robot density, this paper takes the ratio of industry- patent type quantity to the employed labor force in the industry i’ as the industry-patent density index (Du and Lin 2022). As shown in Eq. (4), \(I{P}_{rt}^{i\text{'}k}\) represents the annual authorized quantity of \(k\) type patents in the information industry \(i\text{'}\) of the \(r\) economy during the \(t\) period. \(EM{P}_{rt}^{i\text{'}}\) reprensents the number of labor force employed in the information industry \(i\text{'}\) of \(r\) economy in the period \(t\). A higher per capita patent count within an industry signifies greater knowledge intensity and technological proficiency in that sector.

In Eq. (1), another core explanatory variable digital technology spillover (\(DigTempowe{r}_{r}^{i\text{'}j}\)) measures digital technology spillover between the information industry \(i\text{'}\) and service sector \(j\), calculated as the sum of digital patent density demanded by the domestic service sector and digital patent density supplied by the domestic service sector. To clarify the feasible modes for the utilization of digital technologies to promote the service tradability, we decompose the digital technology spillover into four categories according to upstream, downstream, domestic and foreign countries.

First, the geographic sources and destinations of digital technology spillovers (domestic vs. international), not only determine the domestic sector’s exposure to foreign technology restriction and functional specialization trap, but also impact whether the development of digital technology align with national industrial priorities (Stöllinger 2019). The U.S. for example, restricted exports of lithography machines and chips technology to China, severely disrupting revenue streams for Huawei and ZTE (Bown 2020). This illustrates that the difference in the spillover stability of digital technology at home and abroad is a factor that cannot be ignored.

Furthermore, the GVCs position of the service industry relative to the information industry shapes heterogeneity digital technology spillover effects. Downstream service sectors, such as logistics and retail absorb digital technologies through demand for intermediate products. Upstream service sectors, such as R&D and software design, supply foundational technologies to downstream information industries (e.g., semiconductor design tools), which then drive digitalization in further downstream industries. The complexity of spillover pathways (one-step absorption vs. multi-tiered diffusion) determines the assimilation efficiency of digital patents in service sectors.

Based on the above framework, this study defines four categories of digital technology spillover variables:

-

1.

Backward Domestic Technology Demand (\(DF{T}_{r}^{i\text{'}k}\)). Measures domestic information industry patents embedded in intermediate products demanded by downstream service sectors. For example, Japanese logistics firms adopting domestically developed AI-powered scheduling systems.

-

2.

Backward International Technology Demand (\(FF{T}_{r}^{i\text{'}k}\)). Captures foreign information industry patents embedded in intermediate products demanded by downstream service sectors, such as U.S.-designed CPUs in Chinese retail sector computers where China is the home country.

-

3.

Forward Domestic Technology Supply (\(DI{T}_{r}^{i\text{'}k}\)). Quantifies domestic information industry patents stimulated by services provided by upstream service sectors (e.g., The U.S. fintech firms developing block chain platforms that drive domestic cloud computing patents).

-

4.

Forward International Technology Supply (\(II{T}_{r}^{i\text{'}k}\)). Tracks foreign information industry patents stimulated by services provided by upstream service sectors. For instance, Swiss research institutes’ analytics services accelerating semiconductor patents in South Korea. Here Switzerland is the home country.

Equations (5)–(8) operationalized the four digital technology spillover variables, with full derivations detailed in Appendix 1. Equation (9) calculates the total spillover patents \(IPspil{l}_{r}^{i\text{'}j}\) by aggregating upstream service-supplied patents and downstream service-demanded. Then, we can infer the patent spillover density index \(DigTempowe{r}_{r}^{i\text{'}j}\) that quantifies the intensity of digital technology empowerment in the domestic service sectors, calculated as total spillover patents divided by service sector employment \(EM{P}_{j}\).

Control variables

\(\sum\,{\mathrm{ln}}\,Contro{l}_{rt}\) represents a set of control variables. (1) Services Trade Restrictiveness Index (STRI): Numerous studies have confirmed that domestic regulatory restrictions significantly impact the tradability of services (Nordås and Rouzet 2017). (2) Tariff: Tariff barriers are the most typical and prevalent border-regulation mechanisms that directly impede trade liberalization. This article represents it as the percentage of import taxes to total tax revenues. (3) Size of the Domestic Market: This is expressed as the Gross Domestic Product (GDP). (4) Exchange Rate: This is denoted as the rate of the U.S. dollar against the domestic currency. (5) Language: A value of 2 signifies that the official language of the economy is English, 1 denotes that the official language is Latin-based, and 0 indicates that the official language is neither English nor Latin-based. (6) Colonial Background: A value of 1 indicates that the economy has declared independence and liberated itself from colonial rule, while a value of 0 denotes other economies.

