Abstract

Green hydrogen is critical for decarbonizing hard-to-electrify sectors, but it faces high costs and investment risks. Here we define and quantify the green hydrogen ambition and implementation gap, showing that meeting hydrogen expectations will remain challenging despite surging announcements of projects and subsidies. Tracking 190 projects over 3 years, we identify a wide 2023 implementation gap with only 7% of global capacity announcements finished on schedule. In contrast, the 2030 ambition gap towards 1.5 °C scenarios has been gradually closing as the announced project pipeline has nearly tripled to 422 GW within 3 years. However, we estimate that, without carbon pricing, realizing all these projects would require global subsidies of US$1.3 trillion (US$0.8–2.6 trillion range), far exceeding announced subsidies. Given past and future implementation gaps, policymakers must prepare for prolonged green hydrogen scarcity. Policy support needs to secure hydrogen investments, but should focus on applications where hydrogen is indispensable.

Similar content being viewed by others

Main

There is a widespread consensus among scientists1,2,3,4,5, industry6 and increasingly also policymakers7 that green hydrogen, produced from renewable electricity via electrolysis, is critical for reducing emissions in end-use applications that defy straightforward electrification. Additionally, hydrogen is a promising candidate for long-duration energy storage of renewables8,9 and the precursor to all electrofuels10, which are highly versatile yet costly11. Consequently, policy measures to stimulate the ramp-up of the hydrogen market are gaining momentum as more than 40 governments have already adopted hydrogen strategies1,7. Prominent examples are the supply-side subsidies implemented through the the US Inflation Reduction Act12 and the EU Hydrogen Bank13. Such policy support is urgently required: to meet the median ambition in 1.5 °C scenarios, namely, 350 GW by 2030, green hydrogen production needs to grow 380-fold, more than doubling each year. However, implementation is not going according to plan.

Following a surge of enthusiasm14,15, the green hydrogen market and associated expectations have recently entered a phase of consolidation16 as high costs17,18, limited demand19 and lagging implementation of support policies1 are hampering deployment. Shortfalls in the announced deployment of electrolysers, the key component for green hydrogen production, are representative of the systemic challenges of scaling up supply, demand and infrastructure at the same time. In 2022, instead of the 2.8 GW electrolysis capacity initially announced, eventually only 0.62 GW was realized on time (Fig. 1a). Similarly, in 2023, of the 7.1 GW initially announced, only an estimated 0.92 GW was realized and operational. In stark contrast to these recent setbacks, announced future growth rates of green hydrogen have increased substantially over the past 3 years, indicating a backlog of projects as well as further increasing ambition (Fig. 1b). This raises questions such as whether recent failure rates and the looming ‘valley of death’20 can be overcome to meet updated project announcements, whether the expected role of hydrogen in ambitious climate change mitigation scenarios has changed and what plausible implementation pathways exist given currently announced hydrogen support policies.

a, Past green hydrogen implementation gaps in 2022 and 2023, defined as the difference between project announcements and realized projects (denoted as (1), also see Fig. 3). Realized projects in 2023 show the outcome of project announcements by 2023, based on our own research (Methods). b, Green hydrogen ambition and implementation gaps in 2030. We define the 2030 ambition gap as the difference between 1.5 °C scenarios and project announcements (denoted as (2), also see Fig. 4). The depicted data range shows the IEA Net Zero Emissions by 2050 scenarios, while the full analysis includes further scenarios (Fig. 4a, Extended Data Fig. 1 and Methods). We define the 2030 green hydrogen implementation gap as the difference between project announcements and our estimate of projects that are either supported by implemented demand-side policies or by currently announced subsidies (denoted as (3), see Fig. 5 and Supplementary Fig. 17). The black line indicates our central estimate and the light grey corridor indicates the uncertainty range spanned by the sensitivity analysis. Green hydrogen project announcements are displayed in terms of electrical input capacity of electrolysers. Project announcements are based on three snapshots of the IEA Hydrogen Projects Database, which we have validated comprehensively (see Methods, Supplementary Table 1 and Supplementary Figs. 1–4). The dashed curve between a and b connects the same data point in 2024 and illustrates the different y-axis scale between project announcements until 2024 (a) and until 2030 (b).

In this paper, we structure and analyse the past and future challenges of the nascent green hydrogen industry by introducing and quantifying the green hydrogen ambition and implementation gap. This builds on the well-established concepts of emissions gaps21 and recent extensions towards a carbon dioxide removal gap22. Looking back, we define the past implementation gap as the difference between announced and eventually realized capacity in 2022 and 2023 (Fig. 1a). Looking ahead to 2030, we define the ambition gap as the difference between 1.5 °C scenario requirements and announced projects and find that it has been gradually closing in the past 3 years for most scenarios (Fig. 1b). However, this has been accompanied by a widening future implementation gap, which we define as the difference between announced projects and projects that are backed by policies in 2030 (Fig. 1b). Analysing the competition between green hydrogen (and hydrogen-based electrofuels) and incumbent fossil competitors across 14 end-use sectors, we estimate that realizing all green hydrogen projects would require subsidies, or alternative policies such as end-use quotas, for at least another decade, even with ambitious carbon pricing and potentially indefinitely without. This paper is structured around these three gaps and concludes with a discussion of policy implications to safeguard climate targets against uncertain green hydrogen supply.

The wide green hydrogen implementation gap in 2022 and 2023

Green hydrogen project announcements reveal two opposing trends over the past 3 years. First, there has been a notable short-term setback, with capacities diminishing as projects approach their announced launch year (Fig. 2a). This trend of downward-adjusted expectations persists in both 2022 and 2023, indicating a dramatic green hydrogen implementation gap in recent years. Second, however, this trend reverses from 2024 onwards, with project announcements increasing steadily over the past 3 years (Fig. 2b). This steep mid-term growth of announcements is mostly driven by Europe, which accounts for the largest share of announced capacity by 2030, followed by Australia and Central and South America (Fig. 2d). These opposing trends raise the question as to whether future promises can overcome past setbacks. We address this question in the next section, following the quantification of the 2022 and 2023 green hydrogen implementation gaps.

a,b, Project announcements by status from 2020–2024 (a) and 2024–2030 (b). c,d, Project announcements by region from 2020–2024 (c) and 2024–2030 (d). For each year there are three bars. The left bar shows announcements by 2021, the middle bar shows announcements by 2022 and the right bar shows announcements by 2023, each of which corresponds to different project database snapshots (Methods). Two main trends are visible. First, in 2022 and 2023, project announcements decrease strongly as the year of project launch approaches (a,c), leading to a wide green hydrogen implementation gap (see Fig. 3 and Supplementary Fig. 5). Second, after 2024, this pattern reverses as the project pipeline has surged over the past 3 years (b,d), thereby gradually closing the green hydrogen ambition gap to 1.5 °C scenarios (see Fig. 4). However, the vast majority of projects have not secured an FID yet (b), which gives rise to the 2030 green hydrogen implementation gap due to a mismatch of required and announced policies (see Fig. 5). In contrast to Figs. 1a and 3, this figure does not show the outcome of project announcements for 2023. C and S America, Central and South America; MENA, Middle East and North Africa. Region mapping is available in ref. 67.

Tracking 190 individual green hydrogen projects announced globally for 2023 over the past 3 years (Methods), we observe a substantial implementation gap as only 0.3 GW of the initially announced 4.3 GW added capacity was eventually installed and operational, leading to an overall success rate of 7% (Fig. 3a). Furthermore, comparing announcements by 2021 with the final outcome reveals that virtually no project announced in 2021 was realized on time in 2023, with 86% experiencing delays and 14% disappearing altogether (Fig. 3b). Similarly, of the projects announced in 2022, only 3% were realized on time, with 76% delayed and 21% disappearing (Fig. 3c). Projects in the feasibility study or concept stage almost always had a success rate of zero, implying that projects announced without a final investment decision (FID) in 2021 or 2022 were never realized on time in 2023 (Fig. 3b,c). Across all years of announcement, even projects that had secured FIDs, or that were already under construction, were mostly delayed or had disappeared (Fig. 3b–d). The success rate varies by region, with projects in North America equivalent to the global average, European projects below average, Asian projects above average and a success rate of zero for Australian projects (Supplementary Figs. 7–10). On the global level, these high failure rates are not compensated by an influx of newly announced projects or projects that were delayed from previous years (grey bars in Fig. 3a), such that a dramatic green hydrogen implementation gap of almost 4 GW remained in 2023.

a, Sankey diagram showing the development of green hydrogen projects announced for 2023 in terms of added electrolysis capacity (n = 190). The bars show different snapshots of the underlying project database, where, for example, ‘Announcements by 2021’ refers to the database published in 2021 and therefore contains project announcements made by 2021 (Methods). In 2021, 4.3 GW of new capacity was announced to be installed in 2023. This was revised downward to 2.6 GW in 2022, and again to 1 GW in 2023. Finally, in 2024, it became clear that only 0.3 GW of new capacity had been installed and was operational in 2023. This results in a green hydrogen implementation gap of almost 4 GW in 2023. In contrast to Fig. 2, this figure additionally shows the outcome of project announcements for 2023 as ‘Outcome in 2024’, based on our own research (Methods). The outcome in 2024 refers only to projects that were included in the 2023 database. Additional projects that were missing in the 2023 database could change the success rate. b–d, Percentage rates of success, delay and disappearance of uncertain green hydrogen projects announced to launch in 2023, comparing announcements by 2021 with the outcome in 2024 (b), announcements by 2022 with the outcome in 2024 (c) and announcements by 2023 with the outcome in 2024 (d). In b–d, the left panel shows the total share and the right panel shows the disaggregation by status. As indicated by the horizontal whiskers at the bottom, the widths of the bars in the right panels correspond to the share of the total capacity (also compare with a). Within each colour band, individual projects are shown as segments, ordered by size. The ‘disappeared’ outcome category contains projects that appeared in one database, but were absent in subsequent databases. This includes cancelled or discontinued projects, but may also be due to other reasons (Supplementary Note 1).

