Abstract

What expectations do firm representatives hold regarding future climate change, and how certain are they in their expectations? We analyze German firm representatives’ expectations and effects of the firms’ policy affectedness and engagement, and firm representatives’ knowledge using an information treatment experiment. We find modest economic sector differences and a positive association of engagement (i.e., energy and emission metering and reduction target setting) with expected global warming. The information treatment increases the global warming expectations in the optimistic (low warming) scenarios and decreases expectations in the pessimistic (high warming) scenarios. Moreover, representatives from less engaged firms appear rather uncertain and overly optimistic and tend to be pushed upwards in their expectations by the information treatment, while a downward shift is observed among the more engaged firms. Our results imply that the majority of respondents have a high degree of uncertainty and limited knowledge regarding climate change and appear easily influenceable.

Similar content being viewed by others

Introduction

While scientists worldwide agree on the existence of human-induced climate change and its risks for ecosystems, human wellbeing, and economic development1,2,3, the complex interdependencies of natural and social systems create uncertainties in climate change forecasts4. In particular, future emissions are unknown as they depend on climate change mitigation actions, which in turn are influenced by individuals’ climate change expectations (“climate change perception feedback loop”)5. Expectations are important for reaching social tipping points that scale up climate action6, and in contrast, a deviation in expectations from the climate policy targets may jeopardize the achievement of these very targets.

Firms’, or more concretely, firm representatives’ expectations of future climate policies and climate risks are of particular relevance, not only because firms are relevant political players influencing climate policy, but also because firms’ climate change expectations have real economic impact, e.g. on their strategic and operational decisions, financing options, and ultimately firm value7,8,9,10,11,12,13,14,15,16,17. In the context of expected global warming scenarios, studies show links between expectations and economic outcomes such as the willingness-to-pay for climate policies, option pricing and risk valuation18,19,20. Moreover, expected returns from green technologies depend on expectations of future climate policies, such as environmental regulations and carbon pricing, with expectations of more ambitious policies motivating a substitution of brown technologies with greener technologies2,21, while it is still unclear whether greater risk and uncertainty leads to lower or higher investments in low-carbon technologies4,22,23,24,25,26,27.

However, empirical evidence on climate change expectations is still scarce. Evidence from several countries exists that most individuals are informed about climate change to a certain degree21,28,29,30,31, but knowledge is limited to basic facts and uncertainty is high29,32. In particular, research has mainly focused on private households, and in this context on expectations on physical climate risks and climate change skepticism33,34,35,36,37,38,39,40,41,42. In contrast, research on firm expectations has mainly focused on single markets or products43, transition risk44, or expected firm-level physical impacts of climate change45,46,47,48,49,50,51,52.

We fill this gap by providing climate scenario expectations of firm representatives in a large sample of German firms and testing the stability of the expectations using an information treatment experiment. In contrast to most existing firm-level literature, we rely on survey data of expectations. While empirical derivations based on market data only allow very narrow conclusions and rely on strong identification assumptions, our study is based on a representative sample in terms of industry structure and products and allows conclusions with regard to the broad concept of climate transition expectations.

We focus on the link between climate change expectations and the degree to which firms are potentially affected by climate policies (in particular rising energy cost due to carbon pricing), their engagement in reducing energy consumption and emissions, and their uncertainty about climate change and climate policy (see Supplementary Information). We capture firm affectedness by the share of energy costs on total costs and industry, and engagement in climate change mitigation by energy and CO2 metering and reduction targets. We argue that in the case of a high energy cost share, firms are likely to be more engaged and thus better informed about climate change. This argumentation is in line with the literature which finds strong reactions such as energy cost reduction and input substitution with rising energy prices due to the introduction of a CO2 tax53,54. From a business perspective, it is clear that more affected firms in terms of higher energy cost shares will invest more in business intelligence to reduce energy and emissions, which requires both firm-level knowledge of emission sources and knowledge about current and planned policies as a precondition of firm-specific climate action55. Thereby, energy costs are not the only cause for engagement and knowledge. Climate policies and climate change risks may affect firms beyond energy prices, for instance over their supply chain, e.g. in case of energy-intensive upstream activities or agricultural produce. This may be captured by differences between industries. Moreover, also “green” companies exist that do not have particularly high energy cost shares but nevertheless high engagement in emission reduction.

Investments in knowledge concerning energy and climate policies will reduce uncertainty about future climate change. While uncertainty to a certain degree exists due to the complexity of physical determinants of climate change as well as unknown future policies and technologies, additional uncertainty may arise in the case of insufficient information. Therefore, we expect individuals who are well informed and have high confidence in their knowledge to react less to new information, such as an anchor information treatment, following motivated reasoning arguments56,57. Hence, firm representatives in more affected and engaged firms will be able to reduce their uncertainty and gain confidence in their expectations by building up knowledge in physical mechanisms, planned climate policies, and upcoming technologies. The relationship between expectations and uncertainty may be positive or negative (similar to the link of expectations and investments27). However, as the extreme scenarios are based on stronger assumptions (best and worst case) than the scenarios in between, which can result from various combinations of policies and technologies, a convex progression of uncertainty across expectations results. Uncertainty is measured by the firm-level standard deviation of climate scenario probability distributions (for details see Methods).

Firm representatives, who form their climate scenario expectations based on their knowledge and (perceived) uncertainty can be expected to be influenced by attributes of their companies both due to selection effects and firm-specific knowledge formation. But beyond firm-level factors, individual differences in knowledge and uncertainty likely exist, due to individuals’ personal and professional background58,59,60, which is not included here and may lead to lower coefficients of determination of the model.