Data source

The OECD-TiVA (Trade in Value-added) database provides value-added, export value (in million US dollars), and employment for 45 industries and 76 economies during 1995–2020. Other economies are denoted by ROW (Rest of World). The WIPO database provides information on the quantity of 35 types of patents. Accordingly, this paper accounts for the tradability of service industry (\(STradable\)) and the patent density of the information industry (\(DigT\)). The data for calculating Leontief inverse matrix, Ghosh inverse matrix and employment involved in patent spillover density index (\(DigTempowe{r}_{r}^{i\text{'}j}\)) are derived from the OECD international input-output tables. The OECD-STRI database contains an index of regulatory restrictions on services trade for 50 economies for 2014–2022. The World Bank database provides information on the control variables tariff, size of the domestic market, exchange rate, official language, and colonial background. Descriptive statistics for each variable are shown in Table 1.

Stylized fact

Based on the previously constructed variable indicators of tradability contribution of service industry, openness return rate of service industry, digital technology innovation, and digital technology empowerment, this section reports the accounting results of these indicators for the top four countries in the world by GDP from 1995 to 2020. The temporal analysis reveals trends in the tradability of the service industry and digital technology in major economies, while a horizontal comparison highlights the differences in service tradability and digital technology between major manufacturing exporter, China, and other economies.

The trend chart of annual patent increments reveals rapid development in China’s digital technology innovation and digital technology spillover. As shown in Fig. 1, China’s annual increment of patents in the information industry lagged significantly behind that of developed countries on the eve of the 2008 financial crisis. However, in 2020, China led the world with 35,227 new patents in the information industry. As indicated by the secondary axis in Fig. 1, the annual number of newly spillover digital patents in China’s service industry also surpassed the U.S. in 2017, ranking first globally. Despite this progress, the rapid development of digital technology has not improved China’s performance in tradability of services. As depicted in Fig. 2, the service industry is not the major sector for China to participate in GVCs. From 1995 to 2020, the proportion of TiVA in the service industry to total exports continued to rise for the U.S., Japan, and Germany. These countries deepened their specialization in services, increasing their importance in domestic trade structures. In contrast, China’s TiVA in the service sectors accounted for less than 5% of its total exports, indicating low tradability in the service sectors. Some scholars attribute this to China’s focus on becoming a manufacturing powerhouse, while the other three countries rely on service-driven development and cultivate international competitive advantages (Baldwin and Forslid 2023).

As shown in Fig. 3, the opening-up of China’s service sectors has led to a “negative feedback effect.” During the sample period, the more open the service sectors of the U.S., Japan, and Germany, the higher the return rate from service trade. Their positive service trade balance incentivizes further service sector openness. However, China’s service sector has consistently experienced negative returns from openness. The trade deficit in services and the low-quality openness hinder China’s service tradability.

Addressing the paradox of China’s rapid digital technology development and the low tradability of its service sectors, this paper further measures the stock and density of digital technology patents. Technology patents exhibit a certain time lag from inception to commercial application. While annual new patents reflect the speed and cutting-edge nature of digital technology development, they fail to fully capture the quantity of utilized digital technology patents in the service sectors. As shown in Fig. 4 (Stock), by 2020, the cumulative number of spillover digital patents in China was roughly half of the U.S. and similar to Japan. This finding corroborates quantitative analysis of USPTO patent filings (2002–2019), revealing that despite Asia’s accelerated patent output growth, the U.S. retains structural dominance in critical technology domains, commanding 55% of robotics patents and 66% AI patents (Santarelli et al. 2023). Simultaneously, the allocation of labor and technological patents may contribute to the tradability paradox. Figure 4 (Density) illustrates that China’s digital patent spillover density lag behind those of developed countries like the U.S., Japan, and Germany. This implies that China’s service sector relies heavily on labor inputs, with relatively scarce utilizations of digital technologies. The low digital patent spillover density in China’s service sectors could be a reason for the limited service tradability. To verify the causal relationship between digital technology innovation, technology spillover, and the tradability of service sectors, a more rigorous empirical analysis will be conducted in the following sections.