The low success rates of green hydrogen projects are not unique to the year 2023. In 2022, the overall success rate was 6%, with similar patterns of delay and disappearance of projects over time (Supplementary Fig. 5). The high failure rates in 2022 and 2023 may be attributed to supply chain disruptions caused by COVID-19, surging electricity prices during the European energy crisis and rising global interest rates. However, in Europe, the energy crisis was also seen as an opportunity to accelerate green hydrogen deployment, although this has yet to materialize (Supplementary Fig. 9). Considering the project announcements for 2024, it remains questionable whether the more than 12 GW currently announced will be realized on time (Supplementary Fig. 6). Although nearly 5 GW (40%) has already achieved an FID or is under construction, this was also the case for project announcements made in 2022 for 2023, of which only 8% were completed on schedule (Fig. 3c). It will take some more years to determine whether the recent implementation gaps were exceptions caused by unusual global events, or the unfortunate norm.

Substantial implementation gaps may be common for emerging energy technologies in the early stages of technology diffusion, as large projects almost always exceed their budget and run behind schedule23. However, while research has identified similarly high failure rates for complex and customized technologies24 such as carbon capture and storage25, this does not apply to highly modular technologies such as solar photovoltaics (PV) and wind power23,26. For green hydrogen, recent evidence suggests that while the mass-producible electrolyser stack is highly modular, other components of the electrolyser system and the overall green hydrogen production plant are more complex and require customization17, making them more prone to budget and time overrun23. As long as the underlying uncertainties remain unresolved, policymakers should avoid relying solely on project announcements to assess progress on green hydrogen.

Apart from the unsettled question of electrolyser modularity, three tangible factors contribute to the low success rate of green hydrogen projects. First, cost estimates for electrolysers have recently surged due to increasing equipment and financial costs1, and because only the electrolyser stack may be set for rapid cost reductions24. Second, analysts have observed a lack of offtake agreements19, which could arise from a limited willingness to pay for costly green hydrogen. Furthermore, required hydrogen end-use investments, such as transforming steel production from a blast furnace to a direct reduction route, are often difficult to reverse and therefore pose the risk of becoming locked into an expensive and potentially scarce energy carrier. Third, bridging the substantial cost gap and reducing investment risks requires hydrogen-specific support policies and regulation, even in countries with ambitious carbon pricing27. However, lagging implementation of support policies1 and regulatory uncertainty regarding green hydrogen production standards in the European Union (EU) and the United States, although crucial to ensure climate benefits28,29, have hampered growth.

What implications does the sobering track record of past project announcements have for the future of green hydrogen in ambitious climate change mitigation scenarios? To explore these ramifications, we next focus on the mid-term horizon towards 2030. First, we provide an overview of electrolysis requirements in 1.5 °C scenarios, introducing the 2030 green hydrogen ambition gap. Second, we analyse the economic viability of surging project announcements and estimate the subsidy volumes that would be required to realize all projects, leading to the 2030 green hydrogen implementation gap.

The closing 2030 green hydrogen ambition gap

Comparing green hydrogen project announcements with 1.5 °C scenarios, we find that the green hydrogen ambition gap for 2030 has been gradually closing over the past 3 years (Fig. 4). Due to a steadily growing project pipeline, the gap has already closed for most scenarios, including the median of both the integrated assessment model (IAM) scenarios (169 GW) and the institutional and corporate scenarios (350 GW).

a, Electrolysis capacity requirements for 2030 in 1.5 °C scenarios from IAMs (n = 60) and from institutional and corporate 1.5 °C scenarios (n = 15), excluding one outlier scenario with a capacity of 1,700 GW in 2030 (see Extended Data Fig. 1). Each dot represents one scenario. Red dots indicate the IEA NZE scenarios (b). The whiskers indicate the range of capacities, 3–1,072 GW for the IAM scenarios and 30–1,016 GW for the institutional and corporate scenarios, underlining the high uncertainty around mid-term green hydrogen deployment. The boxes indicate the upper and lower quartiles, spanning the interquartile range of 38–375 GW for the IAM scenarios and 203–655 GW for the institutional and corporate scenarios. The horizontal line inside each box indicates the median at 169 and 350 GW, respectively. For the IAM scenarios, it remains uncertain whether models explicitly represent different hydrogen applications and whether the results have been vetted. When estimating the required subsidies for a 1.5 °C scenario, we therefore only used the institutional and corporate scenarios (Methods and Supplementary Figs. 11 and 13). Extended Data Fig. 1 shows data for all of the scenarios over time. b, Electrolysis capacity requirements in the IEA NZE scenarios and the project pipeline for 2030. Only the NZE scenarios provide annually updated electrolysis capacity in 2030 over the past 3 years. The x axis shows the year of announcement of the projects database and the year of publication of the NZE scenarios. Individual projects are shown as segments within the coloured bars. For the NZE scenarios, the green hydrogen ambition gap in 2030 has gradually closed as (1) the project pipeline for 2030 has almost tripled in the past 3 years and (2) the NZE scenarios in the past 3 years show a decreasing role of green hydrogen by 2030. For 80% of the IAM scenarios and 60% of the institutional and corporate scenarios, the 2030 ambition gap has already closed. However, more than 97% of the announced project capacity in 2030 is not yet backed by an FID.

Green hydrogen requirements vary substantially across different 1.5 °C scenarios, consistent with previous research30 (Fig. 4a). For 2030, this lack of consensus leads to an enormous range of 3–1,072 GW for the IAM scenarios and 30–1,016 GW for the institutional and corporate scenarios (excluding an outlier of 1,700 GW), with corresponding interquartile ranges of 38–375 and 203–655 GW, respectively. This heterogeneity results from two key uncertainties. First, the pace at which the nascent green hydrogen value chain can be scaled up is highly uncertain31, particularly as project announcements have been a poor indicator of growth. However, to reach 1.5 °C scenarios by 2030, green hydrogen would need to experience unprecedented growth rates (Extended Data Fig. 1a,c). Second, although evidence shows that hydrogen and electrofuels are promising for decarbonizing maritime shipping32, aviation33 and steel34, substantial uncertainty remains concerning the competition with alternative mitigation options such as direct electrification, biofuels or carbon capture and storage35,36,37. This structural uncertainty also persists in the long run, explaining the high heterogeneity until 2050 (Extended Data Fig. 1b,d).

Despite the high heterogeneity, a notable trend emerges in a subset of the 1.5 °C scenarios: the International Energy Agency (IEA) Net Zero Emissions by 2050 Scenario (NZE), which has been updated annually over the past 3 years38,39,40, indicates a steady downward revision of required electrolysis for 2030 (Fig. 4b). This adjustment reflects recent setbacks for green hydrogen and the rapid progress of competing mitigation options, particularly the deep electrification of road transport as well as industrial and residential heat40. Meanwhile, the 2030 green hydrogen project pipeline has nearly tripled from 161 GW to 422 GW, surpassing the requirements for 1.5 °C in 48 of the 60 IAM scenarios, and 9 of the 15 institutional and corporate scenarios. As a result, the green hydrogen ambition gap in 2030 has already closed for 60–80% of the scenarios and can be expected to close soon for the IEA NZE scenario.

Although the convergence of project announcements and 1.5 °C scenarios is encouraging, the past green hydrogen implementation gaps in 2022 and 2023 cast doubt on the reliability of ever-increasing project announcements. Of the 422 GW announced by 2030, 97% are still in the concept or feasibility study phase, which have exhibited critically insufficient success rates in the past (see the previous section). Achieving the level of ambition required in 1.5 °C scenarios hinges on overcoming these high failure rates. Yet, how much policy support would be required to realize all project announcements?