The analysis is based on data collected as part of an online panel targeting a representative sample of 9227 firms in Germany (BOP-F)61. The panel includes firms of all industries and firm sizes (with large firms oversampled) and covers questions about firms’ economic situation and expectations as well as further varying topics62. With a response rate of 18%, the panel is within the range of response rates for German company surveys63,64. The vast majority of respondents (88%) are the company’s owners, members of the executive board or attorneys (see Supplementary Information). Thus, these respondents’ individual expectations will likely influence firm strategy. Accordingly, it is common to use firm representatives’ survey responses as a proxy for firm-level analyses27,65,66,67.

Respondents were asked to estimate how likely they deemed five verbally described climate change scenarios, which were drawn from the 6th IPCC report (reference climate change scenarios with a global temperature of 1.4, 1.8, 2.7, 3.6, and 4.4 °C, respectively, see Methods for question wording). From these responses, we calculate respondent-specific empirical expected values, the climate scenario expectation, and standard deviations to capture uncertainty. While this detailed question is demanding for respondents, it is less prone to social desirability and experimenter demand effects than direct questions about the existence of climate change and provides detailed insights into not only how optimistic respondents are but also how much scope they see in climate change.

The information treatment experiment for identifying respondents’ knowledge makes use of an expert anchor treatment element, which a random 50% split of the respondents received directly before the probability assessment task as background information. The information treatment explicitly mentions global warming temperatures that climate scientists consider as unlikely and very unlikely to be reached. The text is based on a recent Nature article on the likelihood of climate scenarios (translation of German survey text)68.

“A long-term rise of 3.6 °C or more is considered unlikely* by climate scientists.”

*Pop-up text box: “A large part of climate researchers consider an increase in global temperatures of 3.6 °C unlikely and an increase of 4.4 °C very unlikely, as technological advances in the energy sector are already being made and climate action measures being taken.”69

Anchors have been widely used in the literature as a robust instrument for testing individuals’ knowledge and probability estimates, such as the mean temperature in Germany or the likelihood of a nuclear war70,71. Recent literature explores, for example, how climate consensus communication anchors affect individuals’ climate change beliefs, e.g. depending on which political party is the strongest in the region where the person lives72. We use our anchor treatment in a similar way. It serves as a revelation instrument for respondents’ knowledge on climate scenarios, as anchors typically have a stronger effect on uninformed than on informed respondents.

Here, the expert anchor information treatment may have two effects: The simple displaying of figures may pull the scenario expectations towards the anchor values of 3.6 °C and 4.4 °C if respondents take the information content of this “pure number” and lean towards it. This may be the case in particular for respondents with low levels of prior information or low interest in the topic, who may not grasp the deeper information content of the treatment text, which provides information about the low likelihood of high temperature scenarios but the lower temperature scenarios. On the other hand, if respondents with pessimistic expectations, particularly those with higher levels of interest and prior knowledge, understand (and believe) the information provided in the anchor information treatment, they may adjust their scenario expectations downwards. This should be especially true for scenarios above 3.6 °C as well as neighboring scenarios so that the compression of the density function should increase at high values.

Results

Distribution of climate scenario expectations and mean impacts of firm characteristics

The histogram in Fig. 1 shows the climate scenario expected values differentiating whether respondents were subject to the information treatment (white) or not (green). These are empirical individual expectations (i.e., a respondent’s expected temperature calculated as the probability-weighted average of the scenario temperatures). The distributions are skewed to the right and peak at the temperatures of the IPCC scenarios. The scenario with the highest probability is the 2.7 °C scenario, followed by the more optimistic 1.8 °C scenario. The mean expectation value is 2.39 °C, which is in line with evidence on the alignment of firms’ CO2 reduction targets with climate change temperature goals73. However, it is more optimistic than scenarios considering the nationally determined contributions (2.7 °C) and current policies (3.6 °C). A similar pattern, albeit with less details, can be seen in the raw data on the probability distributions (see Supplementary Information).

The treated respondents’ distribution (white) displays a lower density mass in its tails than the non-treated respondents’ distribution (green). This indicates that the treatment causes an increase in mass in the center of the distribution while thinning out at both tails. This is puzzling given the fact that the treatment contains information only about the likelihood at the right tail of the distribution, i.e., on high temperature scenarios. We will analyze the sources of these countervailing effects in detail below.

Figure 2 reveals patterns of climate scenario expectations according to firm characteristics. The graph shows coefficients of a linear regression of climate scenario expectations on several explanatory variables. Tables A1 and A2 (see Supplementary Information) contain descriptive statistics.

Note: OLS regressions with robust standard errors. N = 8418, R²=0.11. Point estimates with 95% confidence intervals. The results of the Wald tests for the equality of the coefficients of the respective engagement variables indicate significantly different scenario expectations for different levels of engagement. There are predominantly statistically significant differences between “No Energy Metering” on the one hand and the other engagement variables on the other (p-values of the test statistics: 0.021, 0.000, 0.051 and 0.000 for Energy Metering, Energy Targets, CO2 Metering and CO2 Targets). See Table A5, Supplementary Information, for detailed regression results.

The largest coefficient in the model is for uncertainty (i.e., the respondent-level standard deviation arising from the spread of indicated scenario probabilities). However, this association is mostly a technical effect caused by the structure of the scenario expectation question and should not be interpreted as a causal relationship (see Section 3 in the Supplementary Information for details).

The other effect sizes are moderate and mostly statistically insignificant. Contrary to our expectations, the affectedness variable (Energy Cost Share) is not associated with climate scenario expectations. The engagement variables, Energy and CO2 Metering and Targets, are negatively associated with the scenario expectations: The higher engagement the lower are the scenario expectations, with coefficients ranging from −0.10 to 0.10 °C for the extreme cases (CO2 target setting vs. no engagement).

Sector differences are statistically significant, but effect sizes are moderate, amounting to roughly 0.21 °C at the maximum, i.e. between the sectors “food and beverages” and “public administration, defense, social security”. However, these values are estimated controlling for many other variables. In a model including only sector dummies as explanatory variables, maximum sector differences amount to 0.27 °C (see Table A6, Supplementary Information).