Results

This section begins by analyzing the structural characteristics of digital technology on the tradability of the service industry. It estimates not only the direct effect of digital technology innovation but also evaluates the indirect effects of technology spillover on service tradability. Following this, the paper conducts a robustness analysis and an endogeneity test. Subsequently, it introduces the mechanisms through which digital technology empowers the tradability of the service industry. First, the digital technologies such as AI and industrial robots affect the tradability of services through labor reallocation between the secondary and tertiary industries. Second, there is an increasing return to scale mechanism that matches the expansion of employment in the service sectors.

Benchmark regression analysis

Table 2 presents the results of the benchmark regression concerning digital technology and service tradability. Column (1) of Table 2 does not take control variables into account. The empirical findings indicate that the regression coefficient of the direct effect is significantly negative, meaning that the technological advancement within the information industry itself inhibits the tradability of domestic services. The regression results in column (3) indicate that when the dependent variable is switched from the tradability contribution of the service sectors to capturing the profitability of domestic service trade, the coefficient for digital technology innovation remains statistically significant and negative. These empirical outcomes support research hypothesis H1 and aligns with the view of some scholars who suggest a substitution effect between digital technology innovation and tradable service (Hao 2020). This stems from technical barriers and the rapid obsolescence of knowledge, which impedes the service tradability (Weigelt et al. 2012). Excessive concentration of patents in the information industry can create a “patent thicket” effect, significantly raising licensing costs for service firms to access critical technologies (Yuan and Hou, 2024). For instance, patent barriers in cloud computing or data encryption may hinder small and medium-sized service enterprises from developing cross-border digital services (Butollo and Schneidemesser 2022). The current landscape of GVCs shows off-shored high-knowledge activities and on-shored low-knowledge activities (Autio et al. 2021). If digital technologies remain confined to the information industry without converging with service sectors, services such as healthcare, education, finance, and tourism will miss critical opportunities to transform into high-knowledge activities and tradable sectors (Trincado-Munoz et al. 2025).

Next, this paper analyzes the indirect effects of digital technology spillover on service tradability. The regression results in columns (1) and (3) of Table 2 indicate that spillovers of digital technology from the information industry to the service industry enhance tradability contribution and return rate of the services trade. Specifically, for every 1% increase in digital technology spillovers to the service industry, the tradability contribution and return rate of the domestic service sectors will significantly increase by 0.119% and 0.113%, respectively. Columns (2) to (4) affirm that digital technology spillovers continue to significantly boost domestic service tradability even after the inclusion of control variables. The hypothesis H2 of this paper was verified.

In one respect, these findings validate how digital technology spillovers empower the service sector to transcend spatial-temporal and physical constraints (Frandsen et al. 2022). Historically, workforce mobility and language barriers have been significant constraints to the outsourcing of services such as R&D and business. However, the widespread adoption and enhancement of remote office and translation technologies now enable low-cost technical talents from various countries to collaborate with labor in high-income countries, providing high value-added services like software programming (Baldwin and Okubo 2024). In another respect, some scholars attribute this phenomenon to digital technology spillovers transforming services from “experience goods” into “search goods” or even “standardized goods”, thereby overcoming the traditional “Proximity-Concentration Trade-off” in service trade (Nooteboom 2019). AI-driven automated services, such as ChatGPT-powered customer service and standardized financial software, reduce service heterogeneity and enhance tradability. Digital technologies decompose traditionally “inseparable” service processes into offshorable modules, like cloud-based collaborative design drafting (Moro-Visconti et al. 2023).

Robustness analysis

The robustness analysis in this paper is twofold: it involves replacing core variable indicators and altering the measurement method to verify the stability of the benchmark regression results.

-

(1)

Robustness test by replacing indicators: Eliminating the impact of specific indicator selection on causality would be achieved by replacing indicators. Initially, this section constructs an indicator of relative services tradability by calculating the ratio of the service industry’s participation in GVCs to the overall GVCs participation of the economy, substituting the service sectors’ tradability contribution. Furthermore, we replace the openness return rate with the value-added ratio of service sectors. The regression results are displayed in column (1) of Table 3. Moreover, columns (2) and (3) of Table 3 employ the one-period lagged and two-period lagged of explained variables, respectively, to test the robustness of the benchmark regression results. Finally, acknowledging the potential influence of the 2008 global financial crisis on the regressions, this paper omits the data from 2008 and 2009 for estimation purposes. As indicated by the regression coefficients in columns (1) to (4) of Table 3, the direct effect remains significantly negative. Furthermore, the indirect effect of digital technology continues to significantly improve service tradability. The consistency of the robustness test results with the benchmark regression confirms the reliability of this paper’s findings. Hypotheses H1 and H2 are reaffirmed.