Estimating the 2030 green hydrogen implementation gap

The flipside of the closing of the green hydrogen ambition gap is the widening future green hydrogen implementation gap in 2030, which we define as the difference between project announcements and projects that are supported by policies. In this context, we estimated the policy support required to realize all 422 GW of green hydrogen project announcements by 2030. Modelling pay-as-bid market premium auctions, we estimated the required subsidies across 14 end-use sectors represented in the projects database (Extended Data Fig. 2). We modelled the competition between four green products (green hydrogen, plus three hydrogen-based synthetic electrofuels, e-methanol, e-kerosene and e-methane) and five incumbent fossil competitors (natural gas, grey hydrogen, grey methanol, kerosene and diesel). For each end use, we calculated the gradually declining cost gap between the green product and its fossil competitor, considering higher efficiencies of hydrogen if applicable (Extended Data Table 1) and accounting for end-use-specific transport and storage costs (Supplementary Table 2). We explored the impact of more progressive and more conservative parameter values, which cover wide ranges for green products (Extended Data Table 2) and fossil competitors (Extended Data Table 3). For the latter, we also assessed the impact of a high carbon price in line with EU climate targets. To recover their costs, green hydrogen and electrofuel projects must sell at their respective levelized costs throughout the payback period (see illustrative explanation in Extended Data Fig. 3). Assuming that offtakers are broadly not willing to pay a premium for green products, the cost gap determines the specific per-megawatt hour subsidy required. To estimate the total required subsidies, for each end use, we tracked all project announcements throughout their payback period and combined this vintage tracking with the cost gap between the levelized cost of the projects and the corresponding fossil fuel cost. Our model includes the impact of end-use-specific implemented demand-side policies, which reduce subsidy requirements by increasing the willingness to pay (Supplementary Fig. 15 and Methods) but also incur macroeconomic costs (Supplementary Note 5).

Across all end uses, the competitiveness analysis reveals a substantial and prolonged cost gap between all green products and their respective fossil competitors. This is exemplified by the competition between green hydrogen and natural gas, which is relevant for end uses such as industry, power and grid injection (Fig. 5a,b), as well as between green hydrogen and grey hydrogen, covering the end uses ammonia, refining and some biofuel routes (Fig. 5c,d). Together, these account for over 90% of the announced electrolyser capacity by 2030 (Extended Data Fig. 2). In contrast, project announcements for electrofuels remain limited, which may be due to a larger cost gap to the fossil competitors in the respective end uses (Extended Data Fig. 5g–l). Without carbon pricing, the cost gap between green hydrogen and natural gas of US$150 MWh−1 in 2024 implies that green hydrogen is initially more than seven times as expensive as natural gas (Fig. 5a), while the cost gap between green hydrogen and grey hydrogen is only slightly lower at US$121 MWh−1 in 2024 (Fig. 5c). As green hydrogen costs decrease, the cost gap gradually reduces, but typically prevails also into the long term. This pattern holds across all end uses. Without carbon pricing, in our central estimate, no green product becomes competitive with its fossil competitor until 2050. This is robust across a wide range of progressive and conservative parameter values (Extended Data Fig. 5, left column).

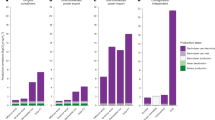

a–d, Cost gap between green hydrogen and natural gas (a,b) and between green hydrogen and grey hydrogen (c,d) without carbon pricing (a,c) and with an ambitious carbon price pathway (b,d) that is in line with reaching EU climate targets41 (US$149 tCO2−1 in 2030, US$246 tCO2−1 in 2040 and US$407 tCO2−1 in 2050, see Extended Data Table 3). These two markets cover over 90% of the project announcements by 2030 (Extended Data Fig. 2). The represented end uses are shown next to each row. Extended Data Fig. 5 displays the full set of competition across all end uses, covering four other markets and different hydrogen-based electrofuels. The red double-headed arrows and the light-red shading indicate the cost gap that needs to be bridged by subsidies. The stacked bars indicate the decomposition of the LCOH and the total cost of the fossil competitor for selected years (2024, 2030, 2035, 2040 and 2045). For easier visualization, the LCOH bar is shown on the left and the fossil competitor bar on the right. Our 2030 LCOH estimates are in line with recent studies (see Extended Data Fig. 4). LHV, lower hydrogen value. O&M, operations and maintenance. CHP, combined heat and power. NA, not available (end use unknown). e,f, Subsidies required to bridge the cost gap across all end uses to realize all project announcements until 2030 on time, without carbon pricing (e) and with carbon pricing (f). The bars show the required annual subsidies (left axis) and the lines show the required cumulative subsidies (right axis). g, Cumulative subsidies required to realize all project announcements by 2030 compared with globally announced hydrogen subsidies as of September 2023 from BloombergNEF (BNEF)43. Our estimate takes currently implemented demand-side policies into account (see Methods and Supplementary Fig. 15). Without carbon pricing, US$1.3 trillion of subsidies are required to realize all projects announced until 2030 (the values in parentheses show the ranges of more progressive and conservative parameters, see Extended Data Fig. 6). Note that e and f show only the subsidies required for green hydrogen project announcements until 2030. Staying on a 1.5 °C scenario requires substantial further subsidies after 2030 (Supplementary Fig. 16 and Table 1).

In contrast, under an ambitious carbon price pathway in line with EU climate targets41 (US$149 tCO2−1 in 2030, US$246 tCO2−1 in 2040 and US$407 tCO2−1 in 2050, see Extended Data Table 3), green products gradually achieve cost parity with their fossil competitors. While the exact timing of cost parity remains highly uncertain, a relative sequence of hydrogen end-use competitiveness can be derived (Fig. 5b,d and Extended Data Fig. 5, right column). In our central estimate, green hydrogen first becomes competitive with grey hydrogen in 2034 (for example, for ammonia and refining), followed by green hydrogen becoming competitive with diesel in 2037 (for mobility), e-methanol becoming competitive with grey methanol in 2043 (for example, for chemicals), and green hydrogen becoming competitive with natural gas in 2044 (for example, for industry and power). In our central estimate, e-kerosene and e-methane narrowly miss reaching cost parity with their fossil competitors by 2050 (Extended Data Fig. 5h,l). Thus, even with ambitious carbon pricing, the cost gap persists for at least one decade, depending on the end use and the scenario. Sustained support policies complementing carbon pricing are therefore essential to foster green hydrogen growth and reduce investment risks.

The main drivers of green hydrogen costs are electricity prices and electrolyser investment costs (Fig. 5a–d). For electrofuels produced from green hydrogen and renewable carbon, these two factors dominate the overall costs (Extended Data Fig. 5g–l). Although electrolyser investment costs have recently surged1,17, this trend is expected to reverse soon due to learning by doing and economies of scale. Note again that to estimate the volume of required subsidies, we considered a scenario where all project announcements until 2030 are realized on time, while after 2030, cost reductions are driven by the median electrolysis capacity in 1.5 °C scenarios (Methods and Supplementary Fig. 11). This leads to rapidly falling electrolyser costs (Supplementary Fig. 12). We used a payback period of 15 years to calculate the levelized costs (Methods), as well as to estimate the required subsidies (Extended Data Fig. 3); this period represents the typical length of implemented policy support such as auctions42 and is therefore more relevant for investment decisions than the technical lifetime. Our 2030 levelized costs of green hydrogen (LCOHs) are consistent with recent studies (Extended Data Fig. 4).

The annual subsidies required to realize all project announcements across all end uses by 2030 are bell-shaped, with the height and timing of the peak varying by scenario (Fig. 5e,f, left axis). Without carbon pricing, the required annual subsidies rise sharply to a plateau of around US$90 billion per year throughout the 2030s (Fig. 5e). With carbon pricing, the required annual subsidies peak at US$44 billion per year in 2030 (Fig. 5f). The resulting cumulative subsidies for all 422 GW by 2030 follow an S curve (Fig. 5e,f, right axis). In our central estimate, the required cumulative subsidies are US$1.3 trillion without carbon pricing and US$0.5 trillion with carbon pricing, subject to considerable uncertainty (Table 1 and Extended Data Fig. 6). However, these figures only pertain to the 2030 project pipeline. Aligning green hydrogen with 1.5 °C scenarios after 2030 would require substantially higher subsidies, rising to US$9.3 trillion (US$4.2–17.7 trillion range) without carbon pricing by 2050 (Table 1 and Supplementary Fig. 16).