Information treatment results

Next, we evaluate the effect of the information treatment. Overall, we do not find a treatment effect as opposing treatment effects at the tails of the climate scenario temperatures level each other out (see Fig. 1). We therefore use percentile-wise tests to account for countervailing effects across the different ranges of the scenario temperature bandwidth. Percentile regressions not only allow assessing the statistical and economic significance of the treatment across the different intervals of the temperature range of the scenarios but also interacting the treatment variable with potentially moderating variables such as affectedness, engagement, and uncertainty. This is important for our analysis as it enables us to determine which of these variables—affectedness, engagement, and uncertainty—impact information treatment responses. From this it can be inferred which of these variables determine a low or high knowledge level. We use standard percentile estimators that identify the response of the dependent variable to the explanatory variables at the respective percentiles of the distributions. This allows us to determine causal effects of the treatment in different respondent groups and for their characteristics, so that these vary with the individually specific, heterogeneous climate scenario expectations. In robustness analyses, we restrict our sample to respondents holding an upper management position in a firm with at least 25 employees, in order to consider that coordination processes as well as the various incentives of all employees in a firm are the reasons why firm representatives’ answers differ from private households’ answers. The results remain largely robust (see section 4.5, Supplementary Information).

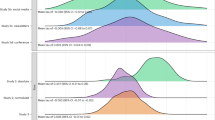

We start by presenting the aggregate treatment effects for the different temperature percentiles, each compared to the comparison group without information treatment. These effects can be interpreted as causal due to the random assignment of respondents to the treatment and the control group (see Table A6, Supplementary Information, for the results of the randomization check). In Fig. 3, the temperature-based percentile-wise coefficients of the aggregated treatment effects are shown, which allow the effects to be assigned to the respective climate scenario. The graph thus maps the results of 99 simultaneous percentile regressions, one respective regression per percentile. The upper and lower marginal percentiles were truncated. Solid lines show statistically significant treatment effects (p < 0.05) over the respective percentiles whereas dotted lines show insignificant treatment effects.

Dotted lines refer to statistically insignificant regression results, solid lines refer to statistically significant regression results (both at the 95% confidence level). Energy Cost Share is included as a control variable; models without Energy Cost Share are included in Figure A4, Supplementary Information. To make effect sizes comparable with dummy variables we present the coefficients for Energy Cost Share evaluated at its mean. Results are robust to applying more conservative multiple hypothesis testing rejection criteria, accounting for the fact that the analyses involve testing multiple null hypotheses simultaneously (see Figure A5, Supplementary Information).

Most interestingly, the information treatment effects appear contingent on the temperature level. For low temperature levels, respondents experience statistically and economically significant upward shifts in their expectations, while for high temperature levels, expectations are shifted downwards.

An explanation may lie in the complex information given with the treatment. Individuals receive the information that the more pessimistic climate scenarios are considered as unlikely by scientists. Thus, the content of the information treatment should make respondents more optimistic. On the other hand, the pure anchor effect should draw expectations upwards by displaying high figures (3.6 °C and 4.4 °C).

The heterogeneous effects found might therefore be explained by additional characteristics such as the respondents’ background knowledge and interest in the topic. As Fig. 3 shows, it turns out that, contrary to our expectations, the anchor effect does not operate through affectedness: Effect sizes of energy cost shares (black line) are negligible and mostly not statistically significant, with the exception of two outliers at the right end of the temperature range. Therefore, we differentiate the treatment effect according to engagement levels in addition to affectedness (Fig. 4a).

a Differentiated by levels of engagement and affectedness, (b) Differentiated by levels of engagement and affectedness additionally controlling for uncertainty. Dotted lines refer to statistically insignificant regression results, solid lines refer to statistically significant regression results (95% confidence level). To make effect sizes comparable with dummy variables we present the coefficients for Energy Cost Share and Climate Scenario Uncertainty evaluated at the means of their respective variables. Results are robust to applying more conservative multiple hypothesis testing rejection criteria, accounting for the fact that the analyses involve testing multiple null hypotheses simultaneously (see Figure A6, Supplementary Information).

Engagement types include no measurement and no target (No Energy Metering), energy metering only (Energy Metering), energy target setting (Energy Targets), emissions metering (CO2 Metering), and emissions target setting (CO2 Targets).

We find positive treatment effects for the most uninformed group comprising firms with neither metering nor target setting (No Energy Metering) with effect sizes up to 0.2 °C. The effect tends to increase with decreasing temperatures, i.e. with greater distance from the anchor. At very low temperatures, the effect collapses somewhat, which may indicate a lack of credibility of the anchor value if the distance from respondents’ uninformed expectations to the anchor value is subjectively too large. The coefficients are for most regressions statistically significant for percentiles smaller than 63% (2.65 °C).

For the second least informed group (Energy Metering) the anchor also has a strong positive impact on the scenario expectations for lower temperature scenarios, but it appears to act in both directions. It is positive below the 41st percentile (2.21 °C) and negative for the 73rd percentile and higher (2.70 °C).

In contrast, for the higher engagement groups, the information treatment causes significant and negative effects for percentiles greater than 78% (2.78 °C) and in the case of the most engaged group (CO2 Targets: firms that measure and set targets for both energy and carbon emissions) the 23rd percentile (1.80 °C). The downward adjustment increases with increasing proximity to the anchor value and reaches values up to nearly −0.4 °C. Treatment effects for low temperature scenarios are mostly insignificant. For the medium engagement types, Energy Targets and CO2 Metering, a positive anchor effect on the scenario expectations can only be observed for a few exceptional cases.