Table 3 Robustness test results. -

(2)

Endogeneity test: The inherent connection between the technological revolution and industry tradability necessitates our attention to the issue of endogeneity in international economics. If the endogeneity problem exists, the regression results will be biased and inconsistent. A commonly used testing model is to find instrumental variables that are closely related to digital technological innovation (\(DigT\)) and digital technological spillovers (\(DigTempower\)), but independent of services tradability for two-stage least squares regression estimation. This paper utilizes the number of fixed-line telephone subscribers in 1986 (IV1) and digital technology research papers (IV2) as instrumental variables for digital technology patent density (Adams and Griliches 1996). Data on fixed-line telephone subscribers are sourced from the World Bank database, while research paper information is provided by Web of Science and Google Scholar database.

In terms of relevance, the fixed telephone (IV1), once a crucial medium for information transmission, has evolved into contemporary digital technologies such as mobile communications, the Internet, and AI. Historical usage patterns can influence the subsequent development of digital technologies. Thus, economies with extensive use of fixed-line telephones in the past are more likely to be current leaders in digital technology. For example, countries with high fixed-line telephone penetration rates in the 1980s often transitioned more smoothly to mobile and internet-based technologies, benefiting from existing technical expertise and regulatory frameworks (Omrane et al. 2023). Additionally, the sophistication of digital technology within an economy could result in a higher scientific research output in this field. Some studies utilize the count of scientific research papers (IV2) on digital technology to measure digital technology innovation and AI development (Mariani et al. 2023).

Regarding exogenous, the number of fixed-line telephone subscribers in 1986 is a historical variable that is plausibly exogenous to current economic outcomes. Fixed-line telephone adoption in the 1980s was primarily driven by factors such as early government policies, geographical constraints, and socioeconomic conditions of that era. The decline in fixed-line telephone prevalence over time has decoupled its direct influence on modern economic variables, making it less likely to correlate with unobserved determinants of service tradability. The number of research papers serves as a significant indicator of research output and academic achievements but does not directly correlate with the tradability of services.

The instrumental variables for digital technology spillovers include the Internet coverage (IV3) and proportion of plain area (IV4). Data for Internet coverage comes from the International Telecommunication Union (ITU). World Bank data provide information on the area of land below 5 meters above sea level. Internet Coverage (IV3) is critical indicator of digital infrastructure, which directly promotes the adoption and diffusion of digital technologies across economies. Additionally, internet coverage can enhance the capacity for knowledge sharing, boosting R&D output in digital technology fields. Regarding exogeneity, internet coverage is primarily determined by historical investments in infrastructure, which are relatively stable over time and less influenced by current service tradability.

For the proportion of plain area (IV4), relevance arises from the fact that flat terrain facilitates the deployment of digital infrastructure, such as fiber-optic networks and data centers. Moreover, plain areas often host concentrated economic activities and research institutions, which can further drive digital technology spillovers. In terms of exogeneity, the plain area is a natural geographical feature that is exogenous to economic policies and market dynamics. It does not directly influence service tradability but affects it indirectly through its role in shaping digital technology development.

Table 4 presents the regression results of the endogeneity test conducted in this study. The first-stage regression results indicate that the chosen instrumental variables (IVs) are strongly correlated with their respective endogenous explanatory variables. Specifically, fixed-line telephone subscribers in 1986 (IV1) and academic paper (IV2) show significant positive effects on digital technology innovation \(DigT\), with a Kleibergen-Paap Wald F-statistic of 21.399, substantially exceeding the Stock-Yogo 10% critical value as shown in column (1). Similarly, Internet coverage (IV3) and proportion of plain area (IV4) show strong predictive power for digital technology spillover (\(DigTempower\)), yielding a Kleibergen-Paap Wald F-statistic of 20.881 against a 16.63 threshold in column (2). The Hansen test statistics of 0.459 for Y1 and 0.264 for Y2 fail to reject the null hypothesis of instrumental exogeneity. Second-stage estimates reveal that digital innovation (\(DigT\)) exerts significant negative effects on both outcomes of columns (3) and (4), where technology spillovers (\(DigTempower\)) consistently enhance service tradability performance. This echoes the results of the benchmark regression. The Kleibergen-Paap LM statistics (16.748 for Y1 and 17.033 for Y2, both **p = 0.000) confirm model identification. The outcomes of these tests suggest that the instrumental variables chosen for this study are suitable. After we consider the endogeneity issue, the hypotheses H1 and H2 still hold.