Due to a substantial discrepancy between required and announced subsidies, a wide 2030 green hydrogen implementation gap arises (Fig. 5g and Table 1). The cumulative subsidies required to realize all project announcements by 2030 exceed currently announced subsidies, estimated at US$308 billion as of September 202343, by over 300% without carbon pricing and by over 60% without. There are counteracting uncertainties regarding this estimate, as announced subsidies are likely to increase in the future, but challenges may arise during their implementation (Methods). Even if all currently announced global subsidies were immediately available, without carbon pricing this would only support 61 GW (32–106 GW range) by 2030 (Supplementary Fig. 17). Depending on the scenario, implemented demand-side policies could support a similar share of project announcements, underlining the crucial role of demand-side regulation for fostering green hydrogen growth.

Our results indicate that permanently subsidizing green hydrogen and electrofuels to compete with cheap fossil fuels would likely end up being prohibitively expensive in the long term, highlighting the key role of carbon pricing in closing the cost gap. Without carbon pricing, green hydrogen growth in line with the 1.5 °C scenario median requires annual subsidies that far exceed the historical support of solar PV and wind (Extended Data Fig. 7a). In particular, without carbon pricing, green hydrogen and electrofuels likely require subsidies until at least 2050 (Extended Data Fig. 7c and Table 1). In contrast, under an ambitious carbon price pathway, the required green hydrogen and electrofuel subsidies could remain in the same range historically observed for solar PV and wind, with per-megawatt hour subsidies steadily decreasing until 2050 (Extended Data Fig. 7b,d).

Discussion and conclusion

The past and future of green hydrogen is characterized by three gaps, reflecting the challenges of scaling-up a novel and as yet uncompetitive energy carrier that requires dedicated policy support. First, the 2023 implementation gap shows that only 7% of initially announced green hydrogen capacity was eventually realized. Second, the 2030 ambition gap has gradually closed over the past 3 years as the project pipeline increasingly exceeds the requirements in 1.5 °C scenarios. Third however, this has led to a wide 2030 implementation gap as enormous subsidies would be required to realize all of the projects by 2030, and even more to put green hydrogen on track for 1.5 °C in the long term.

The high past failure rates indicate a limited reliability of project announcements published by industry, which may announce green hydrogen projects for strategic reasons, such as raising attention or attracting subsidies. Although sobering, this can provide valuable insights for realistic scale-up analyses of green hydrogen31 and other low-carbon energy technologies in feasibility studies44,45,46, some of which45 have recently faced criticism for lacking statistical rigour47. Our results are particularly useful for analyses that use uncertain project announcements as input data25,48. System planners, policymakers and society should interpret the increasingly steep growth suggested by recent project announcements with caution, focusing on scale-up challenges, such as lacking competitiveness and the need for policy support.

To close the green hydrogen implementation gap, policymakers need to bridge the cost gap to fossil fuels and de-risk hydrogen investments. This requires a balanced policy mix and a robust strategy to navigate the following three key uncertainties and risks.

First, the huge past and future implementation gaps indicate that green hydrogen will likely fall short of 1.5 °C scenarios. Even if policy support is strengthened, it remains uncertain whether this would be sufficient to drive the necessary hydrogen investments. Realizing current project announcements would require unprecedented growth rates (Extended Data Fig. 1a,c), exceeding even the fastest-growing energy technology in history, namely, solar PV. Given that green hydrogen technologies are more complex, less standardizable and require new infrastructure, all of which slow down technology diffusion24, realizing such unprecedented growth is unlikely.

Second, current hydrogen policy instruments often seek to spur hydrogen investments by bridging the cost gap to fossil fuels through supply-side subsidies such as fixed-premium auctions. However, as we have shown, this approach requires not only excessive subsidy volumes but also strong perseverance as policy support could be required for several decades, or even indefinitely without carbon pricing or strong demand-side regulation. Subsidies for near-term green hydrogen production are often framed within a narrative of kickstarting a ‘hydrogen economy’ through a short policy push, after which green hydrogen becomes cost-competitive and scales up on its own. However, this critically depends on optimistic assumptions about technology cost reductions, which stands in contrast to recent cost increases of electrolysers1. Without ambitious cost reductions, the ‘kickstarting’ narrative is misleading and raises false hopes.

Third, the primary role of hydrogen in climate change mitigation is to replace fossil fuels in hard-to-electrify sectors. However, strong political support for hydrogen is often accompanied by overconfidence in its potential15, resulting in conflicting visions about its future role. Many global climate change mitigation scenarios show a modest long-term share of hydrogen of 5–15% in final energy2,40,49, focusing on key end uses where hydrogen is highly valuable due to a lack of alternatives5. In stark contrast, incumbent actors in gas, heat, industry and transport tend to endorse a wide use of hydrogen across sectors50, even in end uses such as residential heat, where electrification is cheaper, more efficient and readily available2,40,49,51. Uncertainties remain around the role of hydrogen in complementing the electrification of heavy transport and industrial heat11,35,40.

Disregarding these uncertainties and risks, and instead focusing on supply-side subsidies with the expectation of abundant low-cost green hydrogen in the future, risks crowding out readily available and more economical options, thereby delaying climate change mitigation. To minimize these risks while safeguarding the scale-up of green hydrogen, we draw two key policy conclusions.

First, supply-side subsidies, which reduce the investment risk of electrolysis projects, should be complemented by demand-side policies that guide hydrogen to its most valuable use cases by increasing their willingness to pay. The benefit of demand-side measures is illustrated by the European Hydrogen Bank’s recent inaugural auction, which resulted in surprisingly low successful bids of €0.37–0.48 kg−1 (ref. 52) compared with a similar auction in the UK, which received only high bids equivalent to €9.40 kg−1 (ref. 53). Aside from regional heterogeneity, this stark difference may be attributed to the EU’s demand-side quotas, such as the mandatory 42% green hydrogen share of all hydrogen used in industry by 2030 under the Renewable Energy Directive III (ref. 54), and mandates for hydrogen-based electrofuels under ReFuelEU Aviation55 and FuelEU Maritime56 regulations. Although they incur macroeconomic costs (Supplementary Note 5), demand-side policies can reduce the pressure on supply-side subsidies, helping to close the implementation gap.

Second, policymakers should plan the transition from subsidies to market mechanisms. In the short run, achieving rapid near-term hydrogen growth is crucial to keep 1.5 °C scenarios within reach. This requires strong policies, such as subsidies to directly bridge the cost gap, minimize investment risks and initialize a hydrogen market. However, as hydrogen technologies and markets mature, policy support should shift to market-based mechanisms to (1) reduce policy costs, (2) reveal the full hydrogen costs to markets and consumers, and (3) create a level playing field with other mitigation options. The most important technology-neutral strategy is ambitious carbon pricing. However, as carbon prices are currently too low and too uncertain in the future, complementary instruments are required to de-risk the remaining uncertainties. These include technology-neutral auctions of carbon contracts for difference57, which hedge investors against unpredictable prices by covering the difference between emissions abatement costs and carbon prices, as well as tradable, technology-neutral quotas for, for example, low-carbon materials, fostering green lead markets.

In summary, a comprehensive policy strategy for green hydrogen should include targeted demand-side measures and a gradual transition from subsidies to market mechanisms. In the short term, this would de-risk early investment at manageable costs, guiding hydrogen to its most valuable use cases. In the long term, this would transfer investment risks and competition between hydrogen and other mitigation options to the market, thereby establishing a credible commitment for climate change mitigation while spurring green hydrogen growth.

Methods

Overview

Our approach was split into three parts. First, we tracked green hydrogen project announcements to quantify the green hydrogen implementation gap in 2022 and 2023. Second, we compared project announcements with 1.5 °C scenarios to show the 2030 green hydrogen ambition gap. Third, we modelled the pay-as-bid market premium and estimated required subsidies using a competitiveness analysis of four green products and five fossil competitors across 14 end uses, which led to the 2030 green hydrogen implementation gap.

Green hydrogen projects database

We used data of electrolysis project announcements from the IEA Hydrogen Production Projects and Infrastructure Database58 (previously called the IEA Hydrogen Projects Database), incorporating three database snapshots from 2021, 2022 and 2023. We only included project announcements for electrolysers that included a year of project launch, had a meaningful status (not ‘Other’ or ‘Other/Unknown’) and reported a capacity value. We did not filter for the type of electricity as this was often unknown. These criteria led to 612 projects in the 2021 snapshot, 877 projects in the 2022 snapshot and 1,265 projects in the 2023 snapshot. In the 2023 snapshot, only a single status category was reported for projects that were either under construction or had an FID (‘FID/Construction’). To ensure consistent status categories across all snapshots, we merged the ‘FID’ and ‘Under construction’ categories in the 2021 and 2022 snapshots. Projects with a ‘DEMO’ status were allocated as ‘Operational’, ‘FID/Construction’ or ‘Decommissioned’, depending on whether they were still running, announced for the future or had been decommissioned, respectively. We note that the ‘Concept’ category is very broadly defined with an unspecified credibility bar for inclusion, while the ‘Feasibility study’ category may also contain projects for which a feasibility study is planned, but has not yet started. Confidential projects were distributed to all regions in proportion to the share of capacity from non-confidential projects, but could not be tracked across database snapshots.