The spread caused by the anchor effect on scenario expectations is thus of considerable size and reaches a maximum of approximately 0.6 °C between non-engaged and engaged groups. There are also clear differences between the different engagement types for the comparison at the respective percentiles. Thus, the distances between only energy-metering firms, Energy Metering, and the most engaged firms, CO2 Targets, are up to 0.2 °C across the entire temperature scenario scale. The gap between the least engaged participants, No Energy Metering, and the most engaged ones, CO2 Targets, is 0.3 °C in the middle and up to 0.4 °C in the upper temperature scenario range. Even within groups, the range across the scenario/temperature expectation scale is large and reaches up to approximately 0.5 °C (for the Energy Metering group).

To interpret these patterns, we argue that a greater concern regarding climate change and engagement in climate protection leads to a more adequate processing of the complex treatment information and less emphasis on the naïve anchor information. According to the content of the information, all engagement types in the upper, pessimistic temperature scenario range react by adjusting their expectations downwards. However, the less engaged types in the lower, optimistic temperature scenario range react by adjusting their expectations upwards, which is contrary to the content of the treatment information but corresponds to a naïve anchor response.

These results change significantly when we include our measure of uncertainty (Fig. 4b), which sheds light on the source of the response to the naïve anchor. Uncertainty about one’s own knowledge, either due to poor knowledge or low confidence in own knowledge, is found to explain the positive anchor effects in the low engagement groups. This suggests that the observable uncertainty in stated respondents’ expectations stems from poor knowledge and to a lesser degree from low confidence in own knowledge. This uncertainty effect is higher for the optimistic, low temperature scenarios and impacts mostly low and medium engagement types, but moderately also high engagement types. Accordingly, significant differences of 0.2 to 0.3 °C between the different engagement groups prevail.

This implies that more active engagement through dealing with climate change and climate mitigation policy—obliged or non-obliged by policy-makers—may improve firms’ and their representatives’ knowledge and reduce adverse uncertainty effects. Thus, higher engagement may result in better informed and more persistent climate scenario expectations. However, uncertainty stemming from knowledge gaps seems to be less of a problem for respondents with pessimistic, high temperature scenario expectations.

Discussion

This article investigates firm representatives’ expectations on climate change and policy scenarios. Based on novel representative firm-level data, it explores how expectations are influenced by firm affectedness by climate policies, engagement in energy and emissions metering and target setting in the company, and uncertainty about the future climate transition pathway. Our main descriptive findings indicate that expectations strongly depend on engagement. In contrast, readily available macro variables such as industry sector, firm size, and affectedness in terms of high energy cost shares are significantly associated with expectations but less informative overall. The information treatment we use implies limited knowledge driving uncertainty particularly for less engaged respondents. Accordingly, increasing engagement, potentially through policy rulemaking, may improve firm representatives’ knowledge and decrease uncertainty. This is important because there is only a good chance for adequate long-term structural change investments if the firms’ and their representatives’ expectations match the climate policy goals; adequate expectation formation is a prerequisite for adequate action. In addition, expectations must be stable and not easily influenced in order to ensure lasting behavioral adjustments.

These results imply that climate policy communication may only be accurately conveyed if there is a fair amount of basic knowledge and engagement among recipients74. This is in line with literature e.g. supporting the benefit of tailored communication in transitions e.g. regarding socio-demographics and risk attitudes75. Otherwise, it will remain highly uncertain whether firms appropriately process information and act accordingly in a transition environment.

This also opens a case for policy makers to think about how to provide firms with more basic knowledge regarding climate transition and change in order to enable them to process information correctly.

Limitations of this study and avenues for future research might be a more disaggregate investigation of climate scenarios. Firms often only have a limited view on strategic aspects such as prospect changes of the (legal) policy environment. Although the ambition of policy makers to engage in this worldwide public good game might be well measurable by climate scenarios and scenario temperatures, it might be fruitful to delve deeper in specific policies only relevant for subgroups of firms. However, policy instruments such as prices and subsidies for respective sectors are frequently changed, so it remains to be shown whether a more general climate policy ambition indicator or single policies better serve the purpose of risk assessment. Moreover, we focus on energy cost share as one type of affectedness, but climate change risks comprise far more than only energy costs, including political and regulatory risks such as energy prices as well as direct physical risks, which may or may not companies may be aware of. Future research may investigate the interrelations between affectedness by these different types of risks, attitudes and knowledge about climate change, and finally mitigation and adaptation efforts. Even more generally spoken, further firm characteristics may be more relevant for their representatives’ climate change expectations and knowledge that were not included in this analysis. Finally, investigating firm representatives’ expectations and their stability in other countries, in particular with different political regimes and different endowment with financial and fossil fuel resources, would be most interesting.

Methods

Sampling and data collection

Data are drawn from the Bundesbank Online Panel – Firms (BOP-F)61, a firm survey running since 2020 with quarterly waves with a net sample size of approximately 3000 firms per month. The sample is drawn from the universe of companies based in Germany with a taxable turnover over €22,000 or at least one employee subject to social security contributions and includes firms from all sectors, regions, and sizes76. Firms are invited to the online survey via an invitation letter sent by postal mail addressed to the firm’s management, but without specifying an addressee, so that firms can decide about the person to complete the questionnaire. In most cases (88%), respondents are the firms’ owners, members of the executive board, or attorneys (see Supplementary Information). Survey length is about 15–20 min. Topics covered are the firms’ economic situation and expectations, investments, and varying questions about current economic issues. The present analysis is based on data from wave 8, collected in January to March 2022.

Measures

The items for this study were developed by the authors, except the control variables industrial sector, number of employees, and turnover, which are part of the regular survey.

The variable in focus is climate scenario expectations. Respondents were asked to assess the probabilities of five verbally described climate change scenarios. The scenarios differ in terms of the intensity of political climate protection measures and the resulting global warming path (1.4 °C, 1.8 °C, 2.7 °C, 3.6 °C, and 4.4 °C).

We decided to ask about quantitative statements following the experiences reported for the use of IPCC probability statements and the literature on quantitative vs. verbal probability statements. Verbal probability expressions are interpreted around the midpoint of the scale, which we circumvent to some degree by asking for the quantitative assessments of the degree-based transition scenarios themselves77,78,79.