Mechanism test

Building on the assumptions and theoretical foundations of the previous study, this section examines whether the labor reallocation between the secondary and tertiary industries is a precondition for enhancing the tradability of services through digital technology. Additionally, mechanism analysis examines whether digital technology would promote the tradability of domestic services through increasing returns to scale in the service industry.

-

(1)

Labor reallocation mechanism: In recent years, the utilization of digital technology has accelerated the labor force’s job transition from manufacturing to services (Dauth et al. 2021). In the world’s major economies, the share of labor compensation in manufacturing has been declining significantly, while the share of labor compensation in services has been relatively stable. The cost gaps in labor factors, which is an important basis for trade between North and South countries, applies only to services (Baldwin and Forslid 2023). The availability of “cheap” overseas labor in the service sectors have increased, while the attractiveness of foreign labor in the manufacturing sectors have declined due to industrial robots (Anzolin et al. 2022). This section uses the domestic labor compensation share gap (\(laborshareGap\)) and the overseas labor availability gap (\(FlaborGap\)) between the manufacturing industry and service industry as proxy variables for labor reallocation.

As shown in columns (1) and (3) of Table 5, the regression coefficients of the direct effect of digital technology innovation (\(DigT\)) are significantly negative, while the regression coefficients of the interaction term with labor reallocation mechanism variables are significantly positive. This suggests that the direct negative effect of digital technology innovation on the tradability of services is mitigated when the labor force shifts from manufacturing to services. The possible explanation is that the large-scale shift from manufacturing to services creates an alternative route for tradable services through labor-intensive service exports (Nayyar et al. 2021). It has been observed that the massive migration of labor from manufacturing to services has curbed the rise of wages in the service industry within emerging economies. The cost and quality of labor in some less developed regions for providing equivalent services are even superior to those of AI and language models (Ge et al. 2023). By relying on low-cost human resources and economies of scale rather than advanced digital technologies, this route bypasses the direct constraint of technological barriers, thereby mitigating their suppressive effect on service tradability (Hao et al. 2023).

Table 5 Tests of labor force reallocation mechanism and increasing returns to scale mechanism. In columns (2) and (4) of Table 5, the regression coefficient of the indirect effect (\(DigTempower\)) is significantly positive, and the regression coefficient of the interaction term is also significantly positive. This indicates that the shift of labor from manufacturing to services amplifies the positive impact of digital technology spillover on enhancing the service tradability. Existing studies also highlight the synergistic and dynamic complementary effects between labor migration and technology diffusion (Hübler 2016). First, the inflow of labor into the service sector expands industry scale, generating concentrated demand that compels firms to adopt digital technology, such as CRM systems and cloud platforms, to improve efficiency (Owusu et al. 2021). Large-scale service scenarios accelerate digital technology adoption and reduce diffusion costs (Sun et al. 2024). Second, labor-intensive service sectors leverage cost advantages to gain global market share, enabling capital accumulation and demand feedback (Acemoglu et al. 2024). This drives incremental technological upgrades, creating a virtuous cycle of low-end breakthrough to technological iteration in service sector. If the deep integration and penetration of the service and information industries can create additional service jobs and support more labor in providing international services, then the tradability of services will be further enhanced (Ren et al. 2022). Hypothesis H4a of this paper is thus confirmed.

-

(2)

Increasing returns to scale mechanism: Columns (5) to (8) of Table 5 report the regression results of the increasing returns to scale mechanism in the service industry, that is, whether digital technology can promote the tradability of services by expanding the size of the domestic service market. This section employs the final consumption of services (\(FDS\)) and value-added in the domestic service sector (\(VAS\)) as proxy variables for market size in the service sector.