Data quality validation

We conducted a comprehensive, structured and fully documented data quality validation of the green hydrogen project announcements, manually validating 524 project entries across all three database versions. For projects announced for 2022 or 2023, we covered at least 90% of the announced capacity, while for projects announced for 2024–2030, we covered at least 75% of the announced capacity in all three database versions (Supplementary Table 1). In addition, we manually verified the fate of all projects announced to launch in 2023 in the database published in October 2023 (Fig. 3). Note that we did not attempt to identify missing projects, implying that the success rate may change if projects that were realized in 2023 were missing from the most recent database version included in this analysis, published in October 2023. During the data validation, we adjusted the size of a project if it was not operating at its nameplate capacity, which was the case for the world’s largest green hydrogen project, Sinopec Kuqa in China. The data quality validation procedure is described in detail in Supplementary Note 1.

Tracking green hydrogen projects

Each project has a unique reference number that stays the same across all database snapshots, as confirmed by the IEA in personal correspondence. This enabled us to track the development of project announcements over time (see Fig. 3 for projects announced for 2023, Supplementary Fig. 5 for projects announced for 2022 and Supplementary Fig. 6 for projects announced for 2024). Supplementary Figs. 7–10 also show the 2023 project tracking for those regions that have at least ten trackable project entries. We accounted for changing capacity of projects between two database snapshots by adding dummy projects, which are, however, not explicitly shown in the Sankey diagrams for simplicity. The reported rates of disappearance, delay and success (Fig. 3b–d and Supplementary Fig. 5b, c) only refer to projects announced in 2021, 2022 and 2023, respectively.

Green hydrogen in 1.5 °C scenarios

As an indicator of green hydrogen requirements in stringent climate mitigation scenarios, we collected electrolysis capacity values from a wide range of 1.5 °C scenarios, including (1) IAM scenarios and (2) institutional and corporate scenarios (Extended Data Fig. 1). For the IAM scenarios, we used the IPCC AR6 Scenarios Database59 (category C1) as well as the Network for Greening the Financial System (NGFS) dataset60 (Version 4.2, the ‘Net Zero 2050’ and ‘Low demand’ scenarios). We excluded IAM scenarios that always report zero electrolysis capacity (or zero electrolytic hydrogen production) or, in any period from 2025, report a value that is lower than the operational electrolysis capacity in 2023. We also omitted scenarios from the NGFS project that included climate damages as this is only reported by one model. For the institutional and corporate scenarios, due to limited reporting of numerical data in text or tables, in some cases we resorted to extracting data from graphics using WebPlotDigitizer, which has been shown to be reliable61. All datasets are available via GitHub (see the Data availability statement). If electrolysis capacity was not directly reported, we converted production quantities into electrolysis capacity, assuming 3,750 full load hours, 69% efficiency and the lower heating value of hydrogen, 33.33 kWh kg−1. For IAM scenarios, we transformed the reported hydrogen output capacity to the corresponding input capacity of the electrolyser using the efficiency of 69%. Due to these approximations, reported electrolysis requirements in 1.5 °C scenarios are inherently uncertain.

Modelling pay-as-bid market premiums

To quantify the future green hydrogen implementation gap, we developed a model of the required pay-as-bid market premiums for green hydrogen projects (Extended Data Fig. 3). First, we mapped each of the 14 end-use categories from the green hydrogen projects database to the competition between a green product and a fossil competitor, covering four green products (green hydrogen, e-methanol, e-kerosene and e-methane) and five fossil competitors (grey hydrogen, natural gas, grey methanol, diesel and kerosene), as shown in Extended Data Table 1. For projects without a designated end use, we assumed that green hydrogen competes with natural gas. Second, we calculated the levelized cost of all green products (Extended Data Table 2) and the prices of all fossil competitors with and without an ambitious carbon price pathway that is in line with EU climate targets41 (Extended Data Table 3). Details on these costs and prices are explained in the following sections. Third, we incorporated demand-side policies such as end-use quotas, which increase the willingness to pay for green products and thereby reduce required policy costs (Supplementary Fig. 15). Finally, for each end use, we estimated the required subsidies based on (1) vintage tracking of project announcements and (2) the cost gap between the green product and the fossil competitor (Extended Data Fig. 3).

We included global estimates of implemented demand-side policies in 2030 across four end uses, provided by the IEA1, which we converted into the corresponding electrolysis capacities using the lower heating value, as well as the full load hours and efficiencies of the respective scenario. We proportionally distributed these estimates of electrolysis capacity that are supported by demand-side regulation in 2030 according to the project announcements from 2024–2030 (Supplementary Fig. 15).

If the capacity supported by demand-side policies exceeded the announced capacity, which is the case for refining and synthetic fuels, we omitted the difference, assuming that demand-side policies are end-use specific.

To estimate the required annual subsidies, we combined these components. As shown in Fig. 5a–d and Extended Data Fig. 5, for each end use, the instantaneous cost gap (Δpt) between the levelized cost of the green product in year t (LCOXt) and the price of the fossil competitor (\({p}_{t}^{{{\rm{fossil}}}}\)) is given as:

However, this cannot be used directly to estimate subsidies. As illustrated in Extended Data Fig. 3, a green hydrogen or electrofuel project completed in year t′ must sell the green product at \({{\rm{LCOX}}}_{t^{\prime}}\) for the entire duration of the payback period τ to recover its costs. The required annual subsidies accumulate over time due to projects built in previous years. For example, in 2026, projects that were built in 2024 face a cost gap of \({{\rm{LCOX}}}_{2024}-{p}_{2026}^{{{\rm{fossil}}}}\), projects that were built in 2025 face a cost gap of \({{{\rm{LCOX}}}}_{2025}-{p}_{2026}^{{{\rm{fossil}}}}\) and projects that were built in 2026 face a cost gap of \({{{\rm{LCOX}}}}_{2026}-{p}_{2026}^{{{\rm{fossil}}}}\). These cost gaps have to be bridged for the electrolysis capacity built in the corresponding year t′, denoted as \(\Delta C_{t ^{\prime}}\) (accounting for capacity supported by demand-side policies). For each end use, with electrolyser full load hours \({{\rm{FLH}}}_{{\rm{H}}_2}\), electrolyser efficiency \({\eta }_{{\rm{H}}_2}\) and payback period τ, the required annual subsidy (\({S}_{t}^{{{\rm{annual}}}}\)) in year t is given as:

Note that for subsidies in year t, only the price of the fossil competitor (\({p}_{t}^{{{\rm{fossil}}}}\)) refers to the same year t, whereas all other parameters refer to the year t′ in which the project was built. Thus, the realization of green hydrogen projects built in the year t′ requires subsidy payments for the full payback period \([t^{\prime},\;t^{\prime} +\tau)\) as long as \({{{\rm{LCOX}}}}_{t^{\prime} } > {p}_{t}^{{{\rm{fossil}}}}\). For end uses where the green product and the fossil competitor are not used thermally, we included the relative efficiency improvement of using the green product over the fossil competitor, \({\eta }_{{{\rm{LHV}}}}^{{{\rm{green}}}}/{\eta }_{{{\rm{LHV}}}}^{{{\rm{fossil}}}}\), adjusting the LCOX accordingly (Extended Data Table 1). Note that for green hydrogen, we denote LCOX as LCOH. Correspondingly, the required cumulative subsidies until year t (\({S}_{t}^{{{\rm{cumulative}}}}\)) are given by:

We show in Fig. 5e–g and Extended Data Fig. 6 the required annual and cumulative subsidies as the sum over all end uses.

To analyse what would be required for a 1.5 °C scenario, after 2030 we used the median of the institutional and corporate 1.5 °C scenarios for \({\Delta C}_{t^{\prime} }\) (Extended Data Fig. 1b and Supplementary Fig. 11). To determine the sectoral allocation of the overall capacity to the 14 end uses after 2030, we used the green hydrogen end-use shares of the IEA NZE Scenario40 (Supplementary Fig. 13). The results for this 1.5 °C scenario until 2050 are presented in Supplementary Fig. 16.