The main explanatory variables concern firms’ affectedness by climate policies and engagement in energy and emission reduction. The variable Energy Cost Share in total cost serves as a proxy for the degree to which firms are affected by rising energy costs due to climate policies. Regarding firm engagement, the respondents stated whether their firms measure and set targets for energy consumption and greenhouse gas emissions, respectively. These variables serve as measures for the engagement in topics concerning energy consumption and greenhouse gas emissions. The engagement variables follow an “incremental” logic. Accordingly, we define a composite variable ranging from No Energy Metering to Energy Targets, CO2 Metering, and as the top category CO2 Targets. Other combinations (e.g., CO2 targets but no energy metering) are rare; as they are comprised in the (residual) constant, it is not surprising that approximately symmetric positive and negative deviations of engagement variables around zero are found. A last group of explanatory variables is related to firm size, captured by the variables Firm Turnover and Firm Employment, and industrial sectors (see Table A1 and Table A2).

The exact question wording is given in the following (for the complete questionnaire and the original German version, see the German and English Codebooks80,81). Throughout the web survey pop-ups are included to provide definitions and additional information to questions. The pop-ups are listed as footnotes to the questions in the following.

Assessment IPCC scenario probabilities and information treatment

According to the latest research, the Earth has warmed until the 2010s by around 1.1 °C(1) in comparison to the pre-industrial period (1850–1900). Climate research expects further long-term global warming(2). Currently, five climate change scenarios are under discussion, each describing the level of climate protection measures implemented worldwide and the resulting mitigation of further global warming.

Information treatment [provided to randomly selected 50% of the companies]: An increase of 3.6 °C or more over the long term is seen as unlikely(3) by climate researchers.

How likely do you consider the following scenarios?

Note: This question is about how you estimate the probability of a certain event occurring in the future. Your answers can range between 0 and 100, where 0 means absolutely unlikely and 100 means absolutely certain. You can grade your assessment with values in between. Please note that the answers must add up to 100 across all categories. You can also leave fields empty; these will be saved as 0.

Scenario 1: Very strong climate protection measures and resulting global warming of approx. 1.4 °C in the long term (4)

Scenario 2: Strong climate protection measures and resulting global warming of approx. 1.8 °C in the long term (5)

Scenario 3: Average climate protection measures and resulting global warming of approx. 2.7 °C in the long term (6)

Scenario 4: Weak climate protection measures and resulting global warming of approx. 3.6 °C in the long term (7)

Scenario 5: Very weak climate protection measures and resulting global warming of approx. 4.4 °C in the long term (8)

Pop-ups to this question:

(1) This statistic can be found in the current report of the Intergovernmental Panel on Climate Change from August 2021. The Intergovernmental Panel on Climate Change (IPCC) was founded in 1988. Its task is to summarise the current state of academic research on climate change. It produces regular status reports that provide a foundation for science-based decision-making without making concrete recommendations for action.

(2) In climate science, “long-term” refers to the period up to the years 2081–2100. In this context, global warming is understood in relation to the global average temperature during the period between 1850 and1900 throughout.

(3) A large group of established climate scientists view an increase in global temperatures of 3.6 °C as less likely and an increase of 4.4 °C as very unlikely, as technological advances in the energy sector are already being made and climate policies implemented.

(4) This scenario assumes very low levels of emissions (very strong climate protection measures) and represents the highest possible climate protection target found in the worldwide Paris Climate Agreement adopted at the 2015 COP. It assumes that global warming will be limited to around 1.4 °C in 2100 in comparison to 1850–1900 and that no additional CO2 will be emitted from the middle of the century onwards. Scenario 1 is based on scenario SSP1-1.9 in the current IPCC report.

(5) This scenario assumes low levels of emissions (strong climate protection measures) and represents the minimum climate protection target found in the worldwide Paris Climate Agreement adopted at the 2015 COP. It assumes that global warming will be limited to around 1.8 °C in 2100 in comparison to 1850–1900 and that no additional CO2 will be emitted starting from the middle of the century. Scenario 2 is based on scenario SSP1-2.6 in the current IPCC report.

(6) This scenario assumes medium levels of emissions (average climate protection measures) and falls short of the climate protection targets found in the worldwide Paris Climate Agreement adopted at the 2015 COP. The assumed climate protection measures are consistent with the current agreed-upon national reduction plans, which only slightly improve upon the measures that have already been adopted. In this scenario, warming increases to around 2.7 °C in 2100 in comparison to 1850–1900. Scenario 3 is based on scenario SSP2-4.5 in the IPCC report.

(7) This scenario assumes high levels of emissions (weak climate protection measures) and clearly falls short of the climate protection targets found in the worldwide Paris Climate Agreement adopted at the 2015 COP apparent. The assumed climate protection measures represent only the measures that have already been adopted. In this scenario, warming increases to around 3.6 °C in 2100 in comparison to 1850–1900. Scenario 4 is based on scenario SSP3-7.0 in the IPCC report.

(8) This scenario assumes very high levels of emissions (very weak climate protection measures) and clearly falls very short of the climate protection targets found in the worldwide Paris Climate Agreement adopted at the 2015 COP apparent. Climate protection is at an even lower level than in scenario 4 (around 3.6 °C). In this scenario, warming increases to around 4.4 °C in 2100 in comparison to 1850–1900. Scenario 5 is based on scenario SSP5-8.5 in the IPCC report.

Engagement in energy and emissions metering and target setting

Which of the following statements about energy consumption and greenhouse gas emissions currently apply to your enterprise?

a = We monitor our enterprise’s energy consumption

b = We set targets for our enterprise’s energy consumption

c = We monitor our enterprise’s greenhouse gas emissions

d = We set targets for our enterprise’s greenhouse gas emissions

Energy cost share

What proportion of your total production costs(9) is currently accounted for by energy costs?