As shown in columns (5) and (7) of Table 5, the regression coefficients of digital technology innovation’s direct effects (\(DigT\)) are significantly negative, while its interaction term with service market size is significantly positive. This illustrates that economies of scale in the service sector mitigate the negative direct effects of digital innovation on service tradability. A large service market size dilutes the costs of high-end digital patents through massive demand, thereby alleviating the inhibitory effects of patent royalty barriers on service specialization and tradability. When market size is insufficient, the limited demand in the service sector exacerbates the “patent thicket” effect, relegating the industry to a low-knowledge, non-tradable sector (Autio et al. 2021).

In Columns (6) and (8) of Table 5, the regression coefficients for indirect effects are significantly positive, and the interaction term between market size and digital technology spillover (\(DigTempower\)) is also positively significant. This demonstrates that economies of scale in service sector amplify the positive indirect effects of digital technology in enhancing service tradability. These empirical findings align with the Smith-Young Theorem. The expansion of market size fosters labor specialization, enabling precise integration of digital technologies with service activities. Such precise technology spillover reduces costs and boosts efficiency in services, enhancing tradability (Bian and Fan, 2024). Concurrently, growing markets amplify inter-firm collaboration and industry platforms, which expand digital technology diffusion channels (Butollo and Schneidemesser, 2022). This transforms services into a high-knowledge, tradable sector. Hypothesis H4b of this paper is thus tested.

Heterogeneity analysis

This section employs heterogeneity analysis to further examine whether digital technology spillover is the cause of service tradability. The theoretical models of new trade theory confirm that economies lacking a comparative advantage can still engage in international trade through economies of scale (Krugman 1979). This paper adopts this analytical approach to eliminate the interference of factors such as period, economic size, digital technology correlation, and patent types on causality.

Periodic heterogeneity: The financial crisis of 2008 swept the world, leading to a significant decline in service trade volumes and participation in GVCs. It is crucial to consider the impact of the overall trend change in the explained variables on the regression results. Therefore, this paper uses 2008 as a cut-off point to divide the samples into two groups: before and after the financial crisis. Column (1) of Table 6 reports the regression results for periodic heterogeneity. The direct effects of digital technology significantly reduce the tradability of services both before and after the 2008 financial crisis, while the indirect effects significantly increase it. This indicates that the impacts of digital technology innovation and spillovers on service tradability are continuous and consistent over time.

Size of economy: Data from WIOD and OECD indicate that large economies, such as the U.S., China, and Germany, consume more than 90% of services domestically, with only a smaller portion allocated to exports. Only 20% of the value-added from exports is absorbed by other countries (Koopman et al. 2014). Conversely, small and medium-sized economies like Singapore and Hong Kong export significantly more than their GDP (Krugman et al. 1995). Export-oriented economies maintain high levels of tradability contribution of services. In this paper, the top ten economies by total GDP in 2020 are categorized into the large economies group, which includes G7 members as well as China, India, and Russia. The remaining 66 economies are classified into the small and medium economy group. The regression results in column (2) of Table 6 demonstrate that the direct and indirect effects of digital technology on service tradability remain robust for both groups. In Appendix 2, we present a detailed analysis of regression results for high- and low-performance subgroups within both large and small economies in terms of service tradability.

Digital technology correlation: Existing studies usually equate technological innovation in the information industry with digital technology innovation. This view assumes that technology patents in the information industry are homogeneous (Wang et al. 2021). In fact, there are some patents in the information industry that are weakly related to digital technology, such as physical structure and mechanical design of the hardware. To reflect the impact of the correlation between patents and digital technology on the tradability of services, this paper divides the 11 types of information industry patents in Appendix 1 into high-correlation digital technology patents, medium-correlation digital technology patents and low-correlation digital technology patents. The classification criteria are based on the relevance of information industry patents and digital technology elements such as data, algorithms and computing power (Petralia 2020). High-correlation digital technology patents include: digital communications and telecommunications involving data elements, computer technology and IT management methods related to algorithmic elements, and semiconductors, micro-structural and nano-technology that change computing power. Medium-correlation digital technology patents are basic communications, optics, audio and video technologies. Low-correlation digital technology patents are measurement and control technologies. As shown in column (3) of Table 6, the regression results for groups with high-correlation and medium-correlation of digital technology patents remain robust. However, groups with low-correlation digital technology patents fail to enhance service tradability through digital technology. The regression results for both direct and indirect effects are not significant in the low-correlation group. This suggests that there is a technological relevance for digital technology to facilitate service tradability. Only when the correlation between patents and digital technology reaches a certain level can the tradability of the services be improved.