Levelized costs of green products

For all green products, we first calculated LCOH for each year from 2024 using the annuity method and broadly following the system boundaries outlined in ref. 62 (for the parameters, see Extended Data Table 2), but adding end-use-specific transport and storage costs (Supplementary Table 2). Omitting time indices, the LCOH was calculated as:

where \({\eta }_{{\rm{H}}_2}\) denotes the electrolyser efficiency, \(a(r,\tau )=\frac{r}{1-{(1+r)}^{-\tau }}\) is the annuity factor, \(r\) is the cost of capital, τ is the payback period in years (which can be shorter than the technical lifetime), τstack is the lifetime of the electrolyser stack in years, \({{\rm{FOM}}}_{{\rm{H}}_2}\) is the fixed operation and maintenance costs as a percentage of the specific investment costs, IBOP is the specific investment cost of the electrolyser’s balance of plant (BOP) and other engineering work, Istack is the specific investment cost of the electrolyser stack, \({{\rm{FLH}}}_{{\rm{H}}_2}\) is the electrolysis full load hours, pelec is the price of electricity and \({{\rm{VOM}}}_{{\rm{H}}_2}\) is the variable operation and maintenance costs, which are transport and storage costs (Supplementary Table 2). Both IBOP and Istack relate to the electrical input capacity of the electrolyser (US$ kWel−1).

The electricity price paid by electrolysers is highly dependent on the specific supply case and the regulatory definition of green hydrogen with respect to spatio-temporal matching and additionality28,29. Flexible operation and a direct connection to a renewable energy source reduces the price as electrolysers can tap into hours when electricity is cheap and abundant. Grid-connected electrolysers need to pay grid fees on top of electricity prices, but can run at higher full load hours. Furthermore, stationary batteries can extend the electrolyser’s full load hours by providing a buffer for renewable electricity, but require additional investments. While hourly energy system models can represent these effects in detail28, we accounted for them in an aggregated manner by using the same broad range of electricity prices as in ref. 27. This ensures high traceability of results, while still capturing the effects of system heterogeneity. Further discussion is provided in Supplementary Note 2, while Supplementary Note 3 discusses how energy system models could learn from our results.

We separated the total specific investments costs of the electrolyser (I) into Istack and IBOP because (1) the stack needs to be replaced earlier than the rest of the electrolyser, such that we included two annuities in equation (4)62, and (2) the stack is much more modular and therefore more susceptible to cost improvements17, which we included through different learning rates. Technological learning reduces specific investment costs of both IBOP and Istack in year t (It) according to

where I2023 denotes the investment costs in 2023, Ct denotes the global cumulative electrolysis capacity in year t, C2023 = 0.92 GW installed capacity in 2023 and LR denotes the learning rate. Technological learning is driven by cumulative project announcements until 2030 and subsequently by the median 1.5 °C scenario (Supplementary Fig. 11). Thus, electrolyser costs fall quickly (Supplementary Fig. 12).

For electrofuels derived from green hydrogen (e-kerosene, e-methanol and e-methane), the corresponding LCOX are

where FOMX represents fixed operation and maintenance costs, IX is the specific investment cost of the electrofuel synthesis plant (in terms of electrofuel output), FLHX is the full load hours of the synthesis plant, \({p}_{{\rm{H}}_2}={{\rm{LCOH}}}-{{\rm{VOM}}}_{{\rm{H}}_2}\) is the price of hydrogen (that is, the LCOH without transport and storage costs), ηX is the synthesis energy efficiency, \({p}_{{{\rm{CO}}}_2}\) is the price of renewable CO2 (not the carbon price of emissions), εX is the CO2 intensity of the electrofuel and VOMX is the end-use-specific transport and storage costs (Supplementary Table 2).

The price of renewable CO2, which can either come from biogenic sources or from direct air capture, is an uncertain but important cost component for the production of carbon-neutral electrofuels (Extended Data Fig. 5g–l). While biogenic carbon can initially be as cheap as US$30 tCO2−1, it likely faces availability limits such that it could quickly become more expensive as demand increases (see, for example, Fig. 6.3 in ref. 63). In contrast, direct air capture is more scalable, but currently faces very high costs in the order of US$500–1,000 tCO2−1, which could reduce to approximately US$300 tCO2−1 once the scale of 1 GtCO2 yr−1 is reached in the long term64, although this is again subject to substantial uncertainty. In our central estimate, we set the average cost of renewable carbon to US$200 tCO2−1, which reflects the different CO2 sources reported in electrofuel projects, while the progressive and conservative sensitivity scenarios covered a wide range of US$30–300 tCO2−1.

Prices of fossil competitors

We collected harmonized data on prices for all fossil competitors represented in our pay-as-bid market premium model for 2024, 2030 and 2050 (for parameters, see Extended Data Table 3), using linear interpolation in between. For natural gas, our cost estimate was the average of the EU trading point Title Transfer Facility in the Netherlands and the US trading point Henry Hub, using spot market prices in 2024 and future prices in 2030. For 2050, we used the gas price from the IEA NZE 1.5 °C scenario40. For grey hydrogen and grey methanol, which are produced from natural gas, we first collected current prices for 2024. To ensure internal consistency with natural gas prices, we then calculated the corresponding specific fixed costs in 2024, which reflect the per-megawatt hour capital costs associated with the synthesis plant. Assuming that these stay constant, for 2030 and 2050 we inferred the price of grey hydrogen and grey methanol by adding the corresponding variable costs, that is, the natural gas price divided by the efficiency. We proceeded similarly for kerosene and diesel, using crude oil spot and future prices as the reference for 2024 and 2030, respectively, while for 2050 we again used the oil price from the IEA NZE 1.5 °C scenario. This calibration ensured that prices for fossil products are internally consistent.

Last, we differentiated between scenarios without and with ambitious carbon pricing. For the latter, we used a carbon price pathway that is in line with EU climate targets in the sectors covered by the EU Emissions Trading System, such as industry and energy supply41. The CO2 cost per megawatt hour of the fossil competitor is the product of the emissions intensity, including upstream methane emissions for natural gas, grey hydrogen and grey methanol27, and the carbon price per tonne of CO2. We denote the total cost as pfossil, which includes CO2 costs if applicable. In addition, for natural gas, we considered grid fees of US$5 MWh−1 based on ref. 65 (Supplementary Table 2).

Limitations

As the quality of the data of the IEA Hydrogen Production and Infrastructure Projects Database58 may be limited, we conducted a comprehensive data validation (see the section ‘Data quality validation’, Supplementary Note 1, Supplementary Table 1 and Supplementary Figs. 1–4). Nevertheless, some errors may remain, particularly for smaller projects that were not checked. In general, there are counteracting uncertainties related to project announcements. On the one hand, the database may underestimate projects, as we verified only existing entries and did not conduct research to identify potentially missing projects. On the other hand, the database may include projects that are no longer active, as it is often unclear if and when a project has been scrapped.

The quality of the data of the electrolysis requirements in 1.5 °C scenarios is limited due to heterogeneous sources and limited numerical reporting of the scenario data accompanying the reports. In several cases, we had to infer electrolysis capacity from green hydrogen production values, also for IAM scenarios. Thus, Fig. 4 and Extended Data Fig. 1 show only estimates of electrolysis capacity using publicly available data and should not be interpreted as numerically exact.

Modelling the pay-as-bid market premium to estimate subsidies required several simplifications. First, although we distinguished between 14 end-use applications, four green products and five fossil competitors, we did not account for regional differences in hydrogen production costs. Our estimates can be interpreted as cross-regional averages. Note that our sensitivity ranges are large enough to contain the regional cost heterogeneity found in GIS-based analyses66. Second, we neglected additional end-use transformation costs, which are typically small or even zero, for example, for drop-in electrofuels. Some applications can simply replace grey with green hydrogen with no additional costs (for example, ammonia production), while additional investment costs in other applications are low compared with fossil applications (for example, direct reduced iron-based steel plants or hydrogen boilers). Third, we calculated levelized costs using constant electricity prices, assuming that green hydrogen projects require new dedicated renewable energy plants or long-term contracted power-purchase agreements that deliver electricity at stable prices. Similarly, for electrofuels, this implies dedicated electrolysers or long-term contracts that deliver green hydrogen at constant prices. Fourth, we did not consider the option that projects could pay back a part of the received subsidies once they are profitable relative to their fossil competitor in the future because this would require a contract for differences that allows for this option. Fifth, we did not include factors other than costs that influence the project realization as this was outside the scope of this analysis. Sixth, we did not incorporate the competition of green hydrogen with blue hydrogen and other mitigation options, which we discuss in Supplementary Note 4. Last, we assumed that demand-side policies directly translate into electrolysis capacity without the need for additional subsidies.

The quality of the data of global announced hydrogen subsidies from BloombergNEF (BNEF) may be limited and will likely soon be outdated. The estimate for US subsidies is particularly uncertain as the production tax credits of the Inflation Reduction Act12 are uncapped such that BNEF bases their US subsidy estimates on hydrogen project announcements. Furthermore, the tracked subsidies cover not only green hydrogen but also other sources of low-carbon hydrogen, which we optimistically compared to subsidy requirements only for green hydrogen project announcements. The global subsidy volume of US$308 billion for low-carbon hydrogen as of September 2023 therefore serves only as a snapshot. Although this figure will be outdated soon, it still offers a valuable reference point. However, it should be interpreted with caution as the implementation of these subsidies will critically depend on future government commitments to foster the hydrogen market ramp-up.