Response categories were given in 10% splits (i.e., 0%; up to 10%; 10 to less than 20%; etc.)

Pop-up to this question:

(9) In this context, production costs comprise all unit costs related to the production of goods or services destined for sale (in other words, the cost of sales). This includes in particular material costs (energy e.g., heating and lighting, process energy) and labor costs as well as the costs of debt that can be attributed to production.

Analytical approach: Ordinary Least Squares and quantile regressions

We follow established methods and apply Ordinary Least Squares (OLS) linear regression models to evaluate effect size and statistical significance of the correlation between explanatory and dependent variables.

The models analyze climate scenario expectations calculated as the respondent-specific mean of the five scenario temperatures weighted by the attributed probabilities.

From the scenario question, we also calculate the standard deviations of the climate scenario temperature distribution within respondents, which captures respondents’ uncertainty about climate change forecasts.

Figure 5 shows the empirical standard deviation over the attributed scenario probabilities. These values describe the respondents’ degree of uncertainty about their own knowledge. The left-hand side graphs show the frequency of individual empirical standard deviations (A) and their distribution across scenarios (C). Some respondents appear to be relatively uncertain in their assessment while others make their statements with absolute certainty (graph A). However, by nature of the scenario probability question, respondents expecting temperatures between two scenarios must distribute probabilities over the two neighboring scenarios rather than enter the expected “in-between” temperature directly. For instance, an expected global warming of 1.6 °C can be indicated by a combination of the 1.4 °C scenario and the 1.8 °C scenario with a 0.5 probability each. The resulting minimum possible standard deviation would be 0.2 whereas the minimum possible standard deviation for a climate scenario belief of 1.8 °C would be 0. We therefore normalize standard deviation values in order to make them comparable. Starting from the temperature-specific maximum possible standard deviations we multiplicatively downscale respective standard deviation values in order to make zero values for minimum standard deviations mathematically possible. Graphs (B) and (D) depict the data for multiplicatively normalized standard deviations.

Data availability

Data set: “Bundesbank Online Panel – Firms” panel study data

- The data is used in all Figures and Tables of the Article and the Appendix.

- DOI (/URL): https://doi.org/10.12757/Bbk.BOPF.2023Q2.01

- The data is publicly available and free of charge for usage.

- Raw data for the dataset are not publicly available to preserve firms’ and individuals’ privacy.

Code availability

Stata 18 is used for all analyses. The syntax code is available from the corresponding author upon request.

References

IPCC. Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge University Press, (2021).

IPCC. Climate Change 2022: Impacts, Adaptation and Vulnerability. Contribution of Working Group II to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge University Press, (2022).

Dietz, S., Bowen, A., Dixon, C. & Gradwell, P. ‘Climate value at risk’ of global financial assets. Nat. Clim. Chang. 6, 676–679 (2016).

Eyring, V. et al. Reflections and projections on a decade of climate science. Nat. Clim. Chang. 11, 279–285 (2021).

Moore, F. C. et al. Determinants of emissions pathways in the coupled climate-social system. Nature 603, 103–111 (2022).

Pizziol, V. & Tavoni, A. From niches to norms: the promise of social tipping interventions to scale climate action. npj Clim. Action 3; https://doi.org/10.1038/s44168-024-00131-3 (2024).

Bolton, P., Halem, Z. & Kacperczyk, M. The Financial Cost of Carbon. J. Appl. Corp. Financ. 34, 17–29 (2022).

Bolton, P. & Kacperczyk, M. Signaling through Carbon Disclosure. SSRN Journal; https://doi.org/10.2139/ssrn.3755613 (2020).

Kacperczyk, M. & Peydro, J.-L. Carbon Emissions and the Bank-Lending Channel. SSRN Journal; https://doi.org/10.2139/ssrn.3915486 (2021).

Flammer, C. Corporate green bonds. J. Financial Econ. 142, 499–516 (2021).

Barber, B. M., Morse, A. & Yasuda, A. Impact Investing. J. Financial Econ. 139, 162–185 (2021).

Bauer, R., Ruof, T. & Smeets, P. Get Real! Individuals Prefer More Sustainable Investments. Rev. Financial Stud. 34, 3976–4043 (2021).

Aron-Dine, S., Beutel, J., Piazzesi, M. & Schneider, M. Green Premia, (2022).

Hartzmark, S. M. & Sussman, A. B. Do Investors Value Sustainability? A Natural Experiment Examining Ranking and Fund Flows. J. Financ. 74, 2789–2837 (2019).

Rzeźnik, A., Hanley, K. W. & Pelizzon, L. The salience of ESG ratings for stock pricing: Evidence from (potentially) confused investors. Leibniz Institute for Financial Research SAFE.

Larcker, D. F. & Watts, E. M. Where’s the greenium? J. Account. Econ. 69, 101312 (2020).

Moldovan, E., Cort, T., Goldberg, M., Marlon, J. & Leiserowitz, A. The evolving climate change investing strategies of asset owners. npj Clim. Action 3; https://doi.org/10.1038/s44168-024-00168-4 (2024).

Akter, S. & Bennett, J. Household perceptions of climate change and preferences for mitigation action: the case of the Carbon Pollution Reduction Scheme in Australia. Climatic Change 109, 417–436 (2011).

Cameron, T. A. Individual option prices for climate change mitigation. J. Public Econ. 89, 283–301 (2005).

Viscusi, W. K. & Zeckhauser, R. J. The Perception and Valuation of the Risks of Climate Change: A Rational and Behavioral Blend. Climatic Change 77, 151–177 (2006).

Lübke, C. Climate change denial in Europe. In Research Handbook on Environmental Sociology, edited by A. Franzen & S. Mader (Edward Elgar Publishing Limited, Cheltenham, UNITED KINGDOM, 2021), 250–267.

IEA. Climate Policy Uncertainty and Investment Risk, 2017.