Patent types: Computing power is the driving force; algorithms are the rules; and data is the foundation. This section clarifies the impact of these three types of digital technology patents on the tradability of services. This is conducive to concentrating limit resources, guiding the utilization of relevant digital technology patents in a targeted manner. It has profound meaning in establishing a first-mover advantage in expanding service trade and high-standard openness (Leng et al. 2021). To analyze the impact of digital technology patent types on regression results, this paper further classified digital technology patents into computing power, algorithms, and data. As shown in column (4) of Table 6, all three types of digital technology patents can significantly improve the tradability performance of services. However, digital technology patents related to data and algorithms are more significant than those related to computing power. This indicates that data-type and algorithm-type patents such as digital communications, computing technology, and IT management methods play a more critical role in empowering the tradability of services. These findings align with the tripartite theoretical framework positing: (1) Algorithmic architectures as the catalytic core of digital technology (Autio et al. 2021). (2) Innovation paradigms increasingly anchored in passively generated large datasets (Bamakan et al. 2022). (3) Emergent interplay between datasets and algorithms drives potential commercial rewards (Cockburn et al. 2018).

Further analysis

Previous analyses have examined the impact of digital technology spillovers on the tradability of the service industry from an overall perspective, utilizing a comprehensive digital patent spillover index (\(DigTempowe{r}_{r}^{i\text{'}j}\)). Given existing literature highlights the technology ownership and GVCs position of service sector shape digital technology adoption, it is critical to examine how the four spillover modes contribute to service sector tradability (Stöllinger 2019).

This section first constructs the model to identify the factors that drive the tradability of services among four modes of digital technology spillovers. Appendix 3 presents the regression results for Eq. (11). Technology innovation and forward international technology supply will prohibit the service tradability, while the other three technology spillover modes contribute to it. The persistent impact and critical effect of digital technology on the tradability of services remains to be investigated. Based on the impulse response function of the VAR model, this section first analyzes the long-term and short-term dynamic relationship between the direct and indirect effects of digital technology on the tradability of services. Furthermore, it utilizes the variance decomposition graph of the VAR model to illustrate the significance of the five shocks.

The tradability of services continues to decline after an exogenous shock from technological innovation in the information industry, as shown in Fig. 5 (DigT). This indicates that the direct effect of digital technology will have a long-term negative impact on employment and specialization in the service industry. As depicted in Fig. 5 (DFT and DIT), the cross-industry spillover of digital technology between the information industry and domestic upstream and downstream industries will significantly contribute to the tradability of services. This conclusion is consistent with the regression results in Supplementary Table S3, that is, whether on the demand side or the supply side, the spillover of digital technology within National Value Chains are stable paths to continuously improve the tradability of domestic services. According to Fig. 5 (FFT), the backward international technology demand briefly inhibits the specialization in the domestic services GVCs in the second period, but then continuously promotes tradable domestic services. High-standard openness allows for greater utilization of foreign technology, empowering accelerated progress toward technological self-reliance from a higher starting point (Chen et al. 2022). Figure 5 (IIT) suggests that after a positive shock is applied to the tradability of the service sector due to forward international technology supply, the tradability of the service sector will be restrained, whether in the long term or the short term. Digital technology empowerment exhibits the characteristic of “Matthew effect” (Yang and Zhang, 2023). When its spillover patents are primarily directed toward foreign countries, domestic service industries face significant challenges in developing international tradability.

To clarify the comprehensive effects of digital technology empowering the domestic service tradability, this paper employs a variance decomposition method to compare the relative importance of five types of digital technologies (\(DigT\), \(FFT\), \(IIT\), \(DFT\) and \(DIT\)) in relation to the dynamics of services tradability. The results of the variance decomposition are shown in Fig. 6. The direct effect and international backward spillovers are not the main external reasons determining the trend of services tradability. The negative impacts are smaller than the positive effects of domestic cross-industry spillovers (\(INTFor\) and \(DOMFor\)) from digital technology. The contribution of \(DIT\), \(DFT\), \(DigT\), \(FFT\), and \(IIT\) to the services tradability are 5.20%, 4.80%, 3.00%, 1.60% and 0.40%, respectively. Among the five external factors affecting the services tradability, the largest contributors, \(DFT\) and \(DIT\), both present positive effects. Therefore, the comprehensive effect of digital technology empowerment on the domestic tradable services is positive. While digital innovation initially suppresses tradability through direct effects, its indirect spillover effect ultimately outweighs these constraints, driving overall growth in services trade (UNCTAD 2021). Hypothesis H3 of this paper is verified.