Data availability

All of the data are publicly available via GitHub at https://github.com/aodenweller/green-hydrogen-gap and via Zenodo at https://doi.org/10.5281/zenodo.14041796 (ref. 67). All of the data files include a column that indicates the original source.

Code availability

The R model code used to perform the analyses and produce all figures is available via GitHub at https://github.com/aodenweller/green-hydrogen-gap and via Zenodo at https://doi.org/10.5281/zenodo.14041796 (ref. 67).

References

Global Hydrogen Review 2023 (IEA, 2023); https://www.iea.org/reports/global-hydrogen-review-2023

World Energy Transitions Outlook 2023: 1.5 °C Pathway (IRENA, 2023); https://www.irena.org/Publications/2023/Jun/World-Energy-Transitions-Outlook-2023

Clarke, L. et al. Climate Change 2022: Mitigation of Climate Change (eds Shukla, P. A. et al.) 613–746 (IPCC, Cambridge Univ. Press, 2022); https://doi.org/10.1017/9781009157926.008

Davis, S. J. et al. Net-zero emissions energy systems. Science https://doi.org/10.1126/science.aas9793 (2018).

Wolfram, P., Kyle, P., Fuhrman, J., O’Rourke, P. & McJeon, H. The hydrogen economy can reduce costs of climate change mitigation by up to 22%. One Earth 7, 885–895 (2024).

Hydrogen Insights 2023 (Hydrogen Council and McKinsey & Company, 2023); https://hydrogencouncil.com/en/hydrogen-insights-2023-december-update/

Comparative Analysis of International Hydrogen Strategies, Country Analysis 2023 (DECHEMA and acatech, 2024); https://www.wasserstoff-kompass.de/fileadmin/user_upload/img/news-und-media/dokumente/2023_e_H2_Laenderanalyse.pdf

Hunter, C. A. et al. Techno-economic analysis of long-duration energy storage and flexible power generation technologies to support high-variable renewable energy grids. Joule 5, 2077–2101 (2021).

Dowling, J. A. et al. Role of long-duration energy storage in variable renewable electricity systems. Joule 4, 1907–1928 (2020).

Dieterich, V., Buttler, A., Hanel, A., Spliethoff, H. & Fendt, S. Power-to-liquid via synthesis of methanol, DME or Fischer–Tropsch-fuels: a review. Energy Environ. Sci. 13, 3207–3252 (2020).

Ueckerdt, F. et al. Potential and risks of hydrogen-based e-fuels in climate change mitigation. Nat. Clim. Change 11, 384–393 (2021).

117th United States Congress Inflation Reduction Act (US Government, 2022).

Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee of the Regions on the European Hydrogen Bank (European Commission, 2023).

van Renssen, S. The hydrogen solution? Nat. Clim. Change 10, 799–801 (2020).

Overhyping hydrogen as a fuel risks endangering net-zero goals. Nature 611, 426 (2022).

Reducing Low-Carbon Hydrogen Investment and Operating Costs. (Capgemini and EIT InnoEnergy, 2024); https://www.capgemini.com/insights/research-library/reducing-low-carbon-hydrogen-investment-and-operating-costs/

Achieving Affordable Green Hydrogen Production Plants (Ramboll, 2023); https://www.ramboll.com/net-zero-explorers/what-will-it-take-to-reduce-capex-in-green-hydrogen-production

Shafiee, R. T. & Schrag, D. P. Carbon abatement costs of green hydrogen across end-use sectors. Joule https://doi.org/10.1016/j.joule.2024.09.003 (2024).

Hydrogen offtake is tiny but growing. BloombergNEF https://about.bnef.com/blog/hydrogen-offtake-is-tiny-but-growing/ (2023).

Nemet, G. F., Zipperer, V. & Kraus, M. The valley of death, the technology pork barrel, and public support for large demonstration projects. Energy Policy 119, 154–167 (2018).

Lessons from a Decade of Emissions Gap Assessments (United Nations Environment Programme, 2019); https://www.unenvironment.org/resources/emissions-gap-report-10-year-summary

Lamb, W. F. et al. The carbon dioxide removal gap. Nat. Clim. Change https://doi.org/10.1038/s41558-024-01984-6 (2024).

Flyvbjerg, B. & Gardner, D. How Big Things Get Done: The Surprising Factors That Determine the Fate of Every Project from Home Renovations to Space Exploration, and Everything in Between (Penguin Random House, 2023).

Malhotra, A. & Schmidt, T. S. Accelerating low-carbon innovation. Joule 4, 2259–2267 (2020).

Kazlou, T., Cherp, A. & Jewell, J. Feasible deployment of carbon capture and storage and the requirements of climate targets. Nat. Clim. Change 14, 1047–1055 (2024).

Wilson, C. et al. Granular technologies to accelerate decarbonization. Science 368, 36–39 (2020).

Ueckerdt, F. et al. On the cost competitiveness of blue and green hydrogen. Joule 8, 104–128 (2024).

Zeyen, E., Riepin, I. & Brown, T. Temporal regulation of renewable supply for electrolytic hydrogen. Environ. Res. Lett. 19, 024034 (2024).

Ricks, W., Xu, Q. & Jenkins, J. D. Minimizing emissions from grid-based hydrogen production in the United States. Environ. Res. Lett. 18, 014025 (2023).

Quarton, C. J. et al. The curious case of the conflicting roles of hydrogen in global energy scenarios. Sustain. Energy Fuels 4, 80–95 (2019).

Odenweller, A., Ueckerdt, F., Nemet, G. F., Jensterle, M. & Luderer, G. Probabilistic feasibility space of scaling up green hydrogen supply. Nat. Energy 7, 854–865 (2022).

Müller-Casseres, E. et al. International shipping in a world below 2 °C. Nat. Clim. Change https://doi.org/10.1038/s41558-024-01997-1 (2024).

Dray, L. et al. Cost and emissions pathways towards net-zero climate impacts in aviation. Nat. Clim. Change 12, 956–962 (2022).

Rissman, J. et al. Technologies and policies to decarbonize global industry: review and assessment of mitigation drivers through 2070. Appl. Energy 266, 114848 (2020).

Schreyer, F. et al. Distinct roles of direct and indirect electrification in pathways to a renewables-dominated European energy system. One Earth 7, 226–241 (2024).

Bachorz, C., Verpoort, P., Ueckerdt, F. & Luderer, G. Exploring techno-economic landscapes of abatement options for hard-to-electrify sectors. Preprint at Research Square https://doi.org/10.21203/rs.3.rs-4241841/v1 (2024).

Mignone, B. K. et al. Drivers and implications of alternative routes to fuels decarbonization in net-zero energy systems. Nat. Commun. 15, 3938 (2024).

Net Zero by 2050 (IEA, 2021); https://www.iea.org/reports/net-zero-by-2050

World Energy Outlook 2022 (IEA, 2022); https://www.iea.org/reports/world-energy-outlook-2022

Net Zero Roadmap: A Global Pathway to Keep the 1.5 °C Goal in Reach (IEA, 2023); https://www.iea.org/reports/net-zero-roadmap-a-global-pathway-to-keep-the-15-0c-goal-in-reach

Sitarz, J., Pahle, M., Osorio, S., Luderer, G. & Pietzcker, R. EU carbon prices signal high policy credibility and farsighted actors. Nat. Energy https://doi.org/10.1038/s41560-024-01505-x (2024).

Clean Hydrogen Monitor 2023 (Hydrogen Europe, 2023); https://hydrogeneurope.eu/wp-content/uploads/2023/10/Clean_Hydrogen_Monitor_11-2023_DIGITAL.pdf

BNEF hydrogen outlook. BloombergNEF https://www.pv-magazine.com/wp-content/uploads/2022/01/Session-9_Presentation-02_Adithya-Bhashyam-BNEF.pdf (2023).

Jewell, J. & Cherp, A. The feasibility of climate action: bridging the inside and the outside view through feasibility spaces. Wiley Interdiscip. Rev. Clim. Change 14, e838 (2023).

Cherp, A., Vinichenko, V., Tosun, J., Gordon, J. A. & Jewell, J. National growth dynamics of wind and solar power compared to the growth required for global climate targets. Nat. Energy 6, 742–754 (2021).

Zielonka, N. & Trutnevyte, E. Probabilities of reaching required diffusion of granular energy technologies in European countries. Preprint at Research Square https://doi.org/10.21203/rs.3.rs-4039857/v2 (2024).

Baumgärtner, C. L., Way, R., Ives, M. C. & Farmer, J. D. The need for better statistical testing in data-driven energy technology modeling. Joule 8, 2453–2466 (2024).