Panagiotidis, T. & Printzis, P. Investment and uncertainty: Are large firms different from small ones? J. Economic Behav. Organ. 184, 302–317 (2021).

Lawson, J., Moss, A., Popa, A., Cairns, E. & Mackenzie, C. A. Bespoke, probabilistic approach to climate scenario analysis. https://cepr.org/publications/dp17944, (2023).

Dietrich, A., Müller, G. & Schoenle, R. The Expectations Channel of Climate Change: Implications for Monetary Policy. CEPR Discussion Papers, (202).

Ilut, C. & Schneider, M. Modeling Uncertainty as Ambiguity: a Review, (2022).

Angelico, C. The green transition and firms’ expectations on future prices: Survey evidence. J. Economic Behav. Organ. 221, 519–543 (2024).

Shi, J., Visschers, V. H. M., Siegrist, M. & Arvai, J. Knowledge as a driver of public perceptions about climate change reassessed. Nat. Clim. Chang. 6, 759–762 (2016).

Fischer, H., Amelung, D. & Said, N. The accuracy of German citizens’ confidence in their climate change knowledge. Nat. Clim. Chang. 9, 776–780 (2019).

Tobler, C., Visschers, V. H. M. & Siegrist, M. Consumers’ knowledge about climate change; https://doi.org/10.3929/ethz-b-000052709 (2012).

Poortinga, W., Whitmarsh, L., Steg, L., Böhm, G. & Fisher, S. Climate change perceptions and their individual-level determinants: A cross-European analysis. Glob. Environ. Change 55, 25–35 (2019).

Bruine de Bruin, W. et al. Public Understanding of Climate Change Terminology. Clim. Chang. 167; https://doi.org/10.1007/s10584-021-03183-0 (2021).

Williams, G. Temporal Stability of Attitudes towards Climate Change and Willingness to Pay for the Emissions Reduction Options in Queensland, Australia. Energies 16, 3879 (2023).

Lohmann, P. M. & Kontoleon, A. Do Flood and Heatwave Experiences Shape Climate Opinion? Causal Evidence from Flooding and Heatwaves in England and Wales. Environ. Resour. Econ. 86, 263–304 (2023).

Gärtner, L. & Schoen, H. Experiencing climate change: revisiting the role of local weather in affecting climate change awareness and related policy preferences. Clim. Chang. 167; https://doi.org/10.1007/s10584-021-03176-z (2021).

Meinerding, C., Poinelli, A. & Schüler, Y. Households’ inflation expectations and concern about climate change. Eur. J. Political Econ. 80, 102451 (2023).

Ricart, S., Castelletti, A. & Gandolfi, C. On farmers’ perceptions of climate change and its nexus with climate data and adaptive capacity. A comprehensive review. Environ. Res. Lett. 17, 83002 (2022).

Hernandez Carballo, I. & Sisco, M. R. Examining the effects of gasoline prices on public support for climate policies. Nat. Energy 9, 219–227 (2024).

Osberghaus, D. The determinants of private flood mitigation measures in Germany — Evidence from a nationwide survey. Ecol. Econ. 110, 36–50 (2015).

Nguyen, D. D., Ongena, S., Qi, S. & Sila, V. Climate Change Risk and the Cost of Mortgage Credit. Rev. Financ. 26, 1509–1549 (2022).

Piguet, E. Linking climate change, environmental degradation, and migration: An update after 10 years. WIREs Clim. Change 13; https://doi.org/10.1002/wcc.746 (2022).

Mohammadzadeh Valencia, F. et al. Public support for carbon pricing policies and revenue recycling options: a systematic review and meta-analysis of the survey literature. npj Clim. Action 3; https://doi.org/10.1038/s44168-024-00153-x (2024).

Schlenker, W. & Taylor, C. A. Market expectations of a warming climate. J. Financial Econ. 142, 627–640, https://doi.org/10.1016/j.jfineco.2020.08.019 (2021).

Sen, S., Schickfus, M.-T. & von Climate policy, stranded assets, and investors’ expectations. J. Environ. Econ. Manag. 100, 102277 (2020).

Drellias, E. & Noss, J. Metals, markets and melting points: deriving market expectations of global warming from commodities prices. Available at https://www.kcl.ac.uk/news/metals-markets-and-melting-points-deriving-market-expectations-of-global-warming-from-commodities-prices (2023).

Breeden, D. T. & Litzenberger, R. H. Prices of State-Contingent Claims Implicit in Option Prices. J. Bus. 51, 621–651 (1978).

Kahn, M., Ouazad, A. & Yönder, E. Adaptation Using Financial Markets: Climate Risk Diversification through Securitization, (2024).

Langer, A. & Lemoine, D. What Were the Odds? Estimating the Market’s Probability of Uncertain Events, (2020).

Shimbar, A. Environment-related stranded assets: What does the market think about the impact of collective climate action on the value of fossil fuel stocks? Energy Econ. 103, 105579 (2021).

Tsai, J. & Wachter, J. A. Disaster Risk and Its Implications for Asset Pricing. Annu. Rev. Financ. Econ. 7, 219–252 (2015).

Kang, J. E., Yoon, D. K. & Rhee, J. Factors contributing to business actions in response to climate change in Korea. J. Risk Res. 20, 385–403 (2017).

Dechezleprêtre, A. et al. Fighting Climate Change: International Attitudes Toward Climate Policies (2022).

Martin, R., Preux, L. Bde & Wagner, U. J. The impact of a carbon tax on manufacturing: Evidence from microdata. J. Public Econ. 117, 1–14 (2014).

Martin, R., Muûls, M., Preux, L. Bde & Wagner, U. J. Industry Compensation under Relocation Risk: A Firm-Level Analysis of the EU Emissions Trading Scheme. Am. Economic Rev. 104, 2482–2508 (2014).

Frese, M. & Sabini, J. (eds.). Goal directed behavior. The concept of action in psychology (L. Erlbaum Associates, Hillsdale, N.J, 1985).