Conclusion and discussion

As manufacturing jobs decrease and the service industry becomes tradable, developing countries that used to rely on manufacturing exports are in urgent need to developing new drivers of international trade. Digital technology is an important engine for promoting low-cost labor in developing countries to participate in the GVCs of service industry. This paper empirically analyzes the relationship between digital technology innovation, digital technology spillover, and the tradability of services across 76 economies by using data from the WIPO patent database and the OECD input-output database for the period 1995–2020. The analysis covers direct and indirect effects, mechanisms analysis, and sustainable pathways. The main conclusions and policy recommendations are as follows.

First, digital technology innovation within the information industry inhibits the service tradability. Domestic digital technology spillover increases the service tradability. Although technological advancements in the information industry itself inhibit the deepening of specialization in service trade, the cross-industry digital technology spillover has significantly improved its tradability contribution and openness return rate. Overall, the comprehensive effect of digital technology innovation and digital technology spillovers has promoted the domestic tradable services. Among the indirect effects, the most prominent contributions to service tradability come from the backward domestic technology demand and the forward domestic technology supply. They are also the two largest contributors among the five external factors affecting services tradability. The above conclusions indicate that the comprehensive effect of digital technology on the tradability of the service industry is positive, but less than expected as forward international technology supply will inhibit tradability. Therefore, the following elements deserve attention when manufacturing exporters try to employ the above pathways to promote domestic services tradability. (1) It is necessary to strengthen the frontier research of digital technology through increasing R&D investment and patent innovations to enhance the digital technology patent density of the information industry. (2) It is essential to strengthen the digital technology spillover to domestic service sectors by vigorously promoting the construction of digital economy and increasing the penetration of digital enterprises and service enterprises. At the same time, manufacturing countries should optimize the intellectual property protection system to ensure that digital patent innovations are effectively transformed into competitive advantages in service trade (Zhou et al. 2024). (3) There is a need to accelerate the construction of the market economy, to break up the local protection and market segregation, and to promote the cross-industry and cross-border integration and penetration of digital technology.

Furthermore, the critical mechanisms of digital technology empowering the tradability of services lie in the labor reallocation between the secondary and tertiary industries and the increasing returns to scale in the service sector. In countries or regions with developed digital economies and extensive use of industrial robots, the replacement of humans by robots is common, leading to a decline in the labor compensation share in the manufacturing industry. Although generative AI and automated office systems have also substituted some jobs in the service industries, multiple digital technologies are aimed at assisting human services, making the share of labor compensation in the service industries relatively stable. The labor factor rental value differential, an important basis for trade in North-South countries, emerges only in services, reinforcing the role of digital technology in facilitating the tradability of services. In the context of economic restructuring and the sharp increase in tariffs on goods, this paper proposes the following strategy for the tradable services in export-dependent manufacturing economies. The transformation hinges on overcoming dual constraints of service market scale and limited digital technology. (1) Aligning with the trend of labor migration from manufacturing to services, economies should modularize and standardize unskilled service workers through data platform investment and algorithm optimization. This breaks geographical barriers, enabling directly export the source of their comparative advantage - low-cost labor -without having first to make goods with that labor. (Baldwin and Forslid 2023). For instance, China’s live-streaming E-commerce sector exemplifies this transformation, where massive low-skilled workers transition into live-stream hosts or logistics personnel. Leveraging platforms like TikTok, they propel “cross-border live-stream commerce” as an emerging form of service trade. (2) It is necessary to capitalize on the shift of manufacturing labor to services through targeted reskilling programs, such as coding and AI. This will realize the combination of human service and digital technology by actively upgrading of human resources and labor quality, shorten the time of structural unemployment, and secure a foothold in high value-added linkages. (3) Building on this foundation, post-service-market expansion requires progressive relaxation of data regulation and enhanced data mobility. Specific measures involve clearly defining the scope of remote cross-border services and digital trade provided by domestic individuals and enterprises in the form of a negative list. Additionally, combined policies, such as E-commerce, logistics, and finance, actively support service enterprises to expand internationally, encouraging networked and branded operations. This activates increasing returns to scale mechanisms, creating a virtuous cycle: market expansion → division of labor refinement → technological upgrading → further market growth. With the unlocking of market scale and digital technologies, service sectors in export-dependent manufacturing economies transition into tradable sectors.