Edwards, M. R. et al. Modeling direct air carbon capture and storage in a 1.5 °C climate future using historical analogs. Proc. Natl Acad. Sci. USA 121, e2215679121 (2024).

New Energy Outlook 2024 (BloombergNEF, 2024); https://about.bnef.com/new-energy-outlook/

Ohlendorf, N., Löhr, M. & Markard, J. Actors in multi-sector transitions—discourse analysis on hydrogen in Germany. Environ. Innov. Soc. Transit. 47, 100692 (2023).

Rosenow, J. Is heating homes with hydrogen all but a pipe dream? An evidence review. Joule https://doi.org/10.1016/j.joule.2022.08.015 (2022).

European Hydrogen Bank auction provides €720 million. European Commission (30 April 2024); https://ec.europa.eu/commission/presscorner/detail/en/IP_24_2333

Hydrogen Production Business Model/Net Zero Hydrogen Fund: HAR1 successful projects. UK Department for Energy Security and Net Zero (2023); https://www.gov.uk/government/publications/hydrogen-production-business-model-net-zero-hydrogen-fund-shortlisted-projects/hydrogen-production-business-model-net-zero-hydrogen-fund-har1-successful-projects

Directive (EU) 2023/2413 of the European Parliament and of the Council of 18 October 2023 Amending Directive (EU) 2018/2001, Regulation (EU) 2018/1999 and Directive 98/70/EC as Regards the Promotion of Energy from Renewable Sources, and Repealing Council Directive (EU) 2015/652 (European Parliament and Council of the European Union, 2023).

Regulation (EU) 2023/2405 of the European Parliament and of the Council of 18 October 2023 on Ensuring a Level Playing Field for Sustainable Air Transport (ReFuelEU Aviation) (European Parliament and Council of the European Union, 2023).

Regulation (EU) 2023/1805 of the European Parliament and of the Council of 13 September 2023 on the Use of Renewable and Low-Carbon Fuels in Maritime Transport, and Amending Directive 2009/16/EC (Text with EEA Relevance) OJ L Vol. 234 (European Parliament and Council of the European Union, 2023).

Richstein, J. C. & Neuhoff, K. Carbon contracts-for-difference: how to de-risk innovative investments for a low-carbon industry? iScience 25, 104700 (2022).

Hydrogen Production and Infrastructure Projects Database (IEA, 2023).

Byers, E. et al. AR6 Scenarios Database (IPCC, 2022); https://doi.org/10.5281/zenodo.7197970

Richters, O. et al. NGFS Climate Scenarios Data Set Version 4.2 (NGFS, 2024); https://doi.org/10.5281/zenodo.10807824

Drevon, D., Fursa, S. R. & Malcolm, A. L. Intercoder reliability and validity of WebPlotDigitizer in extracting graphed data. Behav. Modif. 41, 323–339 (2017).

Levelised Cost of Hydrogen. Making the Application of the LCOH Concept More Consistent and More Useful (Agora Industry and Umlaut, 2023); https://www.agora-energiewende.org/publications/levelised-cost-of-hydrogen

The Role of E-Fuels in Decarbonising Transport (IEA, 2023); https://www.iea.org/reports/the-role-of-e-fuels-in-decarbonising-transport

Sievert, K., Schmidt, T. S. & Steffen, B. Considering technology characteristics to project future costs of direct air capture. Joule https://doi.org/10.1016/j.joule.2024.02.005 (2024).

George, J. F., Müller, V. P., Winkler, J. & Ragwitz, M. Is blue hydrogen a bridging technology? The limits of a CO2 price and the role of state-induced price components for green hydrogen production in Germany. Energy Policy 167, 113072 (2022).

Pfennig, M. et al. Global GIS-based potential analysis and cost assessment of Power-to-X fuels in 2050. Appl. Energy 347, 121289 (2023).

Odenweller, A. Green-hydrogen-gap: v1.1.1. Zenodo https://doi.org/10.5281/zenodo.14041796 (2024).

Renewables 2023 (IEA, 2024); https://www.iea.org/reports/renewables-2023

Fuel Cell Electric Tractor-Trailers: Technology Overview and Fuel Economy (ICCT, 2022); https://theicct.org/publication/fuel-cell-tractor-trailer-tech-fuel-jul22/

Jacobasch, E. et al. Economic evaluation of low-carbon steelmaking via coupling of electrolysis and direct reduction. J. Clean. Prod. 328, 129502 (2021).

Water Electrolyzer Stack Degradation (EPRI, 2022); https://www.epri.com/research/products/000000003002025148

Green Hydrogen Cost Reduction: Scaling up Electrolysers to Meet the 1.5 °C Climate Goal (IRENA, 2020); https://www.irena.org/publications/2020/Dec/Green-hydrogen-cost-reduction

The Future Cost of Electricity-Based Synthetic Fuels (Agora Energiewende, Agora Verkehrswende and Frontier Economics, 2018).

Grahn, M. et al. Review of electrofuel feasibility—cost and environmental impact. Prog. Energy 4, 032010 (2022).

Stolz, B., Held, M., Georges, G. & Boulouchos, K. Techno-economic analysis of renewable fuels for ships carrying bulk cargo in Europe. Nat. Energy 7, 203–212 (2022).

E-Kerosene for Commercial Aviation, From Green Hydrogen and CO2 from Direct Air Capture—Volumes, Cost, Area Demand and Renewable Energy Competition in the United States and Europe from 2030 to 2050 (dena, 2022); https://www.dena.de/newsroom/publikationsdetailansicht/pub/studie-e-kerosene-for-commercial-aviation/

E-Fuels: A Techno-Economic Assessment of European Domestic Production and Imports towards 2050—Update (Concawe, 2024); https://www.concawe.eu/wp-content/uploads/Rpt_24-4-1.pdf

World Energy Outlook 2023 (IEA, 2023).

Jing, L. et al. Understanding variability in petroleum jet fuel life cycle greenhouse gas emissions to inform aviation decarbonization. Nat. Commun. 13, 7853 (2022).

Acknowledgements

We gratefully acknowledge funding from the Kopernikus-Projekt Ariadne through the German Federal Ministry of Education and Research (grant nos. 03SFK5A and 03SFK5A0-2, A.O. and F.U.) and the HyValue project (grant no. 333151, F.U.). We thank the IEA, in particular J. M. Bermudez, for providing the Hydrogen Projects Database and for answering related questions. We thank R. Pietzcker for brainstorming figures, P. Verpoort for cost parameters and J. Sitarz for carbon price data. Following the IEA’s Creative Commons license, we note that this is a work derived by us from IEA material and we are solely liable and responsible for this derived work. The derived work is not endorsed by the IEA in any manner.

Funding

Open access funding provided by Potsdam-Institut für Klimafolgenforschung (PIK) e.V.

Author information

Authors and Affiliations

Contributions

A.O. suggested the initial research question, which F.U. extended. A.O. and F.U. collected cost data, while A.O. collected all other data. A.O. performed the analyses and created the figures. A.O. and F.U. interpreted the results. A.O. wrote the paper with contributions from F.U.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Nature Energy thanks Paul Wolfram, Sebastian Zwickl-Bernhard and the other, anonymous, reviewer(s) for their contribution to the peer review of this work.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Extended data

Extended Data Fig. 1 Green hydrogen electrolysis capacity in 1.5 °C scenarios.

a-b, Institutional and corporate 1.5 °C scenarios. c-d, Integrated assessment model (IAM) scenarios. IAM scenarios from the IPCC AR6 Database59 only include scenarios in category C1 (1.5 °C). IMP stands for illustrative mitigation pathway. IMP-LD focusses on demand, IMP-Ren on renewable energy, and IMP-SP on sustainable development. NGFS stands for Network for Greening the Financial System – a project that provides regularly updated IAM scenarios from different models60. We exclude scenarios, which either always report zero green hydrogen, or which in any year from 2025 report a lower capacity than has already been realised in 2023. If scenarios do not report electrolysis capacity, we convert production quantities into corresponding electrolysis capacity, which implies uncertainties (see Methods). The scenarios show a very wide range, particularly in 2030, underlining the high uncertainty surrounding the green hydrogen market ramp-up. Furthermore, panels a and c show that unprecedented growth rates would be required to achieve the 1.5 °C scenarios in 2030 (apart from a few IAM scenarios that report limited use of green hydrogen in 2030). Figure 4a depicts the distribution of these two scenario groups in 2030. For the IAM scenarios, we are uncertain to what extent the different models explicitly represent the different hydrogen applications and whether hydrogen results have been vetted in detail. Therefore, in our analysis of required subsidies for 1.5 °C, we use the median of the institutional and corporate scenarios (see Supplementary Figure 11 and Supplementary Figure 13).

Extended Data Fig. 2 Designated end uses of project announcements.