Myers, T. A., Maibach, E. W., Roser-Renouf, C., Akerlof, K. & Leiserowitz, A. The relationship between personal experience and belief in the reality of global warming. Nat. Clim. Chang. 3, 343–347 (2013).

Furnham, A. & Boo, H. C. A literature review of the anchoring effect. J. Socio-Econ. 40, 35–42 (2011).

Taddicken, M., Reif, A. & Hoppe, I. What do people know about climate change ― and how confident are they? On measurements and analyses of science related knowledge. JCOM 17, A01 (2018).

Ruiz, I., Faria, S. H. & Neumann, M. B. Climate change perception: Driving forces and their interactions. Environ. Sci. Policy 108, 112–120 (2020).

Shi, J., Visschers, V. H. M. & Siegrist, M. Public Perception of Climate Change: The Importance of Knowledge and Cultural Worldviews. Risk Anal.: Off. Publ. Soc. Risk Anal. 35, 2183–2201 (2015).

Smietanka, P., Schmidt, T., Boddin, D., Köhler, M. & Lösch, S. Bundesbank Online Panel - Firms (BOP-F), (2023).

Boddin, D. & Köhler, M. The High Frequency Firm Survey “Bundesbank Online Panel – Firms”. Jahr.ücher f.ür. Natlökonomie und Statistik 244, 267–275 (2024).

IAB & ZEW. IAB/ZEW-Gründungspanel: Technischer Anhang zur Befragung 2023. IAB; ZEW, (2024).

Rammer, C. & Schubert, T. Dokumentation zur Innovationserhebung 2023. Ergebnisse zu sozialen Innovationen, Umweltinnovationen, Energienutzung und Innovationshemmnissen. ZEW, (2024).

Born, B., Enders, Z., Menkhoff, M., Müller, G. J. & Niemann, K. Firm Expectations and News: Micro v Macro, (2024).

Born, B., Enders, Z., Müller, G. J. & Niemann, K. Firm expectations about production and prices: facts, determinants, and effects. In Handbook of economic expectations, edited by R. Bachmann, G. Topa & W. van der Klaauw (Academic Press, Amsterdam, 2022), 355–383.

Enders, Z., Hünnekes, F. & Müller, G. Firm Expectations and Economic Activity. J. Eur. Economic Assoc. 20, 2396–2439 (2022).

Hausfather, Z. & Peters, G. P. Emissions - the ‘business as usual’ story is misleading. Nature 577, 618–620 (2020).

Deutsche Bundesbank Research Centre. Documentation of the Bundesbank Online Panel Firms (BOP-F). Version: 1.0. Available at https://www.bundesbank.de/resource/blob/825486/6ba083d19e3435ffc7d9d3489907ddf8/mL/fragebogen-08-data.pdf (2022).

Mussweiler, T. & Englich, B. Subliminal anchoring: Judgmental consequences and underlying mechanisms. Organ. Behav. Hum. Decis. Process. 98, 133–143 (2005).

Plous, S. Thinking the Unthinkable: The Effects of Anchoring on Likelihood Estimates of Nuclear War1. J. Appl Soc. Pyschol 19, 67–91 (1989).

Zhang, B. et al. Experimental effects of climate messages vary geographically. Nat. Clim. Chang. 8, 370–374 (2018).

Carbon Disclosure Project. Missing the Mark. 2022 analysis of global CDP temperature ratings, (2022).

Hulkkonen, M., Mielonen, T., Leppänen, S., Laakso, A. & Kokkola, H. How tailored climate information affects attitudes towards climate policy and psychological distance of climate change. npj Clim. Action 3; https://doi.org/10.1038/s44168-024-00136-y (2024).

Liu, T., Shryane, N. & Elliot, M. Attitudes to climate change risk: classification of and transitions in the UK population between 2012 and 2020. Humanities Soc. Sci. Commun. 9, 279 (2022).

Boddin, D., Köhler, M. & Smietanka, P. Bundesbank Online Panel Firms. Data Report 2023-07. Deutsche Bundesbank, (2023).

Wintle, B. C., Fraser, H., Wills, B. C., Nicholson, A. E. & Fidler, F. Verbal probabilities: Very likely to be somewhat more confusing than numbers. PLoS ONE 14, e0213522 (2019).

Kause, A. et al. Confidence levels and likelihood terms in IPCC reports: a survey of experts from different scientific disciplines. Clim. Chang. 173; https://doi.org/10.1007/s10584-022-03382-3 (2022).

Budescu, D. V., Por, H.-H., Broomell, S. B. & Smithson, M. The Interpretation of IPCC Probabilistic Statements around the World. Nat. Clim. Chang. 4, 508–512 (2014).

Deutsche Bundesbank, Research Data and Service Centre. Bundesbank Online Panel – Firmen (BOP-F): Übersicht der Fragen, (2023).

Deutsche Bundesbank, Research Data and Service Centre. Bundesbank Online Panel – Firms (BOP-F): Overview on Questions, (2023).

Acknowledgements

We thank Carlo Gallier and Andreas Diekmann as well as the editor and the reviewers for valuable comments improving our analyses.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Contributions

Both authors conceived the research project, designed the empirical approach and coordinated the statistical analyses as well as the interpretation of results. D.S. prepared the data and conducted the analyses of this study. D.S. drafted the text and C.S. revised the paper. Both authors have approved the paper in the submitted version. The authors have agreed both to be personally accountable for each author's own contributions and to ensure that questions related to the accuracy or integrity of any part of the work, even ones in which the author was not personally involved, are appropriately investigated, resolved, and the resolution documented in the literature.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Schober, D., Schmiedeberg, C. Global warming expectations of German firm representatives are overly optimistic, uncertain, and easily influenced. npj Clim. Action 4, 37 (2025). https://doi.org/10.1038/s44168-025-00244-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1038/s44168-025-00244